Quarterly Outlook Q4 2022

Inflation, recession and the reaction function of central banks – this “trio” remains in the market’s spot light.

Review

Fixed Income

The yield on 10-year US Treasuries reached an interim high of just under 4% in the last week of September to finish the quarter at 3.83%. The yield on 2-year US notes ended the third quarter at 4.27%. Thus, the credit spread was -0.44% or minus 44 basis points. The market expected around five further rate hikes (at 0.25% each) until the end of Q1 2023. This would result in a terminal rate of 4.50%. At the end of Q3, the fed funds rate stood at 3.25%. The next scheduled Fed meetings will take place on 2 November and 14 December 2022.

The same picture of rising interest rates also emerged in the euro zone. The yield on 10-year German Bunds rose from 1.37% at the beginning of July to a high of 2.27% in the last week of September. The quarter ended at 2.11%. The yield on 10-year Italian bonds rose to 4.65% and ended the quarter at 4.50%. The yield spread over German bunds was only just slightly below 250 basis points. It is suspected that a sustained breach of this mark will force the ECB to intervene to counter fragmentation risk in the euro zone.

In the UK, the yield on 10-year Gilts more than doubled during the quarter from 2.24% to 4.58% in the last week of September. This sharp rise in interest rates – triggered by the presentation of the new government’s “mini-budget” – forced the Bank of England to intervene in the market to prevent a collapse of the UK pension fund system. At the end of the quarter, the rate stood at 4.10%.

The Bank of Japan made no changes to its yield curve control policy during Q3, which continued to keep the yield on 10-year JGBs below the 0.25% mark.

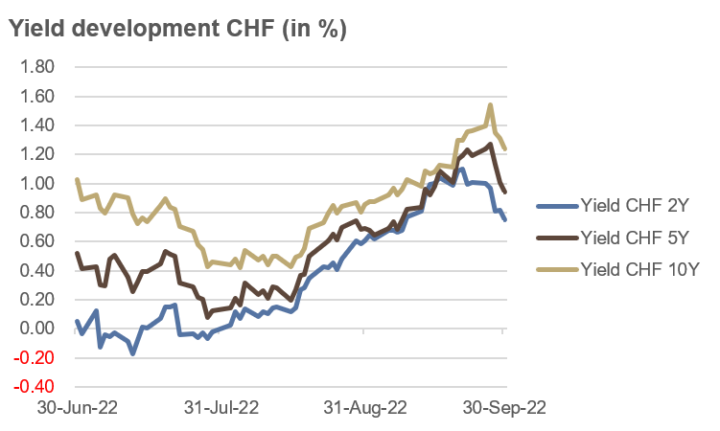

Swiss government bond yields moved in tandem with the interest rate trend in the USA and the euro zone: a decline until the beginning of August, followed by a continuous rise until the last week of September. Due to the Bank of England’s market intervention in the bond market, there was also an abrupt drop in rates at the end of the quarter. The yield on 10-year Swiss government bonds ended the quarter at 1.24%, after topping 1.54%. 2-year Swiss bonds yielded 0.75% at the end of the quarter.

Source: Bloomberg

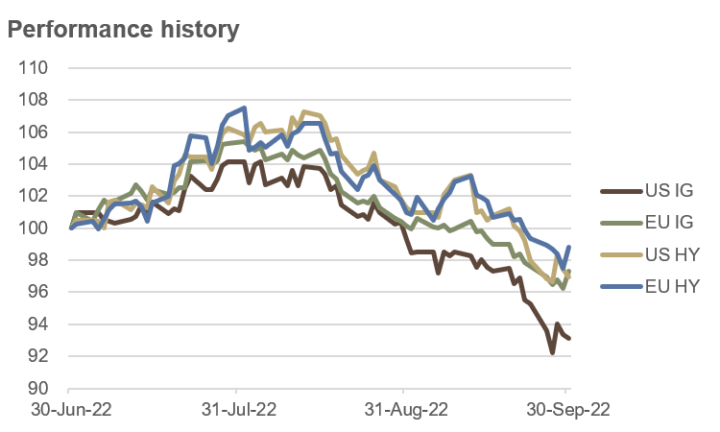

Credit

Until the beginning of August, corporate bonds gained between 4% and 7% due to declining interest rates. Thereafter, rising rates and a deteriorating economic backdrop put some pressure on prices, resulting in a loss of between 1% for European high-yield and 7% for US investment-grade bonds by the end of the quarter.

The change in market sentiment was reflected in US high-yield credit spreads. Until the beginning of August, these spreads fell from 5.87% to 4.21%, after which they rose steadily to 5.50% at the end of Q3.

Investment-grade (IG) bonds are the highest quality bonds as determined by a rating agency; high-yield bonds are more speculative and have credit ratings below investment grade. High-yield bond prices often move similarly to equity markets, while IG bond prices are more sensitive to the general level of interest rates.

In Q3, global convertibles gained 3.3%, while emerging market sovereign bonds (in USD) lost 4.5%.

Source: Bloomberg

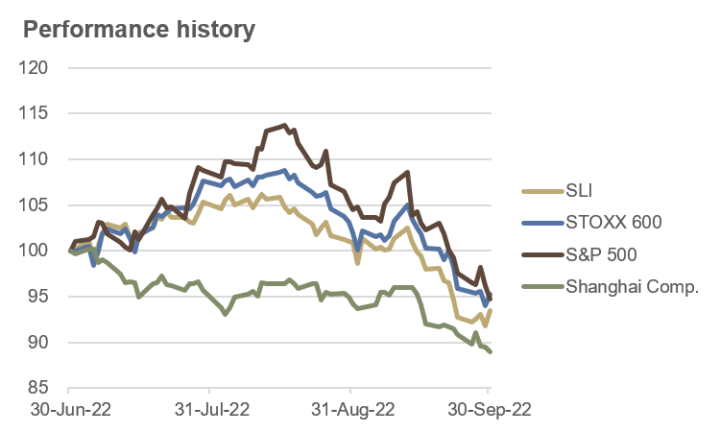

Equities

During Q3, European and US stock markets gained between 6% and 14% until mid-August. Thereafter, accompanied by rising interest rates, a further downward move set in, resulting in a setback of between 5% and 7% at the end of the quarter. Year-to-date, the Swiss Leader Index was down 26%, while the pan-European STOXX 600 dropped almost 21% and the S&P 500 lost 25%.

The Shanghai Composite decreased 11% despite the Chinese central bank reducing key interest rates during the quarter. Even with a weak yen and an ultra-loose monetary policy, the Japanese Nikkei 225 was 2% lower in Q3.

At sector level, the Energy sector was the only sector to gain in the US so far this year (+30%). This was followed by a wide margin by the Utilities (-8%), Consumer Staples (-13%) and the Healthcare (-14%) sectors. The Communications (-38%) and Technology (-32%) sectors came in last.

In Europe, the Oil & Gas (+11%), Basic Commodities (-9%), Healthcare (-14%) and Food & Beverage (-15%) sub-sectors led the year-to-date ranking. Retail (-44%), Real Estate (-42%) and Technology (-35%) were at the bottom.

At country level, Indonesia (+7%), Brazil (+5%) and Saudi Arabia (+2%) occupied the top spots year-to-date.

Source: Bloomberg

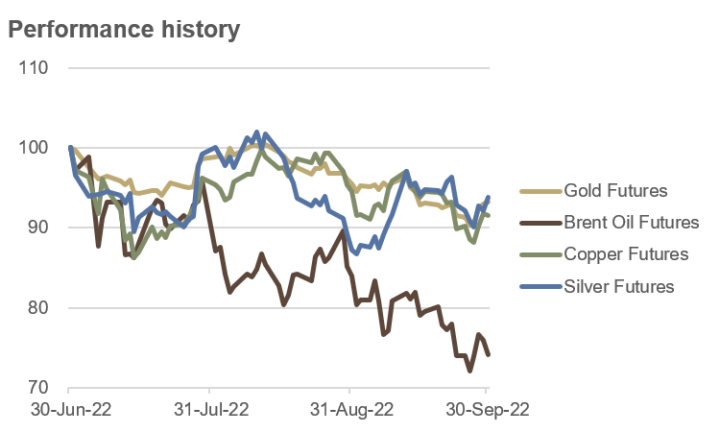

Commodities and Alternative Investments

Fluctuations in the oil price increased again in the 3rd quarter, but this time with negative signs with lower lows and lower highs in each case. At the end of the quarter, a barrel of Brent crude was trading at $85, a quarterly loss of 26%. However, in the course of the year so far, the price was still up 9%.

Over the quarter, the copper price fell 8%, while silver lost 6% and gold shed 7%, respectively. Year-to-date as of September 30, the picture was as follows: Gold -8%, Silver -18% and Copper -23%.

Over in crypto currencies, the bleeding could be plugged during Q3: Bitcoin (BTC/USD) -3%, Ether (ETH/USD) +24%. However, year-to-date still painted a bleak picture with Bitcoin and Ether reporting a loss of 58% and 64%, respectively.

Source: Bloomberg

Currencies

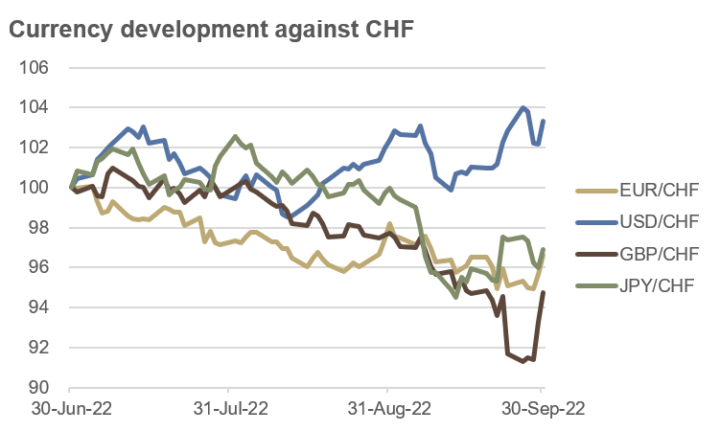

Daily fluctuations in the FX market surged in Q3, with “King Dollar” continuing his triumphant march unperturbed: +7% for the quarter, +17% year-to-date as measured by the Dollar Index (DXY), a currency basket of major trading currencies.

EUR/CHF started Q3 at parity, an exchange rate of 1.00. During the quarter, the currency pair dropped to a low of 0.95 and ended the quarter at 0.9670.

The USD/CHF currency pair fluctuated between 0.94 and 0.99 and ended the quarter near the high at 0.9870, up 3% over the quarter.

Strong swings occurred in the British pound in the last weeks of September. Due to the Bank of England’s U-turn, GBP/CHF fell by over 3% on a single trading day on September 23. At the end of the quarter, a decline of 5% resulted at an exchange rate of 1.1010.

After initial advances, the weakness in the Japanese yen continued in Q3. Against the CHF, the quarterly loss was 3%.

Source: Bloomberg

Outlook

Inflation, recession and the reaction function of central banks – this “trio” remains in the market’s spot light.

Annualized growth in the US was -1.6% in Q1 and -0.6% in Q2 2022, respectively. Usually, two negative quarters in a row meet the definition of a recession. This time, however, no recession has been declared yet in view of the strong labor market. If the labor market remains strong and inflation stays above the 2% target, the Fed will continue to raise interest rates as planned. If the economy and the labor market weaken sharply, expected corporate profits are likely to come under pressure.

Source: forexlive.com

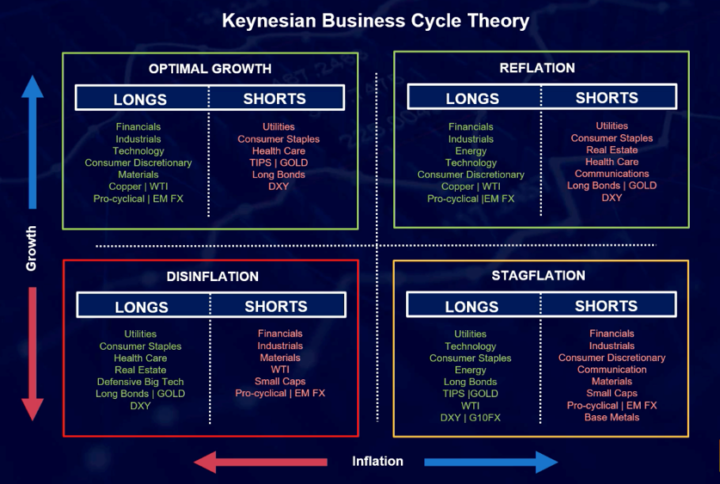

We expect the economy and inflation to cool in Q4. However, inflation is likely to remain at stubbornly high levels in the 7-8% range and the labor market is likely to remain fairly robust due to demographic changes, so the Fed will have no choice but to raise key interest rates further. Consequently, we favor a disinflation, or at best a stagflation scenario (see chart above).

The heightened volatility levels in bond, equity and currency markets call for extreme caution ahead.

Fixed Income

The Bank of England’s (BoE) U-turn in the bond market once again demonstrated that turbulence often comes from the dullest markets that no one has expected. But the BoE’s reaction also showed that the major central banks will not tolerate an uncontrolled slide in their respective bond markets. Consequently, the choice of the “right” currency will come to the fore.

In the euro zone, we expect the ECB’s Transmission Protection Instrument (TPI) to come into play in Q4, triggered by 10-year Italian bonds trading more than 250 basis points over 10-year German bunds.

Due to a global economic slowdown, we are positive on high-quality government bonds, while the choice of currency becoming increasingly important.

Credit

Recently, there has been comments touting high-yield bonds as a promising alternative to equities. We remain skeptical, expect credit spreads to widen further, and we believe that a number of credit ratings will come under pressure in the coming months.

We prefer investment-grade to high-yield and remain highly selective on emerging market bonds due to expected credit defaults and due to the strengthening dollar.

Equities

Due to the expected disinflation or stagflation scenario, as well as strongly increased market volatilities, we prefer a defensive positioning in equity investments. We acknowledge that a lot of bad news has been priced into the market in the last couple of months. Nevertheless, equities will face a strong headwind as long as key interest rates continue to rise. Only when central banks conclude this rate cycle, or are on the verge of doing so, stock markets will find a sustainable bottom.

Commodities

After slumping 26% to $85 per barrel in Q3, we expect Brent crude oil prices to rise in Q4. Geopolitical tensions will outweigh a global economic slowdown. In addition, net long positions in the futures market have fallen sharply in recent months.

For copper, we expect prices to rise in the final quarter. By now, sentiment is very gloomy, as the price has dropped over 23% so far this year. In addition, net short positions in the market are currently extremely high.

In USD terms, the gold price has indeed lost 8% in 2022 so far. However, measured in most other currencies and compared to most asset classes, the yellow metal does not look that bad. We expect gold prices to rise in Q4. Net long positions are currently only about half the 1-year average, signalling many speculators who had bet on rising prices have thrown in the towel. We also appreciate the portfolio diversification characteristics of gold. Silver price performance is likely to be a bit more volatile during the final quarter.

Currencies

The FX market is increasingly turning out to be the “valve” in global financial markets. While bond and equity markets can be supported by their respective central banks if necessary, tensions in the financial system are directly unloaded in the currency market. Volatilities in most currency pairs have risen sharply in recent months, especially against the JPY and against the GBP. On a global basis, the exceptionally strong dollar in particular is being eyed with suspicion, as it has often led to turbulence in very different places in the past. It is difficult to say whether the current tense geopolitical environment will lead to a “Plaza Accord 2.0” as in 1985. At that time, the five leading economic nations decided to appreciate the German mark and the yen against the dollar, as the greenback had become too strong after a massive cycle of interest rate hikes by then US Federal Reserve Chairman Paul Volcker. Some central banks – including the SNB – have realized that a strong currency can also be used as a weapon to combat inflation.

For Q4, we remain bullish on USD/CHF, as the US Federal Reserve will continue to raise interest rates unperturbed. In addition, tensions around Credit Suisse, a systemically-relevant bank after all, are increasingly emerging in Switzerland.

We no longer see the EUR/CHF currency pair in such a negative light, as the energy and security crisis in Europe could lead to joint bond issues, a first step towards a fiscal union.

We remain rather cautiously positioned against GBP, the political tensions between fiscal and monetary policy seem to be increasing with each passing day in the UK.

The JPY could surprise to the upside, especially as the Japanese currency is strongly undervalued against most currencies according to purchasing power parity.

Conclusion

Defensive positioning still seems appropriate. It is true that a lot of bad news has now been priced in by the market. Nevertheless, increased market volatility and the abrupt intervention of the Bank of England show that the financial markets are currently on very shaky ground. It is difficult to assess whether a violent quake will actually occur. As in 2008/2009, there are always short and violent bear market rallies in stock markets. In Switzerland, Credit Suisse appears to be increasingly in trouble. Its share price performance speaks volumes. Against this backdrop, we recommend an overweight of the cash position, an increased allocation in first-class government bonds, in US dollars and also in gold. Furthermore, we take care to invest only in liquid assets and avoid illiquid alternative investments.