Monthly Report March 2024

In addition to certain astrological constellations in March, such as the equinox marking the beginning of spring in the Northern Hemisphere, the month has consistently witnessed significant events and turning points in financial markets. Following the Great Financial Crisis of 2008/09, for instance, the US benchmark index S&P 500 hit its intraday low on March 6, 2009, at 666, a level that was not breached thereafter. Thus, those who invested in the S&P 500 fifteen years ago have seen a return of 671%, or an annualized gain of 14.6% (current S&P 500 level: 5,137).

Another noteworthy March event occurred in the year 2000 with the bursting of the Dotcom Bubble. The Nasdaq Composite reached its peak on March 10 at 5,049, and the S&P 500 followed suit a few days later on March 24, 2000, with an intraday high of 1,553. The index would not reach these levels again until July 2007. However, those who bought the S&P 500 at its peak twenty-four years ago would still have realized a return of 231%, or 5.1% p.a. until today.

Two other significant events in recent years unfolded in March: in March 2020, the World Health Organization declared the COVID-19 virus a global pandemic, and in March 2023, Credit Suisse made its final exit from the financial stage.

March, therefore, serves as a temporal framework for extraordinary and unexpected events and turning points in financial history, even without summoning the “Ides of March” and the assassination of Julius Caesar on March 15, 44 B.C….

In the current year, major stock markets have performed exceptionally well. The MSCI World gained 6.2% as of March 1, while in the US, the S&P 500 rose by 7.7%, and the technology-heavy Nasdaq surged by 8.4%. European stock markets also recorded strong gains, with the Euro Stoxx 50 advancing by 8.2%, and the somewhat defensively positioned Swiss Market Index still showing a 3.2% gain as of March 1.

In Asia, the Japanese Nikkei 225 surpassed its all-time high from 1989 for the first time in 34 years, catapulting itself 19.4% higher in the year-to-date. In China, stock markets faced some challenges at the beginning of the year but managed to turn the tide in February, posting a 1.8% gain in the year-to-date, measured by the Shanghai Composite.

Indeed, since the start of the bull market on October 12, 2022, stock markets have risen by 44%, as measured by the S&P 500 index, while many experts have repeatedly warned of an impending global recession and a stock market crash during this time.

Due to seasonal patterns, winter months historically have outperformed on average. The winter of 2023/24 aligns with this trend, with four consecutive positive months – November, December, January, and February.

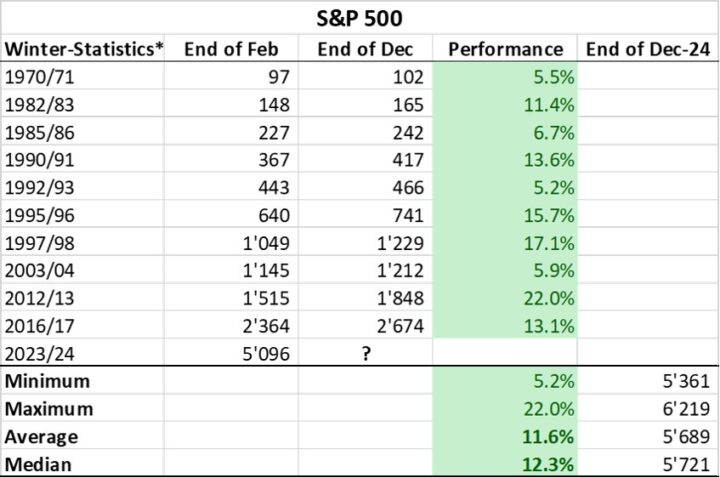

Using the S&P 500 as a benchmark, we examined the period from 1970 to the present. The table below highlights the ten winters in which all four winter months achieved positive returns and how the rest of the year unfolded, from end of February to end of December. It is evident that in these ten cases, every calendar year has produced a positive return, ranging between 5% and 22%, with an average and median of approximately 12%.

Source: own illustration

*Winter Statistics: positive returns in November, December, January, and February.

Even in the late 1990s during the Dotcom Boom, often compared to the current AI euphoria, after four positive winter months, annual returns of 15% to 17% were realized. At that time, then-Federal Reserve Chairman Alan Greenspan, in a widely noted speech in December 1996, cautioned against “irrational exuberance”.

In addition to the aforementioned “Winter Statistics”, the current US Presidential cycle, with the incumbent president seeking re-election, also supports the possibility of a positive year for the stock market. Furthermore, positions in the S&P 500 futures contract at the futures market are far from euphoric; rather, they are short. This implies that the majority of market participants anticipates declining stock prices.

For these reasons, we maintain a slight overweight in equities for the time being. Of course, we remain vigilant, especially in March, for unpleasant surprises and twists. To hedge against geopolitical risks and so-called “Black Swan” events, we include long-duration government bonds and gold investments in the portfolio. This also encompasses gold mining stocks, which have recently underperformed compared to the price of gold.