Quarterly Outlook Q1 2024

A turbulent financial quarter: Government bonds surprise with interest rate declines, stock markets experience a strong rally, while currencies are in motion.

Review

Fixed Income

In the United States, the yields on 10-year Treasury bonds dipped to 3.87% at the year-end, a notable retreat from their brief surge above 5% in October. The substantial decline in long-term bond yields propelled the iShares 20+ Year Treasury Bond ETF (TLT) to a gain of more than 18% in the final two months of the year. Yields on 2-year notes, heavily influenced by expectations of future Fed fund rates, slid from 5.05% to 4.25%. Throughout the fourth quarter, the US central bank held its benchmark rates at 5.50%. However, market expectations for rate cuts in 2024 were officially acknowledged by the Federal Reserve during its mid-December meeting, a departure from the prior stance of “higher for longer”. The market is currently anticipating a rate cut in March, or, at least in May at the latest. The upcoming Fed meetings are scheduled for January 31, March 20, and May 1, 2024.

The decline in yields for long-term government bonds was also observed in the Eurozone during the last two months of the year. Yields on 10-year German Bunds, which reached a peak of 3.02% in October, dropped to approximately 2% by year-end. In Italy, the yields on 10-year government bonds fell from an October high of over 5% to 3.71% at year-end. Yields on 2-year German government bonds finished the year near their lows at 2.40%. Meanwhile, the European Central Bank (ECB) maintained its benchmark rates at 4.50% in the fourth quarter, with the next ECB meeting scheduled for January 25, 2024.

In the United Kingdom, yields on 10-year Gilts exhibited a consistent decline, ranging from 4.70% in October to 3.40% in the final week of December. Meanwhile, central bank rates were held steady at 5.25%. The Bank of England is set to convene its next regular meeting on January 31, 2024.

In Japan, yields on 10-year government bonds slipped from 0.98% to 0.55% in the months of November and December.

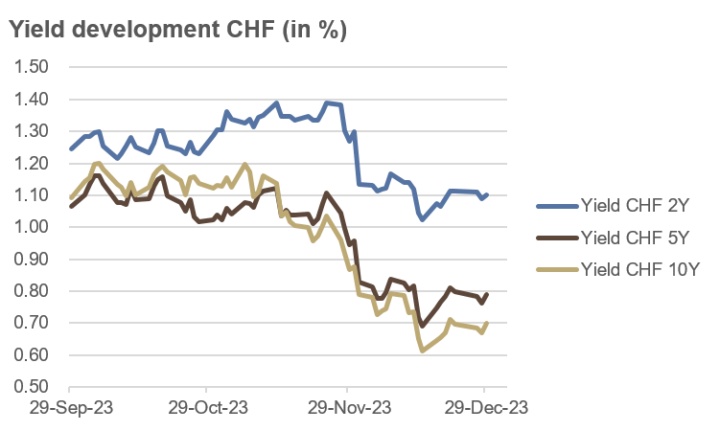

Switzerland saw the yields on 5- and 10-year government bonds fluctuate between 1.00% and 1.20% until mid-November, after which they steadily declined to a new range between 0.60% and 0.80% by year-end. The 2-year yields also settled into a new level of approximately 1.10% by year-end. The Swiss National Bank (SNB) kept its benchmark rates unchanged at 1.75% in the meantime, with the next SNB meeting scheduled for March 21, 2024.

Source: own illustration

Credit

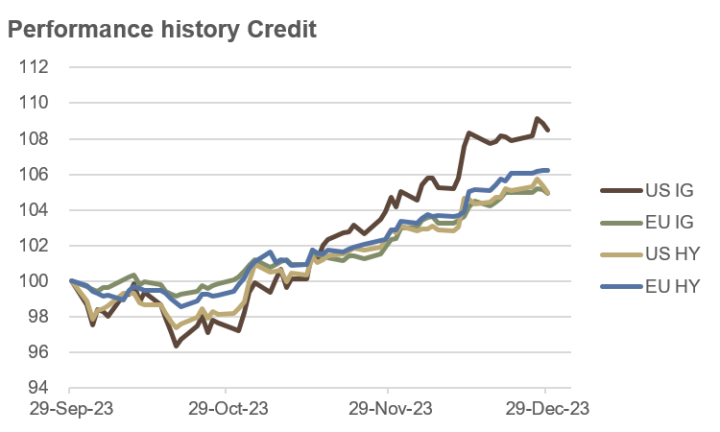

The lower interest rate environment favoured the performance of corporate bonds. Investment-grade (IG) bonds in the United States saw a gain of 8.5% during the quarter, rebounding from a 5.7% loss in the third quarter. European IG bonds experienced a price increase of 4.9%, while high-yield (HY) bond prices climbed by 5.0% in the United States and 6.2% in Europe.

Credit spreads in high-yield bonds narrowed in both regions: in the US from around 4.5% to 3.5% and in Europe from around 5.0% to 4.0%. In the case of a severe recession, spreads in the past have often been measured at well over 6.5%.

Investment-grade bonds are the highest-rated bonds assessed by credit rating agencies, while high-yield bonds are more speculative and have a rating below investment-grade. The prices of high-yield bonds often tend to react similarly to equity markets, while the prices of investment-grade bonds are more influenced by the overall interest rate environment.

The positive environment for risk assets was also evident in emerging market sovereign bonds (in USD), which saw a price increase of 9.2% during the quarter. Meanwhile, global convertible bond investments recorded a price increase of 2.6% in the fourth quarter.

Source: own illustration

Equities

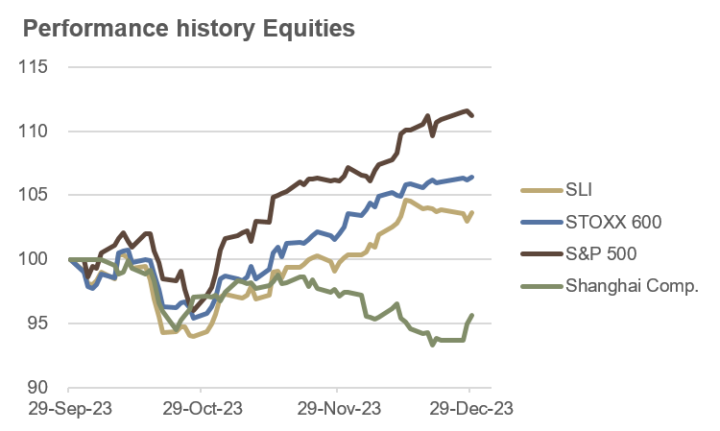

Global stock markets, following a rapid two-month rally, recorded their strongest year since 2019. Investors positioned themselves with the belief that major central banks have concluded their interest rate hikes and will swiftly cut rates again in 2024. The MSCI World Index surged by 16% since the end of October and by 22% over the entire year, marking the best performance in four years. The driving force behind this increase was predominantly the Wall Street benchmark S&P 500, which gained 14% since October and 24% over the entire year, finishing the last trading day of 2023 just below its all-time high from early January 2022.

The impressive gains on Wall Street were particularly propelled by the technology sector. The Nasdaq Composite Index, dominated by technology stocks, rose by 43%, achieving its best performance in two decades. While the “Magnificent Seven” – Apple, Microsoft, Alphabet, Amazon, Tesla, Meta, and Nvidia – played a leading role, the rally expanded in the final weeks of the year to a broader range of stocks.

The pan-European STOXX 600 rose by 6.4% in the last quarter and by 13% over the entire year, while the Swiss Leader Index recorded a quarterly gain of 3.6%, finishing the year with an 8% increase.

In China, the Shanghai Composite faced challenges in the fourth quarter, ending the year with an overall loss of 4%, while the Japanese Nikkei 225 index continued its strong performance from the first half of the year after a dip in the third quarter, concluding 2023 with a gain of 28%.

Source: own illustration

Commodities and Alternative Investments

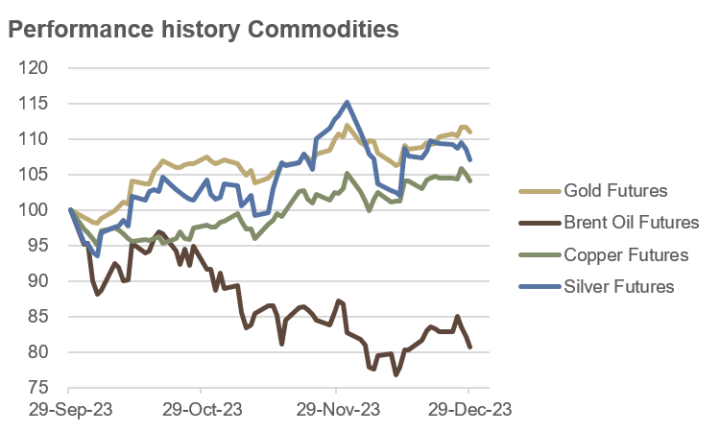

The roller coaster ride in oil prices continued in the fourth quarter, this time with negative signs. After a rapid price surge in the third quarter, the price of Brent crude oil underwent a correction of over 19% in the last quarter. The particularly economically sensitive copper price increased by 4% in the fourth quarter and managed to gain 2% over the entire year of 2023.

Gold prices rose by 11% in the course of the fourth quarter and increased by over 13% over the entire year. The declining interest rate environment, the weaker US dollar, and escalating geopolitical tensions likely provided some support. While the silver price climbed by 7% in the fourth quarter, it ended the year more or less where it started.

In the positive environment for risk assets with rising stock and bond prices and a weaker US dollar, cryptocurrencies also recorded solid gains in the fourth quarter: Bitcoin rose by 57%, Ether by 36%. As a result, there was an annual gain of 156% (BTC/USD) and 91% (ETH/USD). Additional support may have come from rumours that the US Securities and Exchange Commission (SEC) would approve a series of crypto ETFs in the early weeks of January.

Source: own illustration

Currencies

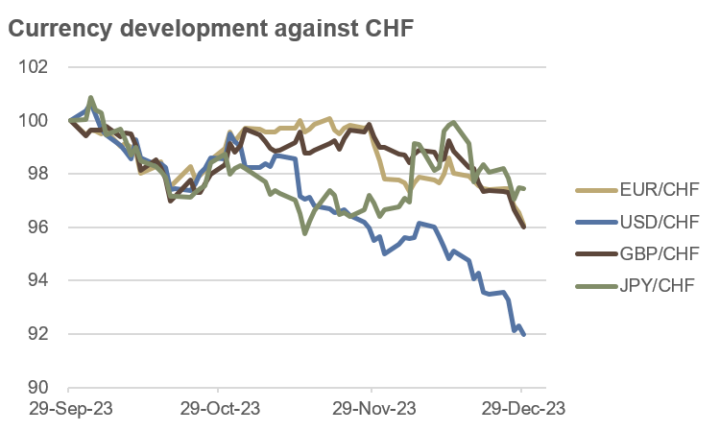

The “risk-on” environment with rising prices across virtually all major asset classes had a significant loser: the US Dollar. Measured by the Dollar Index (DXY), which assesses the value of the USD against a currency basket of six different currencies, the Greenback lost 4.5% in the fourth quarter.

A major winner was the Swiss Franc, which gained ground against all major currencies in the fourth quarter.

Against the CHF, the USD lost 8.0% in the fourth quarter, resulting in a 9.0% decline for the Greenback over the entire year. The EUR/CHF fell by 3.9% in the fourth quarter and lost 6.1% over the entire year. The GBP/CHF declined by 4.0% in the fourth quarter, with a total annual loss of 4.2%. The yen lost 2.6% in the quarter and tumbled by 15.3% against the CHF throughout the year 2023.

One currency that posted a slight gain against the CHF over the course of the year was the Mexican Peso (MXN).

Source: own illustration

Outlook

Despite concerns, economic growth in the United States remained solid in the fourth quarter, with the current estimate from the Atlanta Fed (GDPNow) projecting a +2.5% growth rate. The reshoring boom in the US is driving the construction of approximately three times as many new factories as the average from 2010 to 2020, primarily in the Southeast and Midwest. Additionally, the port of Lázaro Cárdenas – Mexico’s largest port – saw a 42% year-on-year increase in trade volume in the third quarter of 2023.

On the flip side, the downturn in China, combined with a population decline in the Middle Kingdom, could present challenges for the global economy.

Regarding US core inflation, the next few months are expected to see some historical monthly rates between 0.4% and 0.5% dropping from the time series, gradually bringing the annual rate closer to the 2% target. The anticipated decline in core inflation is likely to allow the US Federal Reserve to initiate interest rate cuts in March, at the latest in May. Following the Fed’s lead, other Western central banks are expected to begin reducing their benchmark rates.

As of December 26, 2023, the market priced in the following interest rate cuts for 2024, with an initial move of -0.25%:

- Federal Reserve: -1.56%, first in March

- European Central Bank: -1.61%, first in April

- Bank of England: -1.41%, first in May

- Swiss National Bank: -0.86%, first in June

- Bank of Canada: -1.20%, first in April

- Reserve Bank of Australia: -0.53%, first in June

- Reserve Bank of New Zealand: -0.93%, first in May

For the first quarter of 2024, expectations are for slightly lower growth rates – but no global recession – and generally declining inflation rates. The biggest risk is seen in the possibility that the aforementioned interest rate cuts, already priced in by the market, may not materialize or may be significantly delayed by central banks. Nevertheless, a cautious optimistic stance is maintained for the first three months of the year.

Fixed Income

After the significant decline in yields on long-term government bonds over the past two months, a temporary consolidation cannot be ruled out. However, we believe this is likely to be a temporary phenomenon, as there are still very high short positions in long-term Treasury bonds open in the futures markets. These short positions, which will eventually need to be covered, combined with declining inflation, are expected to drive bond prices higher and yields lower.

Long-term bonds can also serve as a hedge in the event of a possible recession, even though we are not currently anticipating one.

As short-term interest rates are expected to decline throughout the year, considering some extension of very short durations may be considered to mitigate reinvestment risk.

Regarding inflation-protected bonds, we remain more cautious, as we anticipate that inflation rates are more likely to surprise to the downside than the upside.

Credit

While we do not anticipate a global recession in the first quarter, we prefer investment-grade bonds over high-yield bonds. The credit spreads of high-yield bonds are still extremely tight, in our view, and do not adequately compensate for the associated credit risk.

As an interesting addition to the portfolio, specialized funds with emerging market bonds may be considered. Regarding illiquid credit structures, especially from the real estate sector, we remain more cautious.

Equities

After the strong rally in November and December, there has been a consolidation and rotation at the turn of the year. Particularly, technology stocks, which had performed strongly, and those with a pronounced China exposure have come under some pressure.

We expect the market conditions to brighten soon and consider purchases during weakness as sensible. Particularly, stocks in the healthcare, utilities, and insurance sectors are deemed particularly interesting. Overall, we give a slight preference to the American stock market. In terms of factors, value and quality appear attractive.

For more risk-tolerant investors, considering Indian and Latin American stock markets could also be an option.

Commodities and Alternative Investments

After the significant decline in oil prices in the fourth quarter, net long positions in the futures market have also dropped significantly, indicating short-term potential for upward movement. Further support could arise from ongoing tensions in the Middle East. However, the economic slowdown in China could have adverse effects. Overall, we anticipate upward trends in the first quarter.

Regarding copper, net long positions in the futures market have increased substantially, leading us to not anticipate further price increases in the first quarter.

Gold prices experienced a substantial increase in the fourth quarter, and net long positions in the futures market are also quite high. As a result, we expect prices to slightly decrease in the coming months. The silver market may also face some headwinds in the next few months.

A more positive outlook is observed in agricultural commodities. In the coming weeks, we anticipate rising prices, particularly for soybeans, live cattle, sugar, and orange juice.

Currencies

In the fourth quarter, the significance of the USD in the global financial landscape was once again evident. While the prices of most asset classes and currencies rose, the value of the USD experienced some downward pressure.

At the futures market, the positioning in the USD is currently quite negative, making a resurgence of the Greenback in the first quarter plausible. Exposure to the USD also seems prudent for portfolio diversification reasons. Similarly, the positioning in the EUR on the futures market is somewhat negative, making a further sharp decline in the common currency less likely. Conversely, the positioning in the JPY and especially in the CHF appears rather bullish in historical comparison.

We would not be surprised by a sudden interest rate cut by the Swiss National Bank in the March meeting for three reasons: 1) the SNB is known for “surprising” the market; 2) the inflation rate is already well below the target rate of 2% at 1.4%; 3) the CHF is trading at a multi-year high against most major currencies.

Once the market begins to factor in this scenario, the CHF could potentially lose some value.

Conclusion

Just as Jerome Powell, the Chairman of the US Federal Reserve, recently concluded his speech* with the intriguing phrase , “we are navigating by the stars under cloudy skies” – which obviously poses a considerable challenge – investors, too, must proceed cautiously in constructing their portfolios, constantly weighing yield generation against loss avoidance.

Regarding equity investments, we maintain a cautiously optimistic stance, with a slight preference for the US stock market.

We consider positioning in long-term government bonds sensible for hedging against a potential global recession, although we do not anticipate one in the first quarter. For very short-term investments, extending duration may be considered to mitigate reinvestment risk.

Positions in gold and gold miners can be scaled back modestly during strength phases, as we anticipate slightly declining prices. Positioning in USD – whether implicit or explicit – is deemed prudent.

Additionally, positioning in highly liquid trend followers, known as Commodity Trading Advisors or CTAs, makes sense.

*Powell J. (2023), Inflation: Progress and the Path Ahead, https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm, 04.01.2024