Quarterly Outlook Q2 2024

The first quarter of 2024 brought a variety of developments to the financial markets, from rising bond yields to new records on the stock markets.

Review

Fixed Income

In the United States, yields on 10-year Treasury bonds climbed from 3.87% to 4.21% during the quarter. Buoyed by consistently upbeat economic indicators, market sentiment gradually shifted in the first quarter, scaling back expectations from an initial projection of 6-7 interest rate cuts for 2024 to a more modest 2-3 for the remainder of the year. The ascent in long-term US Treasury bond yields led to a 4.3% decline in the price of the widely followed iShares 20+ Year Treasury Bond ETF (TLT) over the same period. Meanwhile, yields on 2-year bonds, which are particularly sensitive to future interest rate expectations, increased from 4.25% to 4.63%. The Federal Reserve opted to maintain its benchmark rates at 5.50% throughout the quarter. Forecasts now anticipate the first rate cut to materialize no sooner than June, possibly extending as far as the end of July. The next Federal Reserve meetings are scheduled for May 1, June 12, and July 31.

The increase in yields was also evident in the Eurozone. In Germany, yields on 10-year government bonds rose from 2.03% to 2.29% during the quarter, and those on 2-year bonds increased from 2.40% to 2.82%. In contrast, yields on 10-year Italian government bonds remained relatively stable around the 3.70% mark, resulting in a narrowing of the yield spread with German government bonds of the same maturity to below 140 basis points. The European Central Bank (ECB) maintained interest rates at 4.50% in the 1st quarter but signalled potential rate cuts later in the year. The next ECB meetings are scheduled for April 11 and June 6.

In the United Kingdom, yields rose from 3.54% at the end of 2023 to 4.19% by the end of February, before settling at 3.98% by the end of the 1st quarter. The Bank of England maintained its benchmark interest rate at 5.25%, with its next meetings scheduled for May 9 and June 20.

In Japan, yields on 10-year government bonds rose from 0.62% to 0.73% over the quarter. There was some surprise as the Bank of Japan departed from both its negative interest rate policy and its yield curve control policy. Interest rates were raised from -0.10% to +0.10%. The next meeting is scheduled for April 26.

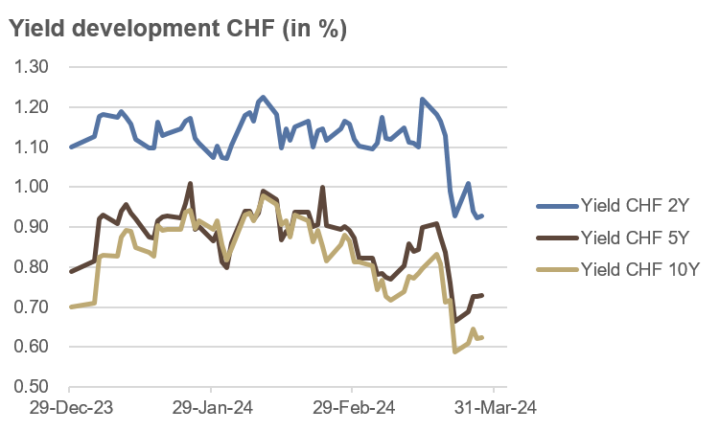

Contrary to the global trend, the interest rate level in Switzerland decreased due to the surprising rate cut from 1.75% to 1.50% by the Swiss National Bank (SNB). Yields on 10-year government bonds fell from 0.70% to 0.62%, yields on 5-year bonds from 0.79% to 0.73%, and yields on 2-year bonds stood at 0.93% at the end of the quarter, down from 1.10% at the end of 2023. The next SNB meeting is scheduled for June 20.

Source: own illustration

Credit

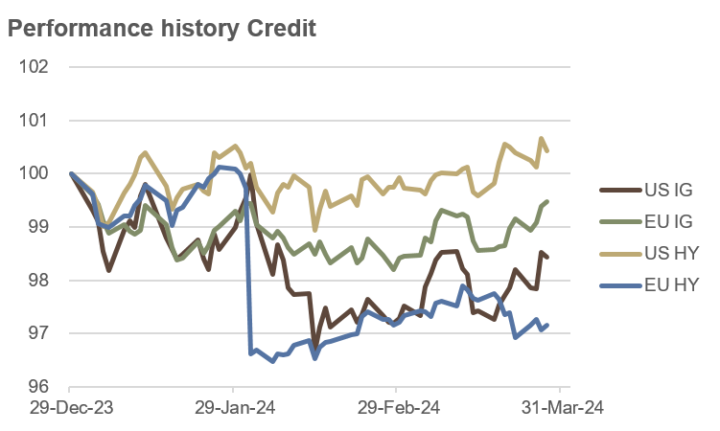

The rising interest rate environment had a dampening effect on the performance of corporate bonds. By the end of the quarter, there were slight losses in both the US and Europe. Only US high-yield bonds managed to finish the quarter with a slight gain by the end of March.

Credit spreads on high-yield bonds tightened in both regions: in the US from approximately 3.4% to 3.1%, and in Europe from approximately 4.0% to 3.5%. During deep recessions in the past, spreads of over 6.5% have been observed.

Investment-grade bonds are the highest-quality bonds rated by rating agencies, while high-yield bonds are more speculative and have a rating below investment-grade. The prices of high-yield bonds often tend to react similarly to equity markets, while the prices of investment-grade bonds are more influenced by the overall interest rate environment.

The “risk-on mode” in the 1st quarter had a positive effect on both convertible bonds (+4.3%) and emerging market sovereign bonds in USD (+1.6%).

Source: own illustration

Equities

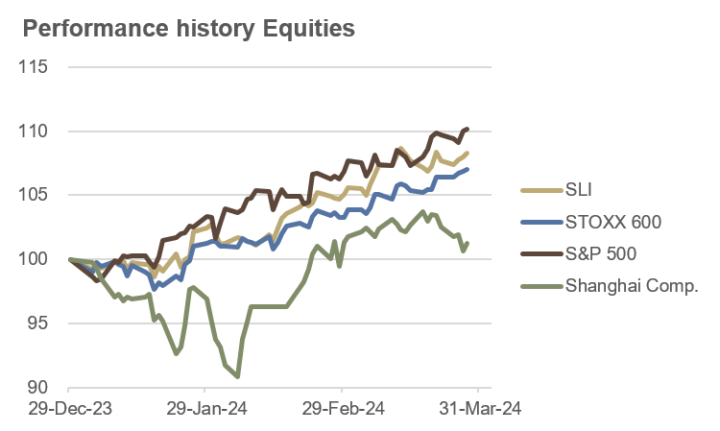

For stock market bulls, the 1st quarter of 2024 marked a dream start to the new year. In the United States, the S&P 500 index recorded a gain of 10.2% in the first three months of the year, marking its best start to a year since 2019. Since January, the leading US index has achieved 22 new all-time highs, ending the entire first quarter at 5,254, setting yet another record.

Surprisingly, the S&P 500 even outperformed the technology-heavy Nasdaq Composite, which posted a gain of 9.1% for the same period. The rally in US stocks was increasingly supported by a broader base: 77% of all S&P 500 constituents ended the first three months of the year in positive territory, with an average gain of 12.6%.

In Europe, the STOXX 600 index has risen by 7.0% since January, while the Swiss Leader Index posted a quarterly gain of 8.3%. In Switzerland, cyclical stocks such as Lonza and Holcim led the pack, while defensive heavyweights Roche and Nestlé experienced losses in the 1st quarter. Amidst the ongoing conflict in Europe, defence companies Rheinmetall and Leonardo emerged among the top performers in the STOXX 600 index during the 1st quarter.

In Asia, the Chinese Shanghai Composite managed to recover from its losses earlier in the year, ending the 1st quarter with a slight gain of 1.3%. In contrast, the Nikkei 225 in Japan saw no restraint, closing the 1st quarter with a solid rally of over 20%. This surge also finally surpassed the all-time high set in 1989. The Nikkei 225 finished the 1st quarter at 40,369, near the new all-time highs reached earlier in the quarter.

The MSCI World Index rose by 8.5% in the 1st quarter.

During the first three months of the year, alongside Japan, the stock markets of Turkey, Italy, and Vietnam recorded the best performance. The poorest performance was reported by the stock markets of Brazil, Hong Kong, and Thailand.

Source: own illustration

Commodities and Alternative Investments

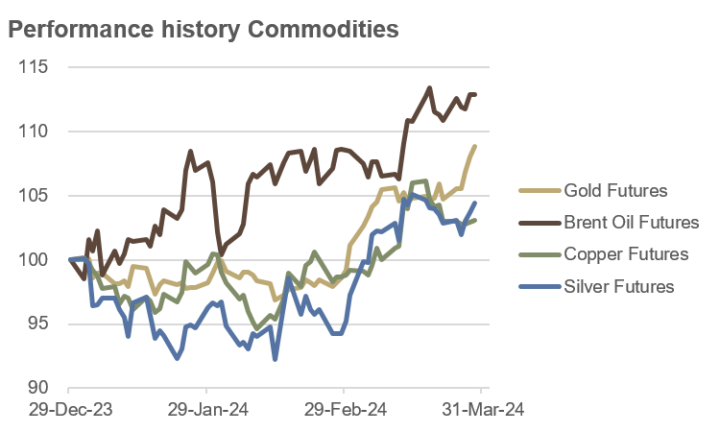

A robust demand outlook coupled with escalating supply-side uncertainties propelled Brent crude oil prices 12.9% higher in the 1st quarter of 2024. Furthermore, the inherently cyclical copper market notched a 3.1% gain over the initial three months, while silver prices surged by 4.5%. Gold, reaching an all-time high of $2,255 per ounce by quarter-end, culminated in an impressive 8.8% quarterly uptick.

The agricultural commodity sector witnessed a surge in prices, largely attributed to the impending El Niño year, with cocoa spearheading the charge, boasting a remarkable 130% surge. Conversely, natural gas prices experienced a notable setback, tumbling approximately 30% in the 1st quarter.

Meanwhile, the cryptocurrency market continued its ascent unabated. Following the green light from the US Securities and Exchange Commission (SEC) for a slew of Bitcoin ETFs in the early weeks of January, the BTC/USD pair extended its meteoric rise, closing the quarter with a staggering 65% gain. Similarly, Ethereum (ETH/USD) saw a notable 54% surge in the same period.

Source: own illustration

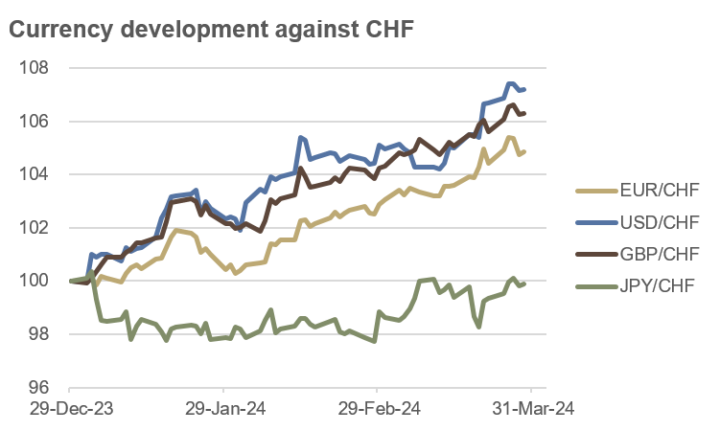

Currencies

In the backdrop of a more risk-taking environment across global financial markets, the traditionally regarded “safe haven” currencies, CHF and JPY, visibly struggled. Remarkably, the Swiss National Bank and the Bank of Japan took diametrically opposed monetary policy actions in the 1st quarter, yet both currencies closed the quarter similarly weak. While the weakness of the CHF appeared somewhat understandable due to the SNB’s surprising interest rate cut, the persistent weakness of the JPY, despite tightening monetary policy there during the quarter, caused some perplexity. Once again, it underscored the importance of considering both sides of currency pairs. Market participants seemingly attributed greater weight to the still surprisingly robust economic data in Western developed nations than to the tighter monetary policy stance in Japan.

By quarter-end, the USD appreciated against the CHF by 7.2%, the GBP gained 6.3%, and the EUR rose by 4.8% against the CHF.

For the US Dollar Index (DXY), which measures the value of the USD against a basket of six different currencies, the first quarter saw an increase of 3.1%.

Even stronger than the USD in the 1st quarter was the Mexican Peso (MXN), which rose by 2.6% against the USD.

Source: own illustration

Outlook

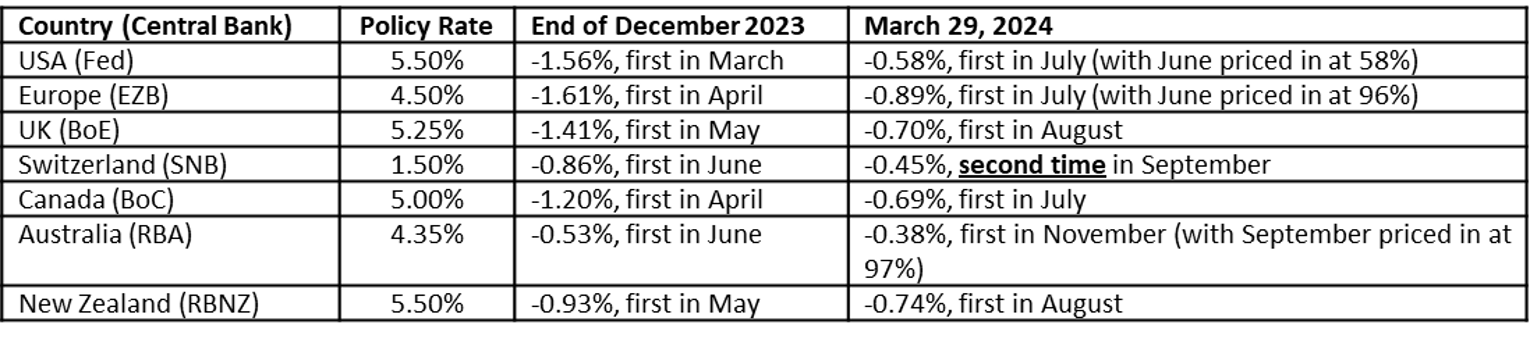

Economic growth in the United States remained notably robust in the 1st quarter, estimated at +2.8% (Atlanta Fed GDPNow, April 1, 2024), leading to a diminishing chorus of experts who had repeatedly forecasted a recession. However, in recent weeks and months, several inflation metrics have been published, coming in slightly hotter than expected. This combination has resulted in market expectations for interest rate cuts throughout the quarter being reduced not only in the US but also globally (see table below).

Source: own illustration

Despite significant shifts in interest rate expectations, they were scarcely felt in the stock market. However, the currency market painted a slightly different picture, with the US dollar emerging as one of the major beneficiaries of the changes in interest rate expectations.

For the 2nd quarter of 2024, we continue to anticipate positive economic growth, albeit with slightly higher-than-expected inflation rates. This reflationary scenario is likely to favour both commodities and certain sectors within the stock market.

Fixed Income

The slight increase in interest rates in the 1st quarter led to a decline in the prices of long-term government bonds. We believe that this consolidation, driven by improved economic data, slightly higher inflation rates, and reduced expectations of central bank rate cuts, will soon come to an end. Notably, short positions in long-term Treasury bonds remain very high in futures markets, suggesting an imminent need for covering.

Furthermore, given the anticipated interest rate cuts, we consider it prudent to extend duration, preferring to do so a few months early rather than too late.

Investing in long-term government bonds can also serve as a hedge against a potential recession, even though we are not currently anticipating one.

We maintain a slightly underweight position in inflation-protected bonds.

Credit

While we continue to refrain from anticipating a global recession, we maintain a preference for investment-grade bonds over high-yield bonds. The credit spreads of high-yield bonds have become exceedingly tight, in our view, inadequately compensating for the associated credit risk.

As a compelling addition to the credit segment of the portfolio, specialized funds featuring emerging market bonds could be considered.

Equities

Following the strong performance in the 1st quarter, we will slightly reduce equity exposure. While we do not anticipate a sharp decline in prices, we anticipate a period of consolidation in the 2nd quarter. Currently, a significant number of “good news” factors are priced in, increasing the likelihood of some disappointments.

Given the expected reflationary scenario, we favour stocks from industrial, energy, and financial sectors. Regarding style factors, momentum and value appear particularly attractive.

European equities could potentially deliver stronger positive surprises in the 2nd quarter compared to US markets, as valuations are notably lower and we anticipate interest rate cuts by the ECB earlier than by the Fed.

We remain cautious on Chinese equities and stocks with significant “China exposure”. More risk-tolerant investors may consider Indian and Latin American stock markets, although the latter have been somewhat disappointing so far this year.

Commodities and Alternative Investments

We anticipate that oil prices will remain at high levels or even continue to slightly increase in the 2nd quarter. Geopolitical tensions are likely to contribute to tight supply, while moderate economic growth should lead to stable demand. Additionally, measures by the Chinese government to stimulate the domestic economy may begin to bear fruit, providing support to prices. In the wake of this, copper prices may see a slight increase, although it’s worth noting that long positions in the futures market for copper are currently quite high, which typically tends to exert downward pressure on prices.

The significant rise in the price of gold to a new all-time high has also led to high net long positions in the futures market, suggesting limited room for further price increases. Nevertheless, we maintain a significant strategic gold position, consisting of physical gold. As for silver, we currently see limited upside potential.

A more promising outlook is observed for a variety of agricultural commodities, where we anticipate price increases in the 2nd quarter. Particularly noteworthy are soybeans, sugar, cocoa, and orange juice.

Currencies

The positioning in futures market for EUR, AUD, and CHF is currently extremely negative compared to historical levels. Consequently, we would not be surprised to see these currencies strengthen in the 2nd quarter. On the other hand, the extremely bullish positioning in the Mexican Peso (MXN) is likely to prevent further significant appreciation of the MXN.

The interest rate decisions of central banks, as well as changes in interest rate expectations, are expected to have an immediate impact on exchange rates.

For diversification purposes and portfolio hedging, we maintain a strategic positioning in USD.

Conclusion

Central banks’ monetary policies will be of particular importance in coming months. Based on past experience, we know that an initial interest rate move is typically followed by several more. Therefore, market participants are hanging on every word from central bank members to anticipate the extent and timing of the anticipated interest rate cuts in coming months as accurately as possible.

Although rate cuts have been repeatedly pushed back over the quarter, we remain cautiously optimistic about equity investments, but will slightly reduce exposure during the 2nd quarter. From a valuation standpoint, we slightly favour European equities over American ones.

We consider a positioning in long-term government bonds prudent to hedge against a possible global recession, even though we do not anticipate one in the 2nd quarter. Additionally, given the forthcoming rate cuts, we view it as opportune to extend duration to minimize reinvestment risk.

We continue to maintain a significant strategic position in gold, but will make slight reductions during periods of strength.

The environment for trend-following funds, known as Commodity Trading Advisors or CTAs, remains favourable.