Quarterly Outlook Q1 2023

Inflation, economic growth and central banks’ interest rate policies will remain the main drivers for price fluctuations in financial markets in 2023.

Review

Fixed Income

The yield on 10-year US treasuries reached its high for the year at 4.25% on October 24. By the end of the year, the yield had fallen to 3.88%. 2-year US treasury yields stood at 4.43% at year-end. As a result, the yield spread between 10 and 2-year government bonds was minus 0.55%, a deeply inverted yield curve.

The Fed fund rate set by the US Federal Reserve was at 4.50% at the end of the year. The market expected three further rate hikes of 0.25% each during Q1 2023. The Fed itself saw the so-called terminal rate at 5.10% in its current summary of economic projections. The next scheduled Fed meetings will take place on February 1 and March 22, 2023.

In the euro zone, the yield on 10-year German Bunds rose to a high of 2.57% at the end of the year, from 2.11% at the end of the 3rd quarter. In Germany, too, the yield curve was inverted, with short-term paper showing a higher yield than long-term bonds. The yield on 10-year Italian government bonds (BTP) rose to 4.90% during Q4; at year-end the yield fell to 4.69%.

The ECB’s key interest rate was 2.50% at the end of the year. The next ECB meetings will be held on February 2 and March 16, 2023.

In the United Kingdom, the bond market calmed down noticeably: at the end of the year, the yield on 10-year Gilts fell to 3.67%, from 4.10% at the end of September. The BOE’s key interest rate stood at 3.50%.

The Bank of Japan raised the target range for the 10-year JGB yield to 0.50% in its December meeting from 0.25% previously as part of its yield curve control policy.

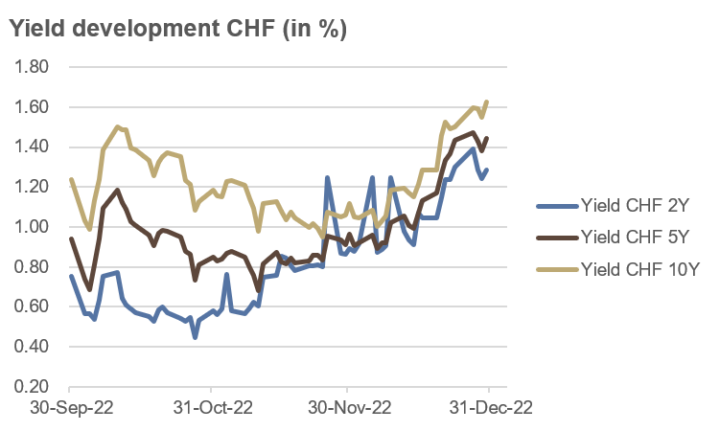

In contrast to some other countries, the yield curve in Switzerland is still fairly normal, i.e. longer-dated government bonds yielded more than shorter-dated ones. As of the end of 2022, the 10-year Swiss bond yield was at the highest level of the year at 1.62%, while 2-year paper yielded 1.28% and 5-year 1.44%, respectively.

The SNB’s key interest rate stood at 1.00% at the end of the year, with its next meeting scheduled for March 23, 2023.

Source: Bloomberg

Credit

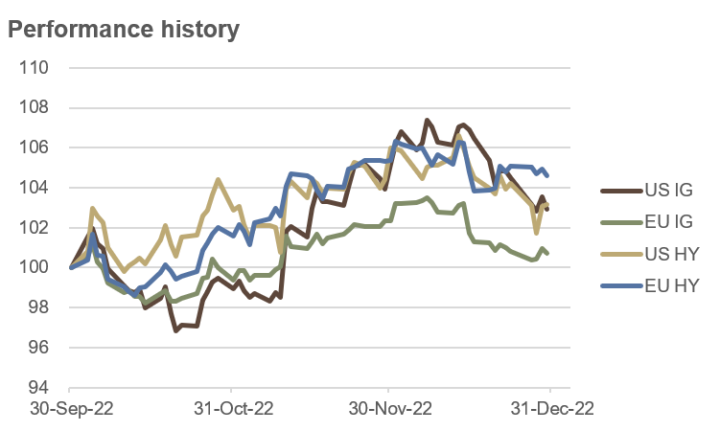

Credit spreads for high-yield (HY) bonds decreased in Q4. This led to a better performance of HY bonds compared with investment grade (IG) bonds. The latter were also more affected by the rising interest rate environment.

At the end of the quarter, European HY bonds were up 4.6% and European IG bonds advanced 0.7%, while US HY and IG bonds were up around 3%.

Nevertheless, the annual loss for IG and HY bonds on both sides of the Atlantic was between 14% and 21%.

Investment-grade bonds are the highest quality bonds as determined by a rating agency; high-yield bonds are more speculative and have a credit rating below investment grade. High-yield bond prices often move similarly to equity markets, while IG bond prices are more influenced by general interest rate levels.

Global convertibles lost 4.3% in Q4, while emerging market government bonds (in USD) gained 6.6%. At the end of the year, convertible bonds lost 16%, while emerging market bonds shed 22%.

Source: Bloomberg

Equities

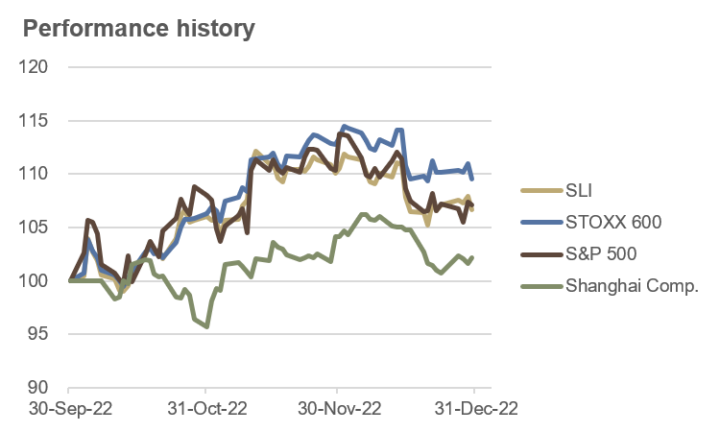

In Q4, the equity market picture was similar in Switzerland, Europe and the US: all stock markets reached the quarterly low at the beginning of October and rallied from there until the end of November. The increasingly hawkish rhetoric of central bankers, followed by actual interest rate hikes in mid-December, led to a renewed slump in stock markets. By the end of the year, quarterly returns were between 7% and 10%.

Despite this rise in the 4th quarter, the annual loss in Switzerland (SLI) and the USA (S&P 500) was around 20%, while the European market (STOXX 600) declined around 13%.

In China, the Shanghai Composite gained just over 2% in Q4 and ended 2022 with a loss of just under 15%. Q4 in the Middle Kingdom was marked by a radical departure from the zero-Covid policy and increasing monetary stimulus by the Chinese central bank.

In Japan, the Nikkei 225 ended Q4 with a gain of just under 1% and an annual loss of just over 9%, respectively.

Best sectors in the US in 2022 – far behind the energy sector – were defensive sectors such as utilities, healthcare and consumer staples. Over in Europe, the same sectors finished the year on top. But additionally, European insurers and European banks were also among the best performing sectors in 2022.

In the 2022 country rankings, Turkey, Indonesia, Portugal, India, Brazil and the United Kingdom were the best performers.

Source: Bloomberg

Commodities and Alternative Investments

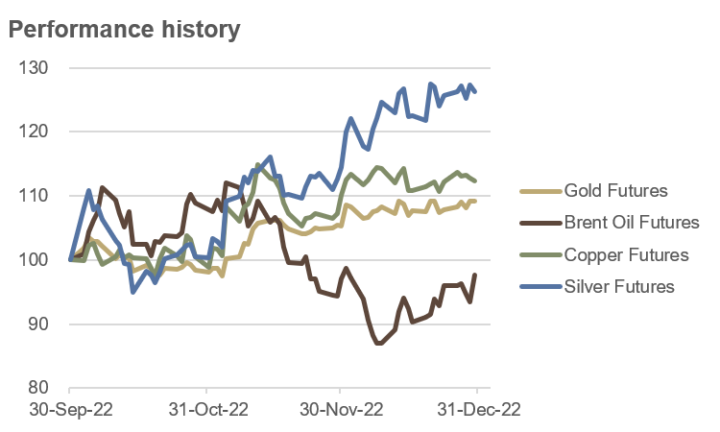

In the 4th quarter, the silver price increased 26%, while the gold price rose 9%. The copper price advanced 12%. The barrel of Brent crude oil stood at just under $86 at the end of the quarter and ended the quarter slightly down by 2%. The lowest price was reached on December 8 at $76.60.

For the full year, the performance results, measured in USD, were as following: gold -0.3%, silver +2.8%, Brent crude +10.5% and copper -14.4%.

Cryptocurrencies lost between 64% (Bitcoin) and 67% (Ethereum) of their value in 2022, measured in USD.

Source: Bloomberg

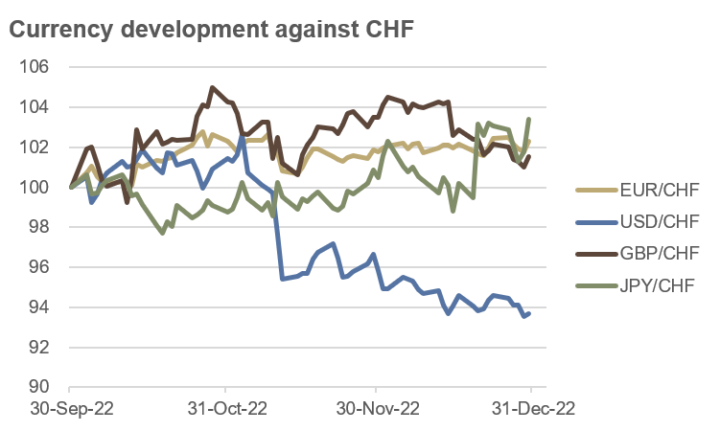

Currencies

The USD lost 6.3% against the CHF in Q4 and ended 2022 at CHF 0.9240. The other major currencies gained against the CHF in Q4, most notably the JPY with a gain of 3.4%, followed by the EUR with +2.3% and the GBP with +1.5%. With the exception of the JPY, currency volatilities declined in Q4 compared to the price fluctuations reached in Q2 and Q3.

Over the year, the USD/CHF increased 1%, from CHF 0.9120 to CHF 0.9240. The EUR lost 5% against CHF, from 1.0370 to 0.9890 and the GBP fell 9%, from 1.2340 to 1.1180. The JPY lost just over 11% against CHF.

Source: Bloomberg

Outlook

Inflation, economic growth and central banks’ interest rate policies will remain the main drivers for price fluctuations in financial markets in 2023.

Although the US inflation rate has fallen from 9.1% in June to 7.1% in November, it is still well above the target of 2%. Core inflation has been hovering around the 6% mark since January 2022. In addition, inflation has begun to spread from the goods sector to the service sector. This is where the great challenge of central banks’ communication skills will come into play: will they succeed in containing inflation expectations? Three secular trends are underway that will make it more difficult for inflation to return to 2%: cheap labor, cheap goods (from China) and cheap energy (from Russia) are largely things of the past….

We expect inflation rates to settle in the 5% to 6% range in the first half of 2023, and monetary policy will therefore remain more restrictive for longer than expected.

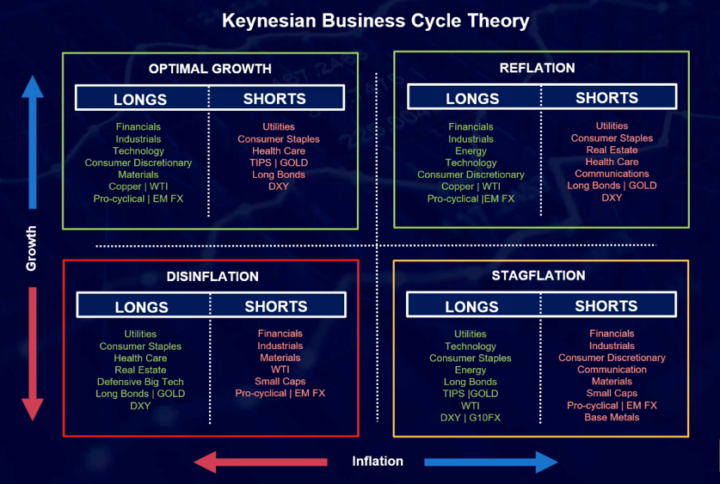

Even a cooling of the economy – which we expect in the first half of 2023 – is unlikely to change this. As a result, we assume a disinflation scenario (see chart below).

This is not a good mix for equity prices, which will come under pressure from two sides at the same time: higher interest rates coupled with lower corporate earnings.

Quelle: forexlive.com

Fixed Income

While short-term bond yields are strongly influenced by monetary policy, long-term bond yields reflect market expectations regarding growth and inflation. An inversion of the yield curve – long-term yields are lower than short-term yields – as currently observed in many countries, is very likely signalling a recession in the near future.

Given the expected economic downturn, we are positive on long-term government bonds.

In addition, the correlations between bonds and equities are likely to return to their usual pattern in the new year, which is highly desirable for portfolio diversification purposes. This means: rising bond prices, when equity prices are falling et vice versa.

Credit

The coming economic slowdown in the first half of 2023 is likely to lead to increased credit defaults. We therefore prefer investment grade to high-yield bonds and also remain very cautious on emerging market bonds, partly due to an expected rise in the US dollar.

Furthermore, we take care to invest only in liquid bonds and ETFs and avoid complex illiquid structures. Here, we increasingly expect that investors’ redemption requests will no longer be fulfilled.

Equities

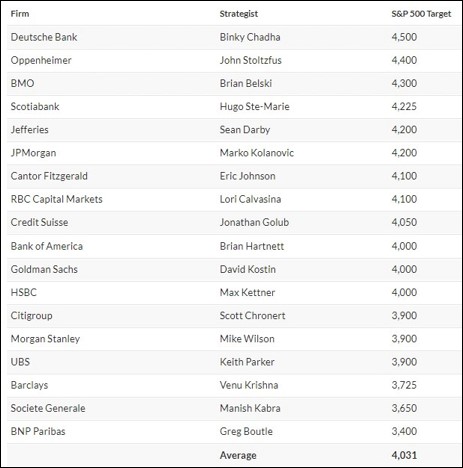

Due to the expected disinflation scenario, we prefer defensive sectors such as consumer staples, healthcare and utilities. It is true that the equity markets have had a bad year in 2022. Nevertheless, the mood still seems to be anything but pessimistic, as the following table shows. Only three analysts forecast a lower level of the S&P 500 at the end of 2023 than today (current level at 3,824).

Quelle: investing.com

In the wake of the pandemic and the disrupted supply chains, inventories were overstocked in many cases in order to cushion dependencies on suppliers. We expect those inventories to be reduced in the coming months, which is an important reason for the expected economic downturn.

China could surprise to the upside. The initial euphoria following the lifting of the zero-Covid policy has given way to a somewhat more sober assessment, as the number of Covid cases has shot through the roof. After a few months, however, the contagion should have run its course and the economy should be able to resume its usual traction. In addition, the Chinese economy is increasingly supported by a loose monetary and fiscal policy in contrast to most Western countries.

Commodities

Crude oil prices were only slightly lower at the end of the year compared with the end of the 3rd quarter, as prices rose sharply again towards the final weeks of December. We expect prices to fall in the coming months due to the global downturn. In addition, net long positions in the futures market have increased in recent weeks and the price is already moving at the upper end of the trading range, which tends to point to falling prices.

The copper price is likely to move sideways in the first quarter, or at best slightly upward. No strong price signals can be observed here.

The gold price has started a nice uptrend since mid-November, initially accompanied by a weaker USD. Meanwhile, the price of the yellow metal is rising even with a stronger greenback, a strong signal indeed! Moreover, seasonality is in favor of gold, as January is historically the best month of the year. However, net long positions in the futures market are already relatively high, which is why we would wait for setbacks to $1,790 – $1,800 before increasing our gold position. We remain more cautious on silver due to the expected economic downturn.

Currencies

We expect a stronger USD in the first quarter. As US benchmark mortgages are generally concluded with a fixed term of 30 years, a rising interest rate level does not immediately lead to problems for private consumers, or rather less so than in other countries. As a result, the strength of the US consumer could surprise on the upside and encourage the Fed to raise interest rates further than other central banks. This should further increase the interest rate differential and provide a stable support to the greenback.

Further, we no longer see the EUR/CHF currency pair in such a negative light. In addition to the ECB’s ever more hawkish stand on monetary policy, the purchasing power parity argues for a higher EUR/CHF exchange rate. In addition, you may throw in a solution to the European energy crisis as a wild card for a positive surprise.

The GBP has returned to calmer waters after short-term political turbulences. Sound and conservative fiscal and monetary policies tend to support higher exchange rates. Furthermore, the UK equity market has been one of the bright spots in the 2022 stock market year, which could lead to some portfolio flows towards GBP.

The first stage of the JPY rocket was ignited in December with the Bank of Japan’s reversal on yield curve control. We expect further strengthening of the Japanese currency, supported by purchasing power parity and due to expected further steps by the Japanese central bank, which will get a new Governor in March.

Conclusion

The order of the day remains defensive positioning and a disciplined process. Only when the major central banks change their hawkish stance, it will be reasonable to take on more risk positions again. Until then, stock market rallies should be used for disciplined selling so that buying can be resumed in the event of setbacks. We assume that the bottom has not yet been found in equity markets. A credit event in the first half of 2023 would not surprise us. We take care to invest only in liquid assets and avoid illiquid and non-transparent structures. We recommend an overweight of the cash position, an increased allocation to first-class government bonds, to US dollars and also to gold.