Quarterly Outlook Q4 2023

A Resilient Surprise: The Global Economy in 2023

Review

Fixed Income

In the United States, the yields of 10-year Treasury bonds reached their highest level since 2007 in the last week of September, concluding the third quarter at 4.58%, just slightly below. At the end of June, the yield stood at 3.84%. The significant surge in long-term US interest rates led to the iShares 20+ Year Treasury Bond ETF (TLT) shedding nearly 14% during the third quarter. In contrast, the yields on 2-year notes, which are heavily influenced by expectations regarding the federal funds rate, saw only a modest increase during the quarter, rising from 4.90% to 5.05%. Over the course of the third quarter, the US Federal Reserve raised the federal funds rate only once, from 5.25% to 5.50%. Despite the hawkish rhetoric from the Fed, the market is highly unlikely to anticipate further rate hikes this year. The next Federal Reserve meetings are scheduled for November 1st and December 13th.

In the Eurozone, yields hit a ten-year high in the final week of September, ending the third quarter just slightly below. The yields on 10-year German Bunds rose to 2.84% by the end of the quarter, compared to 2.39% at the end of June. In Italy, yields on 10-year government bonds climbed to 4.78%. The European Central Bank (ECB) continued its tightening cycle during the third quarter, raising the benchmark interest rate by 0.25% twice, reaching 4.50%. Concurrently, the yields on 2-year German government bonds dropped from 3.27% to 3.20%. The next ECB meetings are scheduled for October 26th and December 14th.

In the United Kingdom, yields on 10-year Gilts fluctuated between 4.20% and 4.70%, closing the third quarter at 4.50%, compared to 4.44% at the end of the second quarter. The Bank of England raised interest rates during the quarter from 5.00% to 5.25%.

In Japan, the policy of yield curve control was adjusted slightly upwards, allowing for a maximum yield of 1.00% (previously 0.50%) on 10-year Japanese Government Bonds (JGBs). Consequently, yields on 10-year JGBs rose to 0.75% by the end of the quarter.

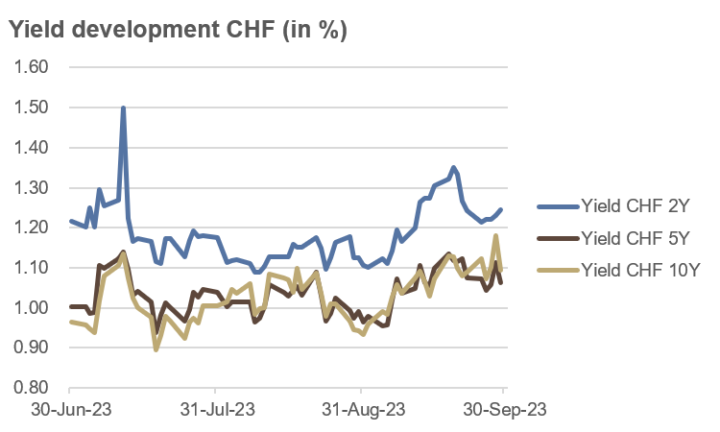

In Switzerland, yields on 5- and 10-year government bonds increased from around 1% to approximately 1.10%, while yields on 2-year bonds settled around the 1.20% mark. The Swiss National Bank (SNB) kept its policy rate unchanged at 1.75% throughout the quarter. The next SNB meeting is scheduled for December 14th.

Source: Bloomberg

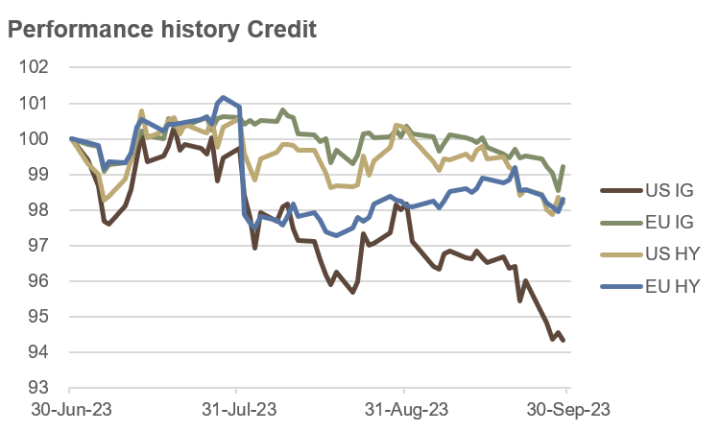

Credit

The elevated interest rate environment, particularly in the United States, posed challenges for Investment-Grade (IG) bonds. They experienced a decline of 5.7% over the course of the quarter, whereas European IG bonds saw a more modest decrease of 0.8%. Both European and US high-yield bonds experienced setbacks ranging from 1.7% to 1.8% during the quarter, with credit spreads even marginally contracting within the range of 4.0% to 4.5%. In past recessions, spreads of well over 6.5% have often been observed.

Investment-Grade bonds are the highest-quality bonds rated by credit agencies, whereas high-yield bonds are more speculative in nature and carry a rating below Investment-Grade. The prices of high-yield bonds tend to react somewhat like equity markets, whereas the prices of Investment-Grade bonds are more influenced by the general interest rate environment.

Emerging market sovereign bonds (in USD) experienced a loss of 2.9% in the third quarter, while global convertible bonds managed to gain 0.9%.

Source: Bloomberg

Equities

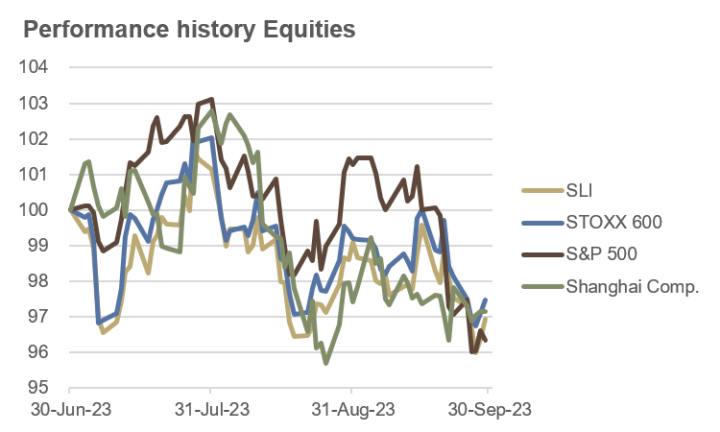

During the third quarter, the stock markets adhered to the historical seasonal pattern: following a positive July, two weaker months in August and September ensued, ultimately resulting in the first negative quarter of 2023.

In the United States, the S&P 500 index recorded a loss of 3.6%, while Europe’s STOXX 600 saw a decline of 2.5%. The Swiss Leader Index (SLI) dropped by 3.1%. China’s Shanghai Composite lost 2.9%, and Japan’s Nikkei 225 fell by 4.0%. Despite a moderation in core inflation rates during the quarter, concerns grew that interest rates could remain elevated for an extended period.

Year-to-date, the S&P 500 had gained 11.7%, while the STOXX 600 had risen by 6.0%. In Switzerland, the SLI had increased by 4.5%. In Asia, the Shanghai Composite managed a modest 0.7% gain, while the Nikkei 225 stood 22.1% above its end-of-2022 level.

At the sector level, in the United States for the first 9 months of the year, the Communication, Technology, and Consumer Cyclicals led the way. Defensive sectors such as Utilities, Real Estate, and Consumer Staples underperformed. In Europe, the sub-sectors of Retail, Banks, and Building Materials performed well, while Basic Resources, Real Estate, and Food & Beverage fared the worst year-to-date.

In the list of countries and indices for the first nine months of the year, Hungary, the Nasdaq, the Nikkei 225, and Italy were at the top. At the bottom of the list were Thailand, Hong Kong, various Chinese indices, and Belgium.

Source: Bloomberg

Commodities and Alternative Investments

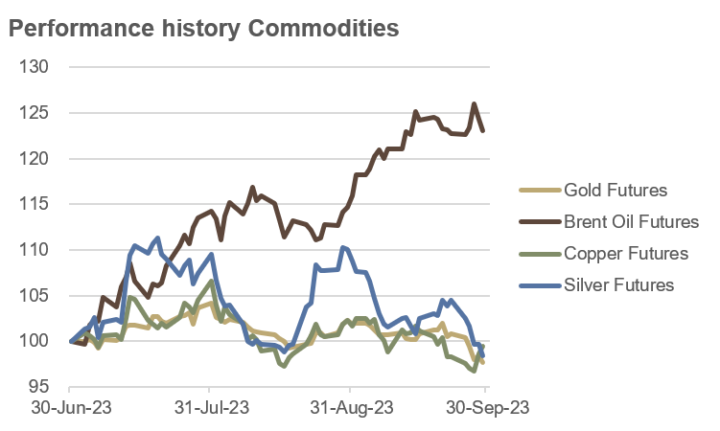

The third quarter was marked by a significant rise in crude oil prices, triggered by coordinated production cuts by Saudi Arabia and Russia. The price of Brent crude oil increased by more than 23%.

Despite expectations of an economic slowdown by many market participants, copper prices saw only a slight decline in the third quarter. Copper prices are often considered a leading indicator for the broader economic outlook and are known to be particularly sensitive to economic conditions.

On the other hand, the rising interest rate environment posed a significant challenge for gold, as gold traditionally does not yield interest. The price of gold decreased by more than 2%, while silver prices dropped by nearly 2%.

In the backdrop of a “risk-off” market environment in the third quarter, accompanied by declining stock prices, cryptocurrencies also incurred losses: Bitcoin lost 11%, and Ether declined by 13%. Nevertheless, they were still up by 63% (BTC/USD) and 40% (ETH/USD) for the year-to-date.

Source: Bloomberg

Currencies

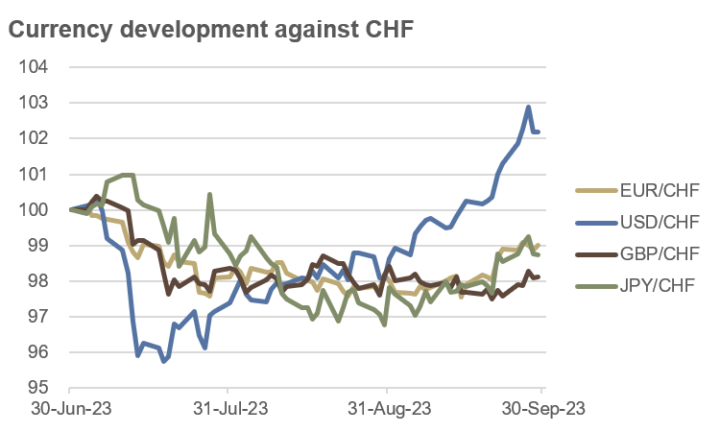

In the third quarter, the USD emerged as the clear winner in the foreign exchange markets. The Dollar Index (DXY), which measures the value of the USD against a basket of six different currencies, rose by 3.2%.

Against the CHF, the USD gained 2.2% over the course of the quarter, with the USD/CHF exchange rate increasing from 0.895 to 0.915. In contrast, the EUR declined by 1.0%, moving from EUR/CHF 0.977 to 0.967. The GBP lost 1.9%, falling from GBP/CHF 1.137 to 1.116, and the JPY decreased by 1.3% against the CHF. Following the somewhat surprising decision by the Swiss National Bank (SNB) on September 21st to keep interest rates unchanged, these currencies were able to make slight gains against the CHF towards the end of the quarter.

Among exotic currencies, the Mexican Peso proved to be particularly strong, gaining slight value against the CHF in the third quarter and rising by 9.7% against the CHF for the year-to-date. On the other hand, the Russian Ruble continued its ongoing depreciation, losing more than 25% against the CHF for the year-to-date.

Source: Bloomberg

Outlook

Contrary to many skeptical forecasts, the global economy has proven to be remarkably resilient in the year-to-date. While there are some signs of weakness in Europe and China, the resilience of economic growth and the job market in the United States has surprised many market observers. It is possible that a certain decoupling from China has contributed to stronger growth and more jobs in the US and other “Western” countries. Additionally, the infrastructure program of the Biden administration, titled the “Inflation Reduction Act”, may have had a positive impact on economic performance.

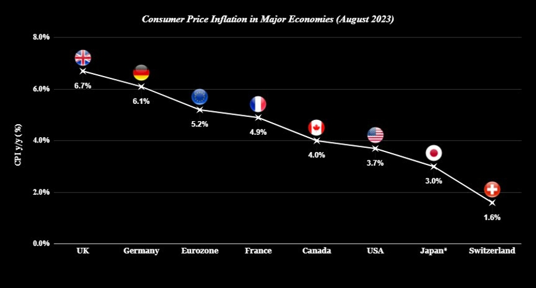

Overall inflation in the United States saw a slight increase in the months of July and August and currently stands at 3.7%. However, the core inflation rate, which excludes food and energy, continues to trend lower and is currently at 4.3%. We anticipate that core inflation will continue to moderate in the coming months, and therefore, the US Federal Reserve is not expected to take further steps in the current interest rate hiking cycle.

In addition to inflation data, economic and labor market data are being closely analyzed. Currently, the motto is “bad news is good news”, as negative news could provide additional evidence that interest rates may not be raised further. This often leads to positive reactions in the stock markets.

Source: forexlive.com

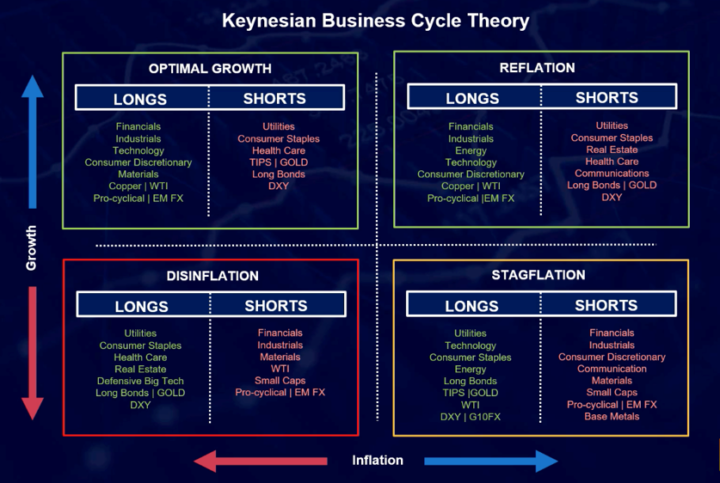

For the fourth quarter, we anticipate relatively stable growth rates and a tendency toward decreasing inflation rates. This should place us in a range between an Optimal Growth and a Disinflation scenario (figure).

Fixed Income

The recent rise in long-term yields indeed raises some questions, especially in the context of declining core inflation rates and the general expectation of an economic cooling. This development may, at first glance, not align with the usual patterns in bond markets, where lower yields and rising bond prices often coincide with an economic slowdown.

We believe that this could be a temporary phenomenon, as there are currently very high open short positions in long-term Treasury bonds in the futures markets. When these short positions need to be covered at some point, it could lead to an increase in bond prices and a corresponding decrease in yields.

Considering this, an investment in long-term government bonds in both the US and Europe could make sense. Long-term bonds can also serve as a hedge in the event of a possible recession, even if we do not currently anticipate one.

To take advantage of the higher short-term interest rates, overweighting money market investments can also be considered. We expect short-term interest rates to remain at their current higher levels for an extended period. Additionally, positioning in short-term money market instruments enhances flexibility in a challenging market environment.

Regarding inflation-linked bonds, we are more cautious, as we anticipate that inflation could be more likely to surprise on the downside.

Credit

In the fourth quarter, while we do not anticipate a global recession, we do prefer Investment-Grade bonds over high-yield bonds. The credit spreads on high-yield bonds are extremely tight, and in our view, they do not adequately reflect the associated risks.

As an interesting addition to the portfolio, specialized funds focused on emerging market bonds can be considered. However, when it comes to illiquid and complex credit structures, we remain cautious.

Equities

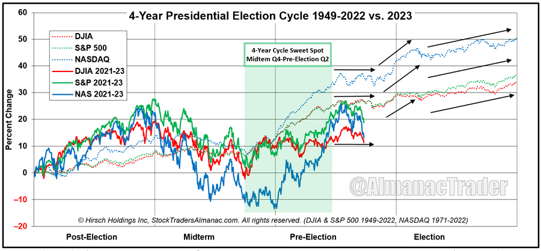

After the two weak months in August and September, we anticipate a brighter outlook for the stock market in the fourth quarter. This would largely align with the seasonal pattern (figure). Since 1950, there have been 17 years prior to 2023 in which the S&P 500 declined in both August and September. In all of these years, the fourth quarter recorded positive months. In fact, 15 out of the 17 years saw a rally in the fourth quarter, with an average gain of 6.58%.

We expect any potential declines in stock prices to be short-lived and view buying opportunities during periods of weakness as sensible. We give a slight preference to the US stock market.

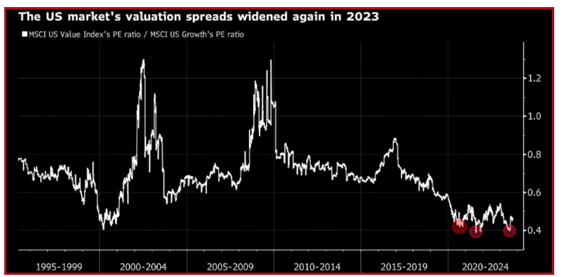

In terms of factors, Value appears particularly attractive compared to Growth from a historical perspective (figure).

However, we remain somewhat cautious on interest-sensitive stocks and shares of heavily indebted companies.

Source: StockTraderAlmanac.com

Source: gloomboomdoom.com

Commodities

Following the significant increase in crude oil prices in the third quarter, triggered by further coordinated supply cuts from Saudi Arabia and Russia, we now see signs that the situation may become more challenging. Net long positions in the futures market have reached very high levels, indicating the potential for short-term setbacks. Additionally, historically, October has been the weakest month for oil price performance. Therefore, we anticipate declining oil prices throughout the entire fourth quarter.

Regarding the copper price, we expect it to rise as the global economy is likely to cool less than widely expected. Furthermore, the positioning in the futures market is currently somewhat negative, which increases the likelihood of a price increase.

Gold prices have recently suffered due to rising interest rates and higher real yields. Although net long positions in the futures market have decreased in recent months, which could be price-supportive, they still remain positive. From a technical perspective, we are currently in a neutral zone. Technical analysts point to price levels of $1,817 and $1,947 (currently around $1,840 per ounce) as important levels to watch. Silver prices are likely to be somewhat less affected by higher real yields than gold due to their increased industrial usage.

Currencies

In the third quarter, the USD, often referred to as “King Dollar”, emerged as the clear winner among major currencies. As is often observed, increasing risk aversion with falling stock prices led to a flight into the greenback. Rising long-term real interest rates provided additional support to the USD.

For the final quarter, we anticipate higher USD/CHF rates as the US economy is expected to prove more resilient. Additionally, we expect US real interest rates to rise more significantly in the coming months, as there is more room for inflation to decline in the US compared to Switzerland (figure).

Higher levels in the EUR/CHF and GBP/CHF currency pairs are primarily supported by purchasing power parity and higher expected real interest rates in the Eurozone and the United Kingdom. This is due to the anticipation of a more significant decline in inflation in these economies, given their higher starting levels. However, in the event of unexpected financial market turbulence, the strength of the CHF could persist.

In the Japanese Yen, the current market positioning is so negative that a strong rebound cannot be ruled out. Additionally, the JPY is significantly undervalued according to purchasing power parity.

Source: forexlive.com, 21. September 2023

Conclusion

Investors commonly adopt medium and long-term strategies, which can create a delicate balance between adaptability and steadfastness. While we anticipate a potential stock market rally in the fourth quarter, we also emphasize the importance of maintaining a higher cash position to retain flexibility in response to possible market disruptions. Additionally, the current short-term interest rates present an appealing yield opportunity. Regarding equity selection, we favor the United States and the Value factor.

Furthermore, we continue to hold long-term government bonds primarily as a hedge against the potential for a recession, although we do not foresee one in the fourth quarter.

To enhance portfolio diversification, we find it prudent to include liquid and transparent trend-following funds, commonly referred to as CTAs (Commodity Trading Advisors). These funds base their investment decisions on historical price patterns of financial markets, independently of macroeconomic predictions.