Quarterly Outlook Q3 2022

Between economic downturn and inflation.

Review

Fixed Income

10-year US Treasuries lost more than 13% so far this year, the worst 1st half since 1788, shortly before George Washington was elected president and the US Constitution was ratified. The yield peaked at 3.50% in mid-June and fell to 3.02% at the end of the quarter. Currently, the market is assuming 7 more rate hikes of 0.25% each by the Fed by the end of the year. At the moment, the fed funds rate stands at 1.75%. Scheduled Fed meetings during Q3 will take place on 27 July and 21 September 2022.

Interest rates also rose in the Eurozone. The yield on 10-year German Bunds moved up from 0.55% at the beginning of the second quarter to 1.82% by mid-June and ended the quarter at 1.37%. However, the yield on 10-year Italian government bonds jumped even more sharply, to 4.27%, leading briefly to a yield spread over German Bunds of more than 250 basis points in mid-June. This prompted the ECB to hold an extraordinary meeting to counter the fragmentation risk in the Eurozone. As a result, the yield on Italian bonds fell to 3.39% at the end of the quarter. In the United Kingdom, the yield on 10-year gilts rose from 1.61% to 2.24% during the quarter.

During Q2, the Bank of Japan continued its yield curve control policy to keep 10-year JGBs yield below 0.25%. At the end of the quarter, yields stood at 0.23%, compared to 0.21% in the previous quarter.

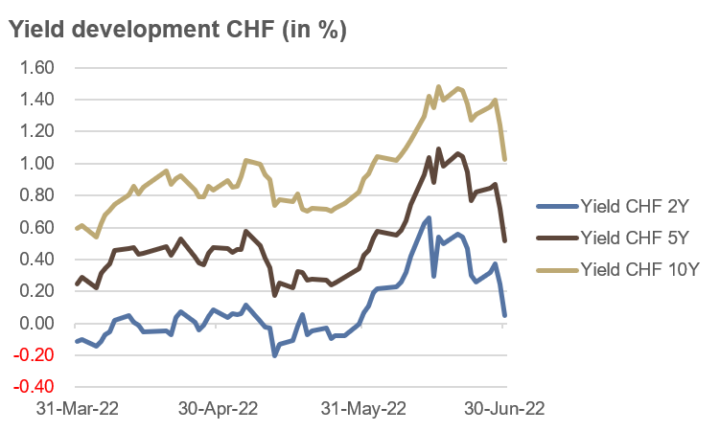

Swiss government bond yields moved in line with the interest rate trend in the US and the Eurozone: a rise until mid-June, followed by a decline in the second half of the month. The yield on the 10-year Eidgenoss ended the quarter at 1.03%, after an interim high of 1.48% on 16 June, the day the SNB surprisingly raised the key interest rate from -0.75% to -0.25%. At the end of the quarter, the yield on 2-year government bonds was only just in positive territory at 0.05%.

Source: Bloomberg

Credit

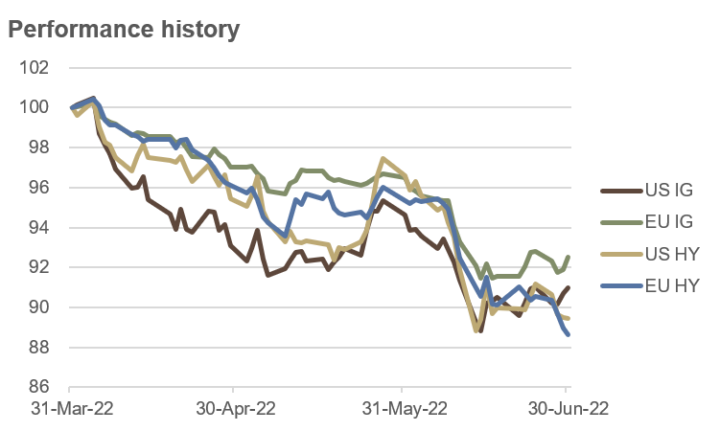

Corporate bonds could not escape the rising interest rate environment and the increasing signs of an economic downturn. High-yield bonds on both sides of the Atlantic lost more than 10% and ended the second quarter near their lows. In the end, the result was -10.5% in the USA and -11.4% in Europe.

The increasing risk aversion was reflected in a rise in credit spreads for US high-yield bonds. These spreads rose from 3.43% to 5.87% during the second quarter.

Investment grade (IG) bonds fared slightly better. European IG bonds lost 7.5% and US IG bonds shed 9.0%. Both were able to recover somewhat towards the end of the quarter from their lows reached in mid-June.

Investment grade bonds are the highest quality bonds as determined by a rating agency; high-yield bonds are more speculative and have a credit rating below investment grade. High-yield bond prices often move similarly to equity markets, while IG bond prices are more sensitive to the general interest rate level.

Global convertible bonds lost slightly less than 10% in Q2.

Source: Bloomberg

Equities

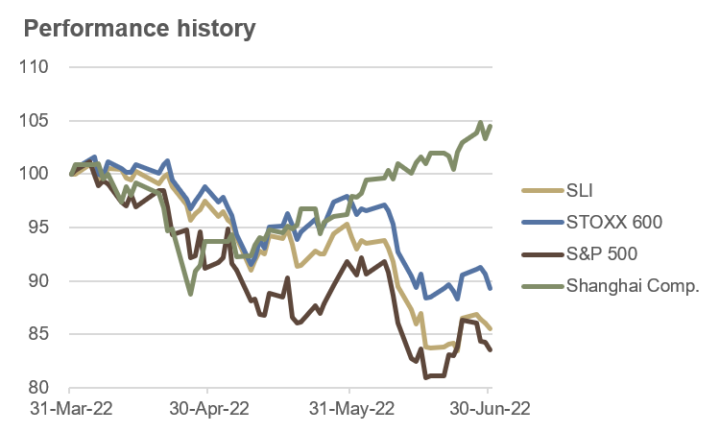

Global equity markets continued their slide in the second quarter. The 47-country MSCI World Index suffered its worst first half since its creation in 1990, losing more than 20%. So far this year, equity markets have wiped out a total of USD 13 trillion in market capitalisation.

In the USA, the rally at the end of the first quarter was short-lived. At the beginning of the second quarter, the price decline continued and the S&P 500 Index ended the quarter down 16.4%. For the year-to-date, this resulted in a loss of 20.8%, the worst start to a year since 1970.

A similar picture was seen in Europe, albeit slightly less gloomy. The pan-European STOXX 600 Index fell by 10.7% in Q2, while the Swiss Leader Index (SLI) lost 14.5%. Since the beginning of the year, the STOXX 600 is down 16.7% and the SLI tanked 20.5%.

Bucking the global trend, China’s Shanghai Composite ended Q2 with a gain of 4.5% after being down by over 10% at the end of April. In Japan, the Nikkei 225 lost 5.1% despite a weak yen.

In the US, the energy sector was by far the best performer in the first half of the year, followed by utilities, consumer staples and healthcare.

In Europe, the list of winners was led by the following sub-sectors (in descending order): Oil & Gas, Telecom, Healthcare, Insurance, Basic Commodities, and Utilities.

So far this year, the best performing equity markets have been those of the following countries – in descending order: Chile, Portugal, Indonesia, Saudi Arabia and the United Kingdom (FTSE 100 Index).

Source: Bloomberg

Commodities and Alternative Investments

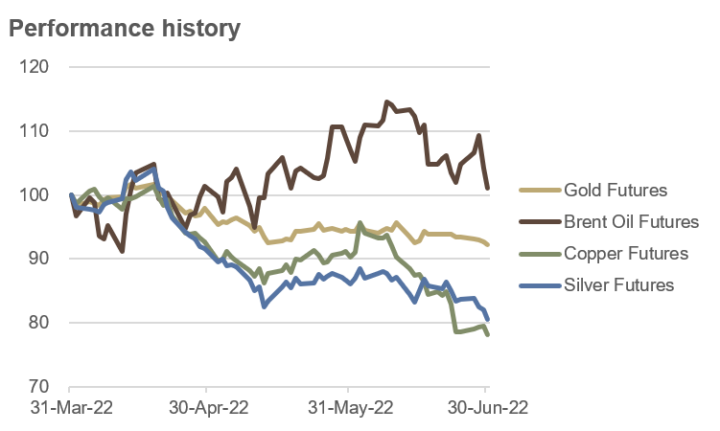

In the second quarter, the volatility of crude oil prices decreased sharply compared to the first 3 months of the year. Brent crude peaked at just over $123 per barrel in the first week of June, falling back to $109 by the end of the month. At the end, this made for a quarterly gain of 1.0%.

The copper price plunged 21.9% and ended Q2 at its low. Silver could not escape the price decline of industrial metals and also lost almost 20% of its value in the course of the quarter.

The gold price fared slightly better, being down 7.8%. However, a steady downward pressure was noticeable, leaving the gold price at its low by the end of the quarter.

Cryptocurrencies lost massively and ended Q2 near their lows: Bitcoin (BTC/USD) -57%, and Ether (ETH/USD) -71%.

Source: Bloomberg

Currencies

The US dollar (DXY Index) gained more than 9% in the first half of the year against a basket of major currencies, while it even rose by more than 15.5% against the Japanese yen, which fell to its weakest level since 1998.

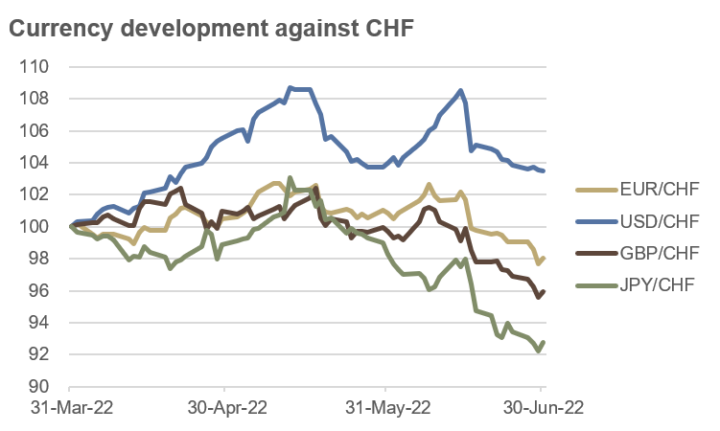

The surprising interest rate hike of 0.50% by the SNB on 16 June is clearly visible in the chart below: on this day the CHF rose significantly against most currencies.

In the course of the quarter, the EUR/CHF exchange rate initially rose by more than 2% to 1.0480, only to reverse course after the SNB’s interest rate move. At the end of the quarter, EUR/CHF stood at 1.0010, down 2.0% for the quarter. Further, GBP/CHF was down 4.1% during the quarter.

The greenback initially rose by over 8% against the CHF to 1.0020, and thereafter lost some ground in the second half of June, ending the quarter at 0.9550 for a quarterly gain of 3.5%. Year-to-date, USD/CHF advanced by 4.7%.

The weakness of the Japanese yen continued during the second quarter, losing 7.2% against the CHF.

Among freely tradable currencies, only the Brazilian real with +6% and the Mexican peso with +2% performed better than “King Dollar” in the first 6 months of the year.

Source: Bloomberg

Outlook

From mid-June, the focus of market participants started to shift towards a weakening economy, after it had previously been on elevated inflation rates. This tension between an economic downturn and inflation risks was joined by differing expectations about the future path of monetary policy steps by central banks: will interest rate hikes and tighter monetary policy continue in the coming months to bring inflation under control or will monetary policy be eased again to prevent or at least cushion a recession?

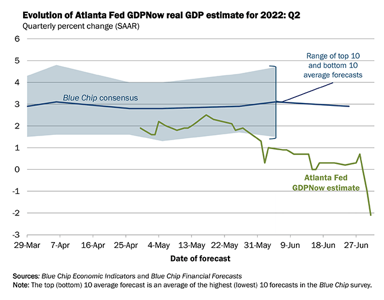

In the US, economic growth in Q1 2022 was an annualised -1.6%. The current estimate for Q2 is -2.1% (figure below). If this were to happen, the US economy would, by definition, already be in a recession with two negative quarters in a row….

Source: forexlive.com

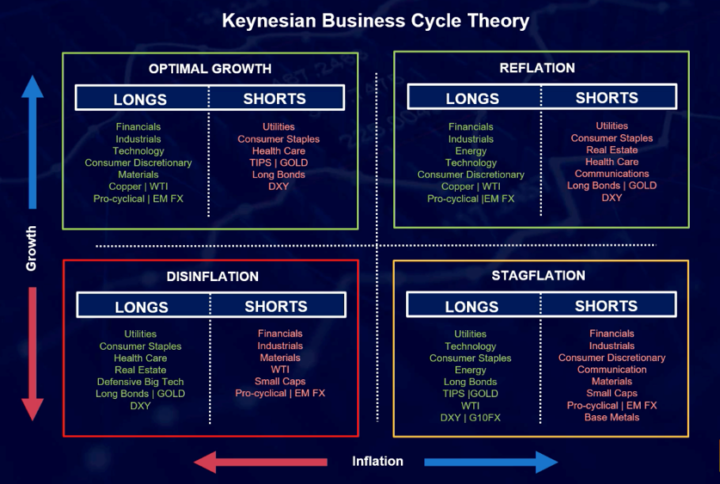

We expect growth and inflation rates to cool in Q3 and consequently assume a disinflation scenario (chart above). However, inflation will remain at stubbornly high levels in the 6 to 7% range, hence the Fed will not be able to avoid raising fed funds rates further in Q3.

Fixed Income

It is quite possible that we have already seen the peak interest rates on prime long-term government bonds, as signs of an economic slowdown or even a recession are mounting in the US and in Europe. Moreover, central banks currently seem to prioritise fighting inflation over supporting economic growth.

Another story remains the fragmentation risk in the Eurozone with Italy, Greece, Spain and Portugal on the receiving end. For the time being, another euro crisis seems to have been averted.

Due to the increased risk of recession and the quite appealing yields, we are rather positive on first-class government bonds.

Credit

Credit markets are increasingly anticipating a recession, especially in Europe. For example, the volume of European corporate bonds with credit spreads of over 10% amounted to more than EUR 40 billion at the end of June, compared to EUR 6 billion at the end of 2021.

Demand for high-yield bonds has also fallen in the US, where credit spreads have continued to widen and currently stand at 5.87% (Figure). Credit ratings are likely to come under pressure in the coming months.

Even though credit spreads have already widened substantially, we continue to prefer investment grade over high- yield bonds.

Equities

Due to the expected disinflation scenario, we recommend a rather defensive positioning in equity investments. After an interim spurt that could last until around mid-July, equities will suffer another setback. On the one hand, central banks will continue to tighten monetary policy for the time being, and on the other hand, the companies’ quarterly results and profits guidance are likely to be less rosy than generally anticipated.

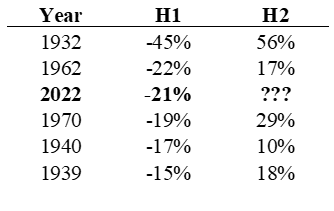

The situation could brighten towards the end of the 3rd quarter. Central banks should be able to pause by then. Moreover, the table below underpins the positive performance of the S&P 500 in H2, after the five worst H1 performances in history (before 2022). It shows that each time, after such large losses in the 1st half, a bounce happened in the 2nd half of the year.

Commodities

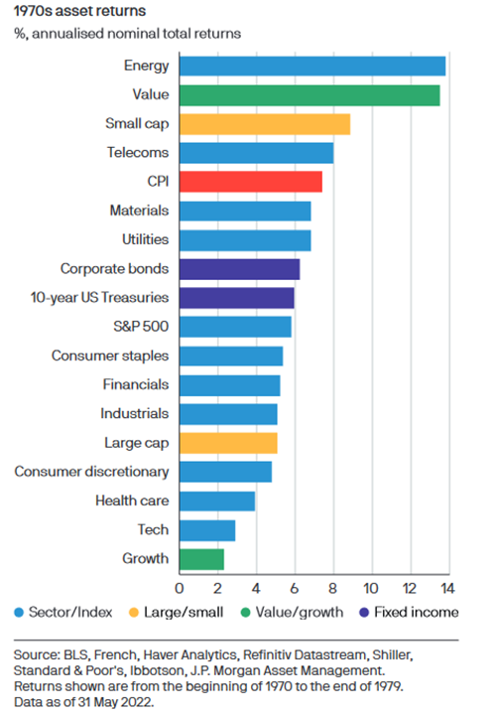

Many market pundits compare the current situation to the stagflation of the 1970s. The following chart from JP Morgan shows the nominal, annual returns of various sectors, factors and asset classes. In particular, the energy and the basic materials sectors benefited from high commodity prices during that decade.

Despite a slowing economy, we expect crude oil prices to rise in the third quarter. On the one hand, OPEC is producing close to maximum output and, on the other, the economic recovery in China is likely to pick up steam. In addition, long positions on the futures market have fallen sharply by historical standards.

After the strong setback in the copper price in Q2, we expect prices to rise slightly in the next three months. Sentiment is now very subdued with very high net short positions in the market.

In absolute terms, the gold price – measured in USD – has not moved much this year. However, it is ahead of most other asset classes, in some cases significantly. We expect prices to rise in the third quarter and also appreciate the yellow metal’s properties for portfolio diversification. The price of silver should also be able to rise, although the price trend is likely to be much more volatile.

Currencies

After the SNB’s surprising interest rate hike, many market participants expect a stronger CHF, as the SNB justified its decision by advocating a stronger Swiss franc to fight inflation.

Without future interventions by the SNB, nothing stands in the way of a sustained undershooting of the EUR/CHF 1.00 parity in Q3. Besides a stronger CHF, the USD should also tend towards strength, especially as long as the ECB only acts rhetorically and is more content with “fire-fighting” exercises.

The Bank of England is likely to curb its rate hike cycle in the coming months, leading to a weakening of the British pound.

As long as the Bank of Japan maintains its yield curve control in place, the Japanese currency will remain weak. However, the yen is now at its weakest level against the USD since 1998 and the market has already positioned itself strongly negative on the yen.

Conclusion

A defensive positioning seems appropriate for the time being. We expect temporarily lower share prices in the course of the third quarter before the picture brightens towards the end of the quarter. Patience is the order of the day. First-class government bonds are likely to have seen their highest yields and lowest price levels, respectively, in 2022. The Swiss franc and the dollar will tend to strengthen. We continue to advocate genuine, structural portfolio diversification. We recommend to invest only in liquid assets and avoid illiquid alternative investments.