Quarterly Outlook Q2 2022

Stubborn inflation and slowdown in global economic growth.

Review

Fixed Income

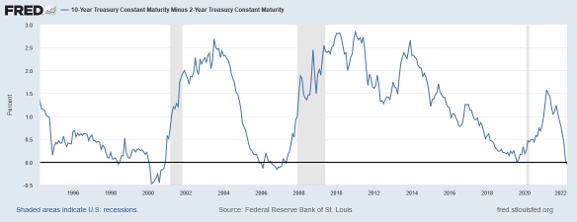

On 1 April 2022, the yield on 2-year US Treasury notes went higher than that on 10-year maturities for the first time since August 2019. The yield on 2-year Treasury notes rose from 0.73% to 2.46%, the largest such increase since Q2 1984, while the yield on 10-year US Treasury bonds rose from 1.51% to 2.39% as of 1 April. A Bloomberg index of a basket of US government bonds posted a record 5.6% decline in the first three months of the year, the worst quarter since the index was introduced in 1973. At the end of March, the market was expecting 8 to 9 more rate hikes of 0.25% each by the end of the year.

In the Eurozone, interest rates also increased. The yield on 10-year German Bunds moved up from -0.18% at the beginning of the year to +0.55% at the end of the quarter. The yield on 2-year German bonds rose slightly less, from -0.64% to -0.07% at the end of March. In the United Kingdom, the yield on 10-year gilts rose from 0.97% to 1.61%.

In Japan, the central bank was tested on its staying power during the second half of March. Since 2016, the maximum yield on 10-year JGBs has been set at 0.25% as part of the yield curve control policy. As the market approached this level towards the end of March, the Bank of Japan bought bonds on a large scale to prevent the 10-year yield from rising above 0.25%. At the end of the quarter, the yield on 10-year JGBs stood at 0.21%, compared to 0.07% at the start of the year.

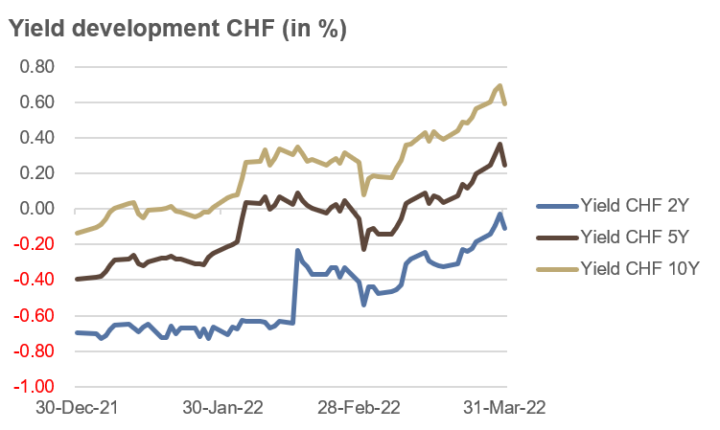

Swiss government bond yields also rose during the first quarter. The yield on the widely followed 10-year government bond ended the quarter at +0.59%, up from -0.14% at the beginning of the year. The yield on 2-year bonds rose slightly less – from -0.70% to -0.11% – as the SNB made no indication to raising its key interest rate from the current -0.75% in the foreseeable future or to end its loose monetary policy.

Source: Bloomberg

Credit

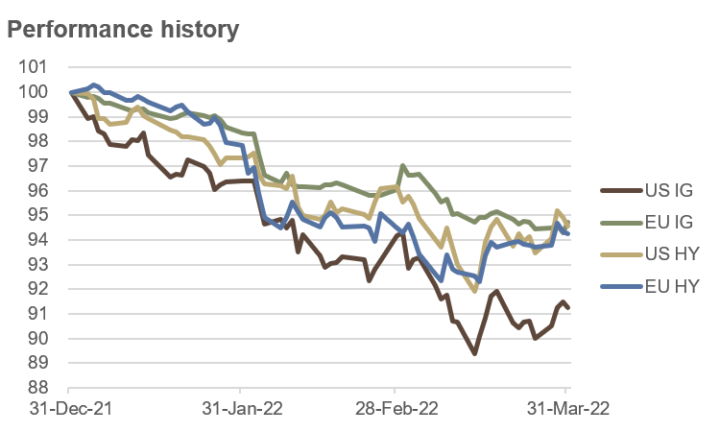

European investment-grade (IG) bonds and US and European high-yield (HY) bonds ended Q1 2022 with losses of around 5.5%. US IG bonds lost 8.7%. The sharp rise in US rates was particularly painful here. On both sides of the Atlantic, high-yield bonds (HY) bottomed out in mid-March and regained some ground in the second half of the month. This trend was illustrated by the credit spreads for HY bonds: in the US, these spreads started at 3.10% at the beginning of the year, rose steadily to 4.21% by mid-March, and fell again slightly to finish at 3.43% by the end of the quarter.

Investment-grade bonds are the highest quality bonds as determined by a rating agency; high-yield bonds are more speculative and have a credit rating below investment grade. High-yield bond prices often move in-line with equity markets, while IG bond prices are more affected by the general level of interest rates.

Global convertible bonds ended the quarter down 5.6%.

Source: Bloomberg

Equities

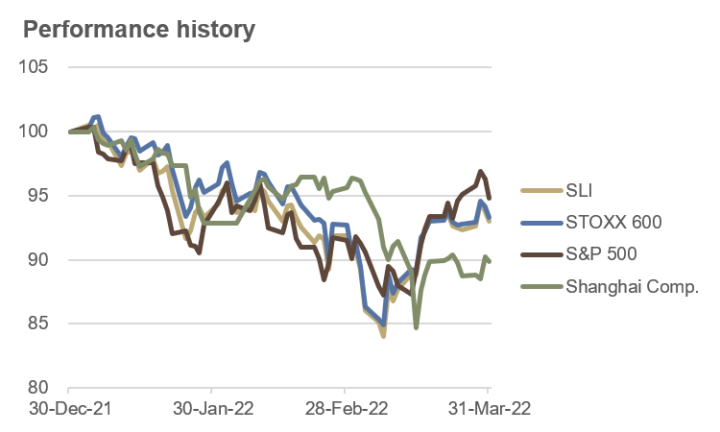

In stock markets, the S&P 500 fell by 4.9% in the first three months of the year and the technology-heavy Nasdaq Composite lost 9.1%. For both indices, it was the first negative quarter since Q1 2020.

In Europe, the STOXX 600 Index fell more than 6% in Q1, while the Swiss Leader Index lost 7%.

Over in Asia, the Shanghai Composite lost 9.3% and Japan’s Nikkei 225 shed 3.4%.

In the USA, the energy sector topped the list of winners by a wide margin. Utilities and consumer staples followed far behind. On the losing side were the communication sector, consumer discretionary stocks and technology.

In Europe, the winners were stocks from the following sub-sectors: basic materials, oil & gas and telecommunications. On the other hand, stocks from the retail, technology and media sub-sectors suffered the biggest losses.

In Q1, the country list with the best performing stock markets was led by Saudi Arabia, Brazil, Portugal, Indonesia, Norway, Mexico and Canada.

Source: Bloomberg

Commodities and Alternative Investments

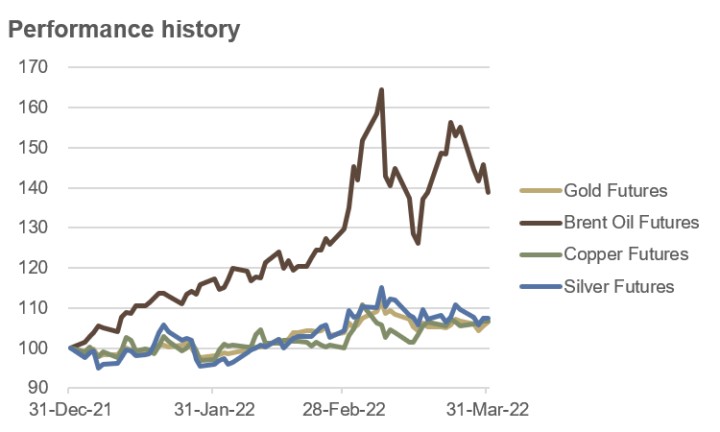

During the first quarter, a striking feature of commodity markets were the volatile price swings of crude oil. Until 8 March, the price of Brent Crude rose from $78 to $128 (+64%). The price subsequently plummeted, rebounded again and ended the quarter at just under $108 per barrel, a gain of almost 40% for the entire quarter.

The price trajectories of gold, silver and copper were somewhat less exciting. At the end of the quarter, all three metals were up between 6.5% and 7.5%, although copper and silver struggled slightly on various occasions.

The two most important cryptocurrencies experienced a wild rollercoaster ride during Q1 2022, which is difficult to guess based on the quarterly performance. At the end of the quarter, Bitcoin (BTC/USD) lost only 1.5%, while Ether (ETH/USD) was down 11%. However, the maximum price losses during the quarter stood at -29% for Bitcoin and -41% for Ether, respectively.

Source: Bloomberg

Currencies

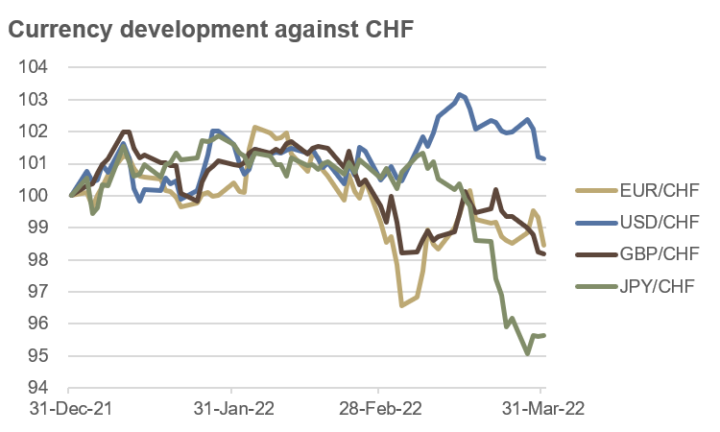

Until the Russian invasion of Ukraine on 24 February, all major currencies were slightly up against the CHF. After that date, exchange rates changed course: while “King Dollar” lived up to its reputation, the euro and the pound lost ground. On 7 March, the EUR/CHF parity was even briefly undercut intraday with a low of 0.9969.

From mid-March, the JPY attracted some attention with large losses. The reason for this was the unlimited purchase of 10-year JGBs by the Bank of Japan as part of its yield curve control policy.

The following exchange rate changes against the CHF resulted at the end of the quarter:

EUR -1.6%, USD +1.1%, GBP -1.8% and JPY -4.4%.

Of note was the continued strength of the Chinese currency (renminbi or yuan) in Q1, despite a slowing local economy and concerns about the Chinese housing market. Against the CHF, the Chinese currency rose 1.5%, even slightly more than the rise of the greenback.

Source: Bloomberg

Outlook

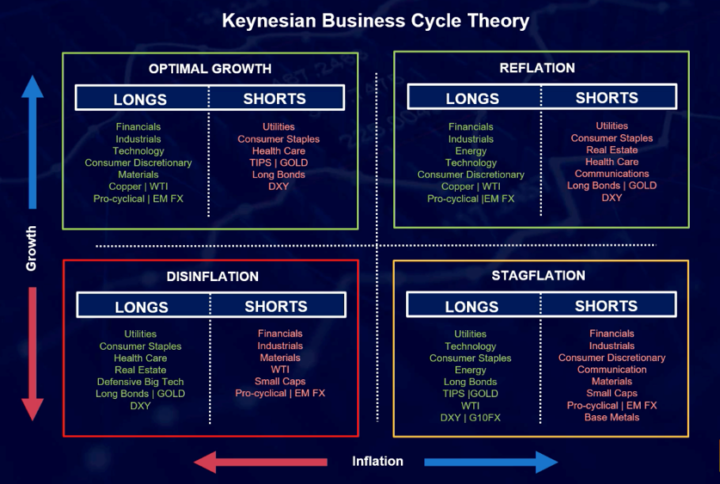

During Q1 2022, inflation remained stubbornly high, even rising a notch from the previous quarter. At the same time, however, there were increasing signs of global economic growth slowdown. This stagflation scenario (see chart) was compounded by the outbreak of war over Ukraine and tighter monetary policy, which led to an inverted yield curve in the US. At the beginning of the second quarter, the yield on 2-year US Treasury notes was above the yield on 10-year Treasury bonds. This inversion of a segment of the yield curve, which is closely watched by investors and policymakers, is usually a sign of an impending recession.

The renewed sharp rise in Corona case numbers in China and its zero-Covid policy receded somewhat into the background. We believe that the lockdowns associated with the zero-Covid policy are likely to ensure a further weakening of global growth.

We expect inflation rates to decline in the coming months due to base effects and are therefore betting on a disinflation scenario with lower growth and lower inflation rates for the second quarter (see chart).

Source: forexlive.com

Fixed Income

The inverse yield curve in the US (see chart) just at the beginning of the second quarter is usually a sign of an upcoming recession and an excessively tight monetary policy. The market now expects 8 to 9 interest rate hikes in the US at 0.25% each until the end of 2022.

We believe that these market expectations are too high, as growth and inflation rates are set to decline in coming months.

Therefore, we are rather positive on short-term government bonds, but are still waiting to buy at this point.

Credit

After the strong yield increases in the first quarter, we assume that the general interest rate level will temporarily calm down. In a disinflation scenario, however, credit spreads are likely to widen somewhat as the probabilities of loan defaults will increase.

Therefore, we prefer investment-grade to high-yield bonds.

Equities

We recommend slightly reducing the equity exposure. Due to the expected disinflation scenario, we are also increasingly focusing on more defensive sectors such as utilities, consumer staples, healthcare, real estate and defensive big tech. In terms of style factors, we favour minimum volatility, value and quality.

As an interesting addition to the equity portfolio, stocks from commodity-producing countries such as Canada, Australia or Norway can be considered.

Commodities

In the second quarter, the volatility of crude oil prices will remain high. However, we expect price trends to fall, as many speculators are now positioned long in this market.

Copper prices should continue to move up during the second quarter. Besides copper, other industrial metals such as cobalt, lithium, nickel and aluminium will also benefit from the trend towards renewable energies and electric vehicles.

We remain cautiously optimistic about the gold price in the second quarter. Both the higher interest rate level and a stronger US dollar could not harm the yellow metal. We also appreciate gold’s portfolio diversification benefits. The fluctuations in the silver price are likely to be somewhat higher than in gold. Hence, we are rather cautious here.

Currencies

The EUR/CHF parity was briefly undershot during the first quarter. Without interventions by the SNB, there would probably be nothing to prevent a sustained undershooting of the EUR/CHF 1.00 mark in the current environment. In addition to a strong CHF, the USD should also tend towards strength due to tighter monetary policy and increasing geopolitical tensions. However, we do not believe that US key interest rates will rise as much as is currently being priced in by the market. At the margin, this could reduce some of the dollar’s tailwinds.

The strong decline of the JPY at the end of the quarter attracted some attention in the FX market. Unlimited purchases of 10-year JGBs by the Bank of Japan as part of its yield curve control policy were mentioned as the reason. This led to a massive expansion of the money supply in Japan. The JPY is likely to remain under pressure as a result.

We expect the volatility in FX markets to increase and potentially even leading to broader turbulences in financial markets, as speculation in foreign exchange trading involves very high leverage ratios.

Conclusion

Volatilities are likely to rise in all asset classes during the second quarter. We recommend a somewhat more defensive positioning, whereby the cash portion may also be increased occasionally in order to be able to profit from opportunities as they may arise. In addition, we continue to adhere to a genuine, structural portfolio diversification.