Monthly Report September 2023

Recession fears, gloomy forecasts - and yet: resilience! Financial markets continue to surprise. Discover why pessimism might be overrated and what opportunities lie ahead.

At the beginning of 2023, a global recession was almost a certainty among financial market strategists (unfortunately, we were included). The only debate revolved around the timing, with a challenging first half of the year followed by a potential recovery in the second half forming the basic scenario. As the year progressed, the narrative shifted, pushing the anticipated recession further into the second half or even into early 2024.

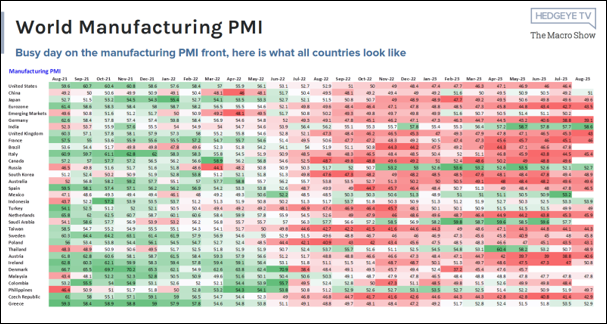

Indeed, in recent months, the global Purchasing Managers’ Index (PMI) for the manufacturing sector has noticeably deteriorated, with many countries recording values well below 50, indicating a significant decline (see table).

Source: Hedgeye Risk Management LLC, 1st of September 2023

Recently, the magazine The Economist also joined the fray, once again labeling Germany as the “sick man of Europe” on its front page (a title it previously bestowed in 1999, see illustration). Although this English magazine enjoys an excellent reputation among experts and academics, it often exhibits an uncanny precision for poor timing when used as a basis for stock market predictions…

Source: The Economist, 17 of August, 2023

The numerous doomsayers and the bad news have had little impact on the stock market rally in the year-to-date, so in recent weeks, once again, an R-word has been circulating: resilience.

In particular, the US economy is being emphasized in this regard. It has proven to be much more resilient than initially assumed, due to:

- Near-record cash on household balance sheets

- Near-record cash on corporate balance sheets

- Private sector income and wealth have outpaced inflation throughout this business cycle

- Limited credit cycle vulnerabilities

- Limited exposure to the volatile manufacturing sector

- Longer “long and variable lags”

- Perfect storm for new housing development

- “Bidenomics”

- Immigration

- Labour hording

Source: 42 Macro LLC, 22 of August, 2023

In the year-to-date, the S&P 500 has delivered a performance of 18%, significantly outperforming the European STOXX 600, which only managed an 8% gain. With just four months left in the year, the S&P 500 is on track to achieve its eighth year of outperformance against the STOXX 600 in the last decade. This year, the buzz around artificial intelligence has had a particularly strong impact, overshadowing economic concerns and higher valuations.

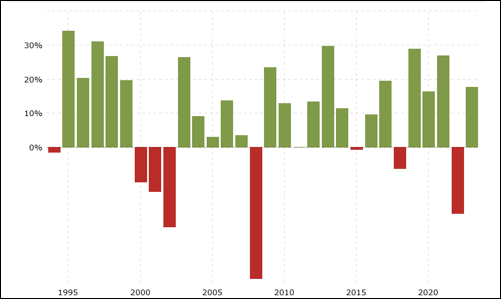

The chart below illustrates the annual returns of the S&P 500 from 1994 to 2023. This long-term 30-year perspective demonstrates that the broad stock market has often risen in the past, averaging an annual return of 9-10% during this period.

Source: macrotrends.net

Nonetheless, the doomsayers are given an exceptionally large platform in most media outlets, and bad news typically garners significant attention. Pessimists and naysayers are often perceived as more intelligent because they appear to have already considered all the “negative” aspects. Psychologically, they strike a chord with many investors who exhibit a phenomenon known as loss aversion. This refers to the tendency where an actual or potential loss is perceived as psychologically or emotionally more significant than an equivalent gain. For example, the emotional pain from losing 100 Swiss Francs is often much greater than the joy derived from gaining the same amount.

Due to the influx of bad news and individuals’ own loss aversion, the state of financial markets is often judged too negatively, and the ingenuity of people and companies who know how to adapt to challenging environments is frequently underestimated or entirely overlooked.

We assume that Western central banks have completed their interest rate hiking cycle and that core inflation rates will continue to moderate for the remainder of the year. This will pave the way for interest rate cuts starting in mid-2024. Dips in the stock market in September can be utilized for purchases, both in Europe – where many negative news have already been priced in – and in the United States.