Quarterly Outlook Q3 2023

Deglobalization, AI, and Inflation: A Transforming Market Landscape.

Challenges for Central Banks and Monetary Policy.

Review

Fixed Income

The anticipated recession, which has been forecasted for some time now, has been repeatedly postponed throughout the quarter. Despite gloomy predictions, the US economy and job market have shown surprising stability. This has led to an increase in yields, with 10-year US Treasury bonds rising from 3.47% to 3.84%. Over the same period, yields on 2-year bonds climbed even higher, from 4.02% to 4.90%, widening the yield spread between 10-year and 2-year bonds from -0.55% to -1.06%. Historically, this inverted yield curve has often served as a reliable indicator of an impending recession. As part of its tightening cycle, the US Federal Reserve raised its benchmark interest rate to 5.25% in early May. While there were no rate hikes during the mid-June meeting, it was reaffirmed that at least two more increases would follow by the end of the year. The upcoming meetings in the third quarter are scheduled for July 26th and September 20th. Additionally, market participants are eagerly anticipating the annual symposium of major central banks in Jackson Hole at the end of August.

In the Eurozone, yields on 10-year German bunds only experienced a slight increase from 2.28% to 2.39%. However, the yields on 2-year bonds responded more strongly to the European Central Bank’s (ECB) tightening cycle, rising from 2.70% to 3.27% during the quarter, thereby intensifying the inversion of the yield curve. By the end of the quarter, the ECB’s benchmark interest rate stood at 4.00%, following 0.25% rate hikes in both May and June. The next ECB meetings are scheduled for July 27th, September 14th, and October 26th.

In the United Kingdom, 10-year Gilts witnessed a continuous rise in yields, climbing from 3.42% to 4.44%. Due to persistently high inflation rates, yields on 2-year bonds reached 5.33% by the end of the quarter. The Bank of England hiked its benchmark interest rate to 5.00%.

In Japan, the policy of yield curve control was retained by the new central bank governor, with the Bank of Japan aiming for a maximum yield of 0.50% on 10-year JGBs.

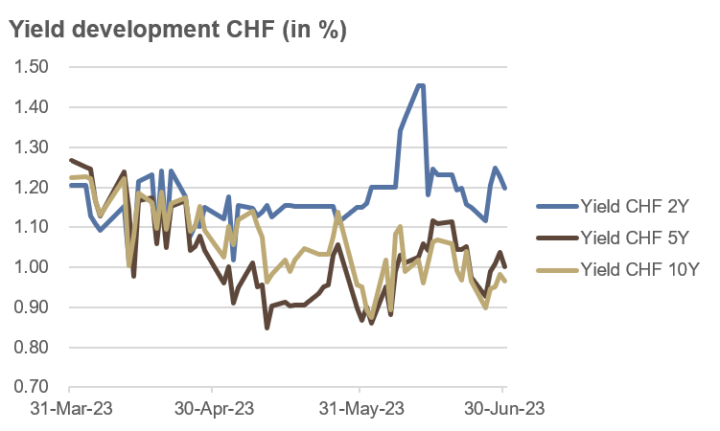

Contrary to the hawkish rhetoric of the Swiss National Bank (SNB), the bond market did not react with higher yields. 2-year papers yielded around 1.20%, while the yields on 5-year and 10-year bonds fell to around 1% or slightly below. This occurred despite a rate hike at the end of June, bringing the benchmark interest rate to 1.75%. SNB representatives announced that the rate hike cycle was not yet complete. Unlike most other central banks, the SNB holds its meetings only once per quarter, with the next session scheduled for September 21st.

Source: Bloomberg

Credit

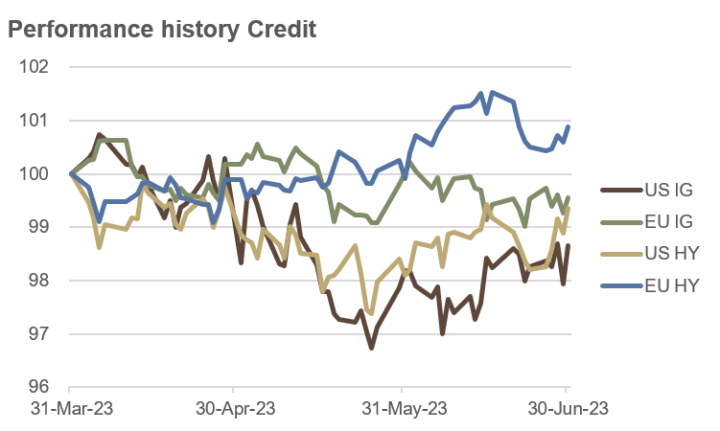

Despite the inverted yield curves and the associated expectations of a recession in most economies, credit spreads for high-yield bonds did not increase over the course of the quarter. In the US, they decreased from 4.6% to 4.1%, while in Europe, they decreased from 4.7% to 4.4%. In past recessions, spreads often reached well over 6.5%.

The slight decline in credit spreads was a positive factor, while the rising interest rate environment, particularly in the US, had a negative impact on bond prices. Ultimately, European high-yield bonds gained 0.9% during the quarter, while US high-yield bonds experienced a slight decline of 0.6%. Investment-grade bonds saw a marginal loss of 0.4% in Europe and 1.3% in the US.

Investment-grade bonds are the highest quality bonds rated by credit agencies, while high-yield bonds are more speculative and have a rating below investment-grade. The prices of high-yield bonds often tend to move in a similar manner to equity markets, while the prices of investment-grade bonds are more influenced by overall interest rate levels.

The positive sentiment in equity markets was also reflected in convertible bonds and emerging market bonds during the second quarter. Global convertible bonds increased by 3.1%, while emerging market sovereign bonds (in USD) gained 2.9%.

Source: Bloomberg

Equities

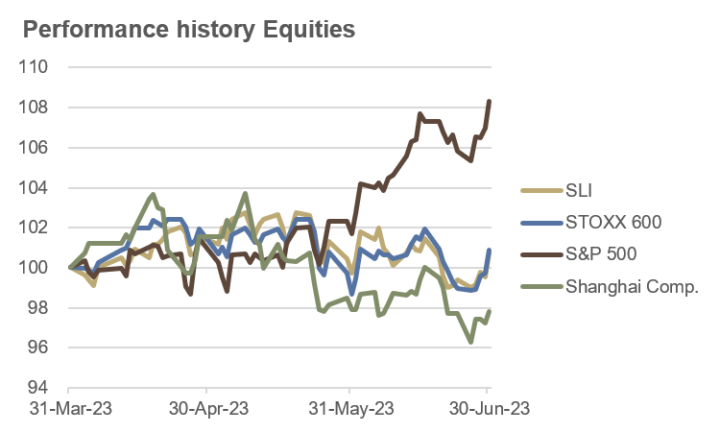

Throughout the second quarter, equity markets exhibited minimal concerns of an impending recession, and the upward trajectory of interest rates did not present a major hindrance to further market gains. However, it is important to note that the robust performance in the US market was largely propelled by the exceptional performance of the “Magnificent Seven” companies, namely Nvidia, Tesla, Meta Platforms, Apple, Amazon.com, Microsoft, and Alphabet.

The extraordinary performance of these seven large-cap companies played a pivotal role in driving the overall performance of the US stock market during the second quarter. This resulted in a 8.3% increase in the S&P 500 index. Particularly noteworthy is the remarkable impact these companies had on the technology-focused Nasdaq index. The Nasdaq 100 index experienced its strongest first half-year performance since its establishment in 1971, soaring by nearly 40%. Similarly, the Nasdaq Composite index achieved its most impressive first half-year performance in four decades, surging by over 30%. Meanwhile, the S&P 500 index recorded a year-to-date gain of nearly 16%.

In Europe, the STOXX 600 rose by 0.9% in the second quarter and gained 8.7% year-to-date. In Switzerland, the Swiss Leaders Index advanced by 0.7% and was up 7.8% at the end of June compared to the end of 2022.

In China, the initial optimism surrounding the resurgence of economic activities following the lifting of COVID-19 lockdowns swiftly gave way to disillusionment due to persistent challenges in the real estate sector. As a result, the Shanghai Composite experienced a 2.2% decline over the course of the quarter. In stark contrast, Japan’s Nikkei 225 index surged impressively by 18.4% during the second quarter, contributing to a year-to-date increase of over 27%.

In the United States, the IT, communication, and consumer cyclicals sectors demonstrated strong performance in the first half of the year, leading the way for equity gains. Industrials and materials sectors also performed well. However, sectors such as utilities, energy, and healthcare faced relative underperformance. Similarly, in Europe, the technology sector took the lead, followed by consumer cyclicals, industrials, and materials. On the other hand, energy and real estate struggled to keep pace. Notably, the quality factor was favored by investors in both the US and Europe.

Turning to country and index-specific rankings, the Nasdaq emerged at the top of the list, showcasing its strong performance. Japan, Taiwan, and Italy also demonstrated notable performance, securing favorable positions. Conversely, Thailand, Belgium, and Hong Kong found themselves at the lower end of the rankings.

Source: Bloomberg

Commodities and Alternative Investments

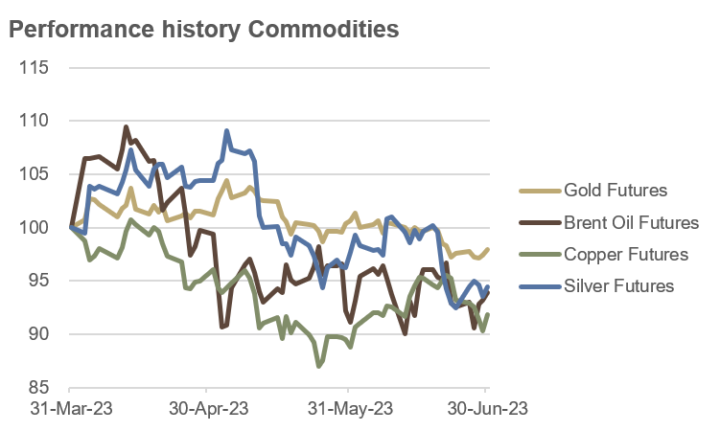

The initial price increases in crude oil at the beginning of the second quarter, driven by announced supply cuts from OPEC+ member countries, proved to be short-lived. Soon, the weak economic data from China started to take its toll. The sluggish manufacturing sector dynamics also affected the prices of copper and silver.

The price of gold reached a peak of $2,055 per ounce in early May but was unable to sustainably hold the psychologically significant $2,000 mark by the end of the quarter. In the second quarter, gold declined by 2.0%, and silver lost 5.6%. Brent crude oil prices decreased by 6.1%, while copper was 8.2% cheaper at the end of the quarter compared to three months ago.

The positive environment for technology stocks also influenced cryptocurrencies, which recorded gains of 6% to 7% during the quarter. Year-to-date, Bitcoin posted a gain of 84%, and Ether saw a gain of 62%, both measured in USD. Rumors of the renowned fund provider BlackRock launching a Bitcoin ETF also provided support to the cryptocurrency market.

Source: Bloomberg

Currencies

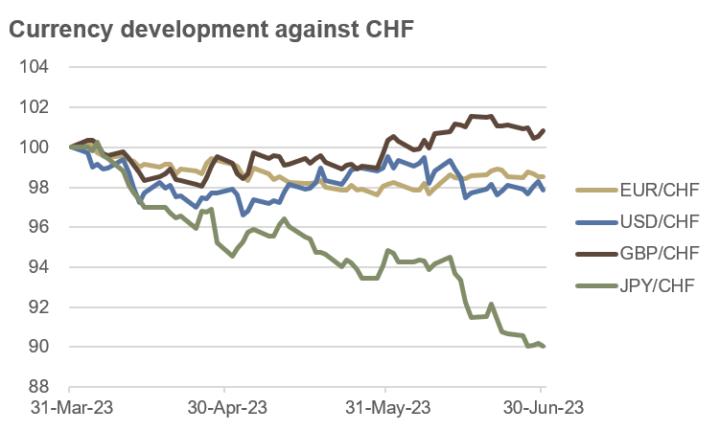

In the second quarter, the major currency pairs traded within narrow ranges, except for the JPY. Against the CHF, the EUR experienced a loss of 1.5% and fell to CHF 0.977. The USD lost 2.1% and reached a level of CHF 0.895. The GBP managed to gain 0.8% against the CHF, closing the quarter at CHF 1.137 compared to CHF 1.128 at the end of the first quarter.

Despite the interest rate hikes by most Western central banks, the Bank of Japan, under new leadership, maintained its policy of yield curve control, leading to a significant decline in the JPY. Against the CHF, the JPY lost 10.0% in value during the quarter.

One of the strongest currencies was the Mexican Peso (MXN), which rose by more than 9% year-to-date against the CHF. Conversely, the Chinese Yuan (CNY) experienced a depreciation of 7.9% against the CHF year-to-date, reflecting the impact of weaker-than-expected economic performance in China. Furthermore, against the USD, the CNY is approaching a low point at CNY 7.25, which was briefly reached in October/November 2022, marking its lowest level since the global financial crisis in 2008.

Source: Bloomberg

Outlook

The process of deglobalization, characterized by the shortening of supply chains and the increased integration of Artificial Intelligence (AI) in business operations, has distinct implications for inflation and productivity. While deglobalization leads to structurally higher inflation in the short and medium term, the use of AI reduces costs and enhances productivity in the medium and long term. The market strives to swiftly and efficiently factor in this transformative moment.

In the US, headline inflation experienced a notable decline from 9.1% in June 2022 to 4.0% in May 2023. This downward trend is expected to persist in June, largely driven by base effects. However, core inflation, which excludes food and energy prices, has remained relatively steady between 5.3% and 5.6% since the start of the year, with only marginal easing anticipated in June. The dynamics surrounding inflation and the decision-making process of central banks can appear puzzling. The reliance on past inflation rates as a justification for policy rate decisions raises questions about the effectiveness of such an approach. The Swiss National Bank’s explanation for further interest rate hikes in the second half of the year, citing rising rental prices from September, can be perceived as grotesque or even absurd.

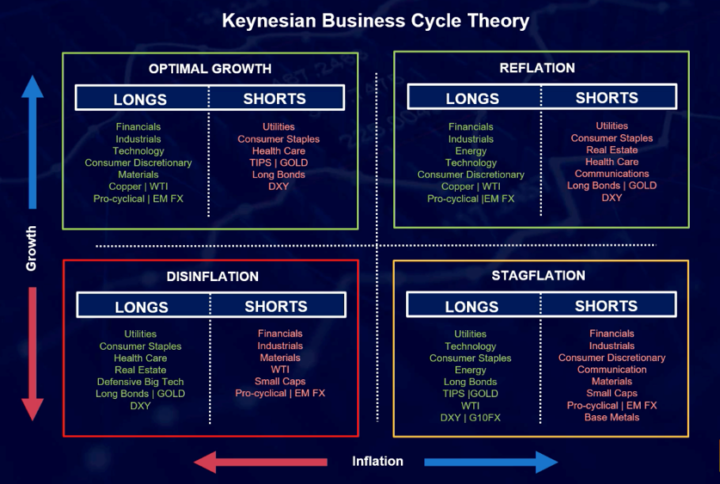

Viewing the figure below from a “reverse engineering” perspective – that is, which sectors and asset classes performed best or worst in the first half of the year – it becomes evident that the market had priced in an optimal growth scenario, and rightly so. Indeed, the growth in the year-to-date has been extremely robust and inflation rates have gradually receded. However, the unexpectedly strong economic performance in the first half of the year has raised the bar, making it increasingly challenging to sustain rising growth rates in the coming quarters.

Source: forexlive.com

Looking ahead to the second half of the year, our outlook suggests a potential slowdown in both economic growth and inflation rates. In light of this, we are adopting a position that aligns with a disinflationary scenario.

Fixed Income

Considering our outlook for a slowdown in economic growth and inflation in the third and fourth quarters, it appears prudent to favor long-term government bonds.

Given the expectation of further interest rate increases despite weaker economic and inflationary indicators, there may be merit in overweighting short-term money market investments to capitalize on higher short-term interest rates.

In contrast, we view inflation-linked bonds as less appealing due to our assessment of a potential decline in inflation. We anticipate that inflation could possibly surprise on the downside, which may limit the effectiveness of inflation-linked bonds.

Credit

In the second quarter, the financial markets witnessed a decline in credit spreads for high-yield bonds, catching many market participants off guard. Typically, such a decrease in spreads suggests an improvement in economic conditions. However, as we foresee a potential moderation in economic performance in the upcoming months, accompanied by widening credit spreads, our preference lies with medium-term investment-grade bonds spanning a maturity of 5 to 7 years rather than high-yield bonds.

Furthermore, we prioritize investing in liquid bonds and ETFs while avoiding complex and illiquid credit structures.

Equities

Equity markets have followed a familiar pattern of causing “maximum pain” for investors. Despite initial predictions of another challenging year for stocks following a lackluster 2022, indices displayed resilience and delivered solid performance at least until the mid-year mark. However, this upward trajectory was predominantly driven by US companies, particularly 7 mega-cap technology stocks.

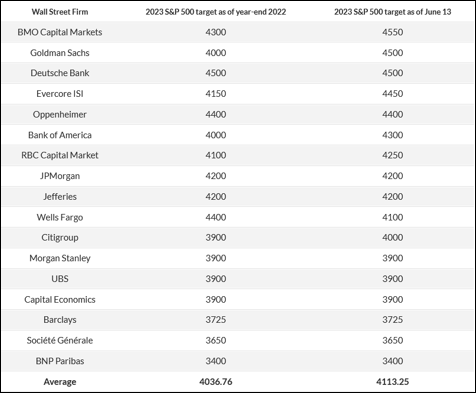

Drawing from the available data (see figure below), many strategists maintain their forecasts of a decline in stock prices by year-end, albeit with some slight upward revisions. As of July 3rd, the S&P 500 closed at 4,455 points, approximately 8% above the average year-end projection.

Although inflation rates are expected to recede more rapidly and significantly than currently anticipated, this shift will also exert downward pressure on corporate earnings growth and revenue. Additionally, central banks are poised to implement further interest rate hikes, presenting certain challenges. Substantial market disruptions will be required to provide central banks with the rationale for interest rate cuts. In light of these circumstances, we favor defensive sectors such as utilities, consumer staples, and healthcare.

From a tactical and seasonal standpoint, our overall equity exposure for the third quarter remains slightly underweight.

We maintain a slight preference for US equities over their European counterparts. When selecting individual stocks, our focus centers on the quality factor, favoring companies with low debt levels and robust business models.

While the Japanese stock market has already exhibited strong performance year-to-date, it is poised for further potential growth, bolstered in part by the fundamentally compelling undervaluation of the JPY.

Source: MarketWatch, June 14th, 2023

Among emerging market equities, we maintain a favorable outlook for India and Vietnam in the Asian region. However, we currently perceive China as comparatively less appealing.

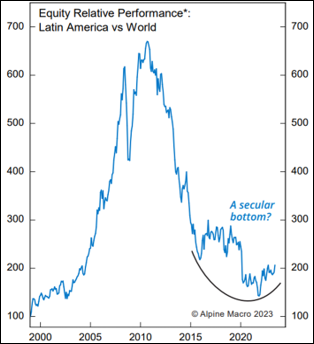

Moreover, we anticipate potential positive developments in the Latin American stock markets in the forthcoming months, as illustrated in the accompanying figure.

Source: Alpine Macro (MSCI Large, Mid & Small Cap total returns in USD terms; rebased to January 1999 = 100)

Commodities

As anticipated, the impact of the OPEC+ supply cuts in early April on crude oil prices was short-lived. Despite a reduction in net long positions in the futures market in recent weeks, they remain at elevated levels. Consequently, the downward trajectory for oil prices is projected to persist in the third quarter, albeit with a somewhat moderated pace. However, uncertainty lingers regarding the timing of strategic petroleum reserves (SPR) replenishment by the United States.

In the case of copper, a technical reversal towards an upward trend may manifest, even amidst anticipated global economic weakness. Copper, often referred to as “Dr. Copper”, due to its correlation with the global economy, is currently witnessing relatively low net long positions in the futures market compared to historical levels.

We anticipate an upward trajectory for gold prices in the second half of the year, presenting a favorable buying opportunity around the $1,900 per ounce level. Net long positions in the futures market have witnessed a notable decline over the past three months, which is viewed positively. Conversely, our current stance on silver is more cautious.

Currencies

In the second quarter, there was a clear loser among the major currencies: the Japanese Yen (JPY). Under new leadership, the Bank of Japan has maintained its yield curve control policy, while most Western central banks continue to be in a tightening cycle. Due to the widening interest rate differentials, the JPY has significantly depreciated against the major trading currencies. However, we believe there has been an overreaction, and we expect a stronger JPY in the third quarter. The purchasing power parity further supports the argument for a stronger JPY.

The currency pair EUR/CHF is expected to rise in the next three months. On one hand, purchasing power parity fundamentally favors a stronger Euro, and on the other hand, despite declining inflation rates and an economic slowdown, the ECB is expected to continue raising interest rates, making real interest rates in the Eurozone increasingly attractive.

The technical outlook for the currency pair USD/CHF is currently less positive for the USD. While the Greenback tends to benefit against most currencies in turbulent times or during a global economic downturn, this is usually not the case against the CHF. The CHF also serves as a “safe-haven currency”. We expect slightly declining USD/CHF rates in the third quarter.

The upward trend in GBP/CHF is expected to continue over the next three months as the Bank of England is expected to implement significant interest rate hikes. The purchasing power parity also supports a stronger Pound.

Conclusion

In light of the anticipated disinflationary scenario characterized by slowing growth and inflation rates, an increased allocation to long-term government bonds and gold is considered a prudent approach. Regarding equity investments, a slightly underweight position is suggested, with a focus on defensive sectors such as utilities, consumer staples, and healthcare. The selection of stocks should prioritize the quality factor, ensuring resilience during periods of uncertainty.

To further enhance portfolio diversification, one may consider the inclusion of liquid and transparent trend-following funds, known as CTAs (Commodity Trading Advisors). These funds base their investment decisions solely on historical price trends, offering potential benefits in volatile market conditions. CTAs have historically demonstrated their ability to provide diversification and achieve favorable long-term returns.