Quarterly Outlook Q2 2023

Central banks' dilemma and financial markets' confusion

Review

Fixed Income

Fears of a looming recession caused yields to fall in the first weeks of January. The yield on 10-year US government bonds moved into the 3.40-3.50% range by mid-January, and remained there until the Fed decision on February 1. At the subsequent press conference, Jerome Powell, Chairman of the Federal Reserve, remarked that the “disinflationary process” had begun. However, inflation fears again made the rounds, with the result that the yield on 10-year Treasuries rose to over 4% by early March. The banking crisis in mid-March led to a flight into safe government bonds and an abrupt drop in yields. 10-year US government bonds ended the 1st quarter at a yield of 3.47%, 2-year notes at 4.04%. US Fed fund rates ended the quarter at 5.00%. The next scheduled meetings of the US Federal Reserve will be held on May 3 and June 14.

In the euro zone, too, yields were initially slightly lower followed by a rise until early March, only to fall again in the wake of the banking crisis and the flight into safe investments. The yield on 10-year German Bunds stood at 2.28% at the end of the quarter, down from 2.56% at the end of 2022. At the end of the quarter, the key ECB interest rate was 3.50%. The ECB’s next meetings will be held on May 4 and June 15.

In the UK, the yield on 10-year Gilts fell from 3.67% to 3.49%. The key interest rate was at 4.25%. The Bank of England’s next meeting is scheduled for May 11.

The Bank of Japan continued to pursue its yield curve control policy in Q1, limiting the yield on 10-year government bonds to a maximum of 0.50%. In the wake of the banking crisis in mid-March, the yield fell to 0.24%. At the end of the quarter, the yield settled at 0.33%. As of April, the Bank of Japan will be led by a new central bank chief, Kazuo Ueda.

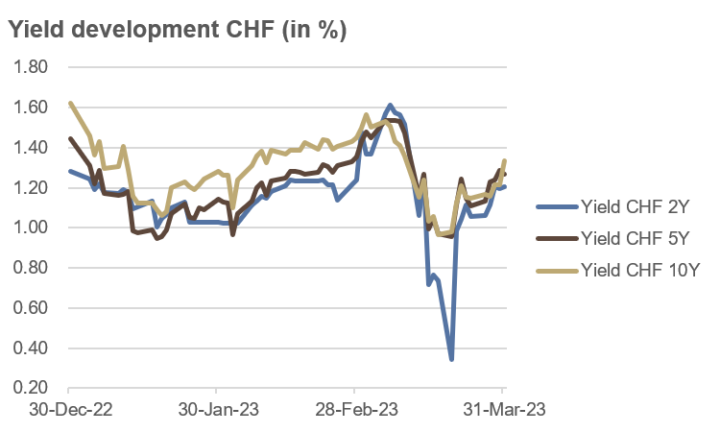

In Switzerland, the yield trend was similar in the 1st quarter, although the yield curve was only partially inverted. The flight into safe short-term paper after the announced emergency takeover of Credit Suisse by UBS was clearly visible. At the end of the quarter, the yield on the 10-year Swiss bond was 1.34%, while 2-year bonds ended the quarter at a yield of 1.21%, after falling as low as 0.34% on March 20. The key interest rate stood at 1.50%. The SNB will hold its next scheduled meeting on June 22.

Source: Bloomberg

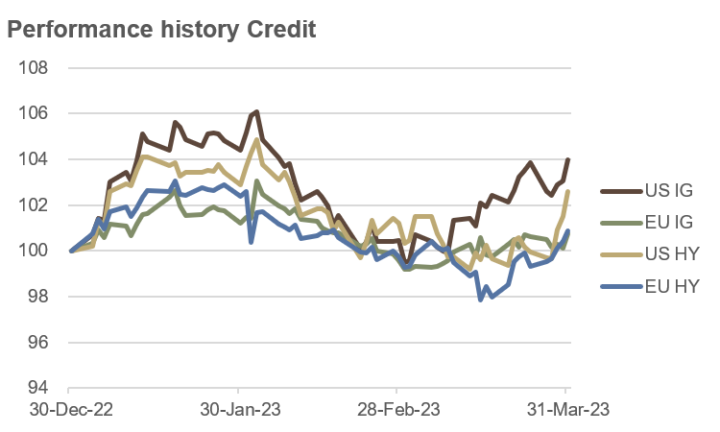

Credit

Despite all the prophecies of doom about a burgeoning recession, credit spreads for high-yield (HY) bonds on both sides of the Atlantic actually fell slightly in the first two months of the year. Only the banking crisis led to a brief spike to a high of just over 5% on March 20. By the end of the quarter, however, the situation had calmed down again noticeably. As a result of this rather small fluctuation in credit spreads, the price trend of corporate bonds was mainly determined by changes in the general interest rate level: falling rates in January led to rising prices, rising rates until the beginning of March led to falling prices, and the fall in interest rates in March as a result of the banking crisis led to rising prices again.

At the end of the quarter, US investment grade (IG) bonds gained 4.0%, followed by US HY bonds with a gain of 2.6%. In Europe, IG bonds advanced 0.7%, while HY bonds rose 0.9% thanks to a quarter-end rally.

Investment-grade bonds are the highest quality bonds as determined by a rating agency; high-yield bonds are more speculative and have a credit rating below investment grade. High-yield bond prices often move similarly to equity markets, while IG bond prices are more influenced by general interest rate levels.

Global convertibles gained 3.4% in Q1. Emerging market government bonds (in USD) rose somewhat less strongly, with a gain of 0.9%, despite the generally risk-on environment.

Source: Bloomberg

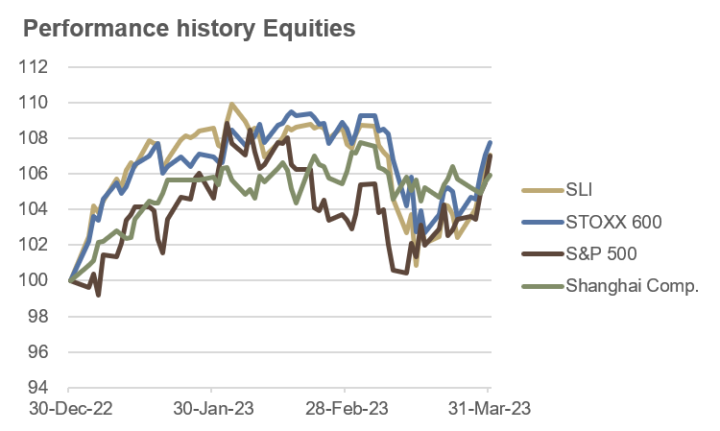

Equities

It is said that bull markets have to climb a “wall of worry”. The 1st quarter of 2023 was a good example of this: neither rising Fed fund rates, recession fears nor an outright banking crisis were able to stop the stock market rally.

Over the quarter, both the Swiss Leader Index and the S&P 500 gained 7.0%, the Nikkei 225 in Japan gained 7.5%, and the pan-European STOXX 600 advanced 7.8%. The Shanghai Composite ended Q1 with a gain of 5.9%.

It was interesting to note that the S&P 500 had given up virtually all of its annual gain in the eye of the storm in mid-March, only to rebound strongly by the end of the quarter.

At sector level, the technology sector led the way in both the USA and Europe. The financial and energy sectors, which had been among the winners in 2022, were among the weakest. In addition, quality stocks were particularly in demand on both sides of the Atlantic in the 1st quarter.

In the country and index rankings, the Nasdaq led the way with a gain of 16.8%, followed by the Italian FTSE MIB with +14.4% and the French CAC 40 with +13.1%.

Source: Bloomberg

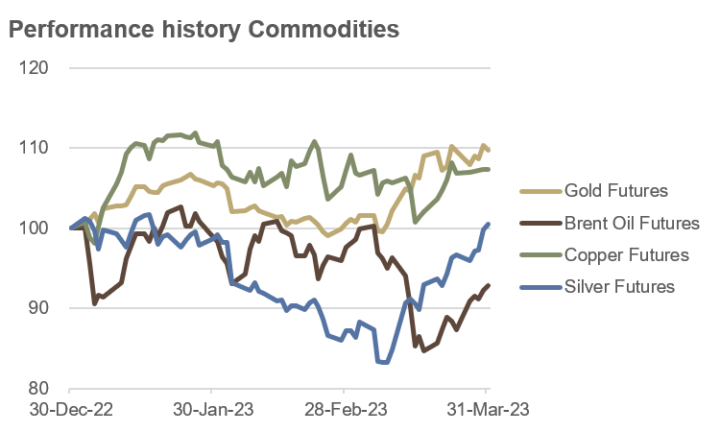

Commodities and Alternative Investments

In the second half of March, the gold price repeatedly scratched the psychologically important mark of $2,000 per ounce. By the end of the quarter, it had risen by 9.7%, while the price of silver managed to cross the finish line with a small gain of 0.5%. In contrast, Brent crude oil could not fully recover the losses by the end of the quarter and ended Q1 at just below $80 per barrel, down 7.1% over the quarter. Copper prices rose over 10% in the first weeks of January, then slowly tripped lower, ending the quarter with a rise of 7.4%.

Cryptocurrencies put a brilliant start to the year on the floor, in a phase in which actually few pundits had expected it: Bitcoin +72%, Ether +52%, both measured in USD.

Trend-following hedge funds, so-called CTAs, which manage a total of approximately $200 billion worldwide, were caught on the wrong foot. Due to the turbulence on the bond markets in March in the wake of the banking crisis, these funds – measured by the Société Générale CTA Index – suffered a monthly loss of over 6%, their worst month since November 2001 (dotcom crash).

Source: Bloomberg

Currencies

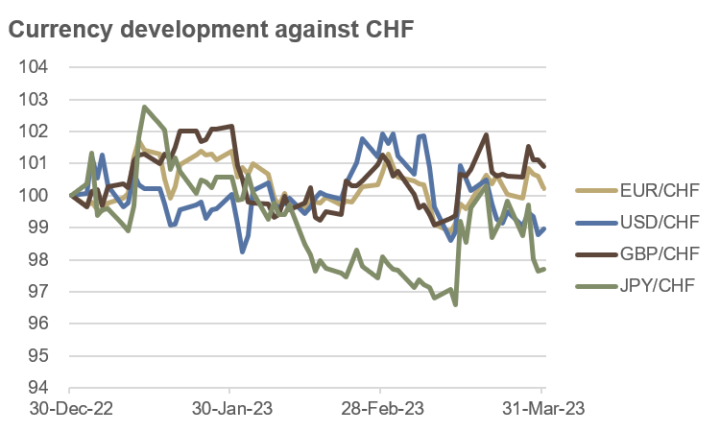

In Q1, the USD lost 1% against the CHF. In simple terms, there were three major movements in the currency pair: downward until the beginning of February, then increasingly upward until the beginning of March, and downward again after the outbreak of the banking crisis. The difficulties and subsequent emergency rescue of Credit Suisse did not cause any lasting damage to the CHF against the USD. The USD/CHF rate was 0.915 at the end of the quarter.

The EUR/CHF currency pair traded in a narrow range between CHF 0.978 and 1.006 or less than +/-2% throughout Q1. At the end of the quarter, the exchange rate was at 0.992, a small gain for the euro of 0.2%.

The GBP gained 0.9% against the CHF, thanks to a closing rally at the end of the quarter following the Credit Suisse demise. GBP/CHF ended the quarter at 1.128.

The largest percentage fluctuations were measured in the JPY/CHF currency pair. Over the quarter, the JPY lost just over 2% against the CHF.

Source: Bloomberg

Outlook

Central banks find themselves in a “trilemma”: the existing trade-off between price stability and stabilization of economic development has apparently been joined by financial market stability. While support for the financial and banking sector and also for the slowing economy would actually require looser monetary policy and interest rate cuts, achieving price stability still requires tighter monetary policy and further interest rate hikes.

At least rhetorically, central banks are still in inflation-fighting mode, probably also because inflation expectations play the key role. At the same time, however, government rescue packages are being put together everywhere with the support of central banks. This balancing act between words and deeds has also confused financial markets. While the US Fed is forecasting one more rate hike and no rate cuts until the end of the year, the market is already pricing in several rate cuts until the end of 2023.

As far as inflation rates are concerned, a certain disillusionment is likely to spread. True, headline inflation in the US has fallen from 7.1% in November 2022 to 6.0% in February 2023 and will probably continue to decline in March and April. However, core inflation (excluding food and energy) has declined only marginally, from 6.0% in November 2022 to 5.5% in February 2023, and is even expected to rise again slightly in the next two months. We therefore expect central banks’ monetary policy to remain restrictive for longer than expected.

Just as an aside, in the medium and long term, increasing government involvement and market intervention will inevitably lead to lower productivity, lower growth rates and thus also lower prosperity.

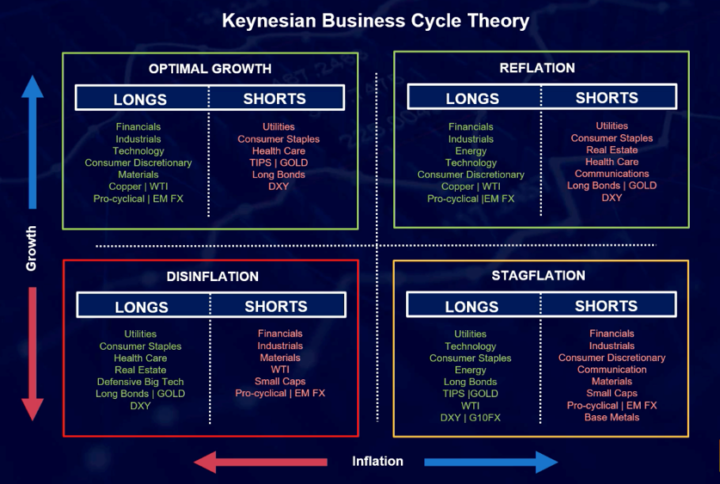

For Q2, we expect a disinflation scenario, or a stagflation scenario, if central banks are not able to keep inflation expectations in check or exogenous shocks (weather, geopolitics, etc.) lead to rising food and energy prices again (see chart below).

Source: forexlive.com

Fixed Income

Interest rates and bond yields are mainly determined by monetary policy, inflation expectations and growth prospects. While short-term bond yields are strongly influenced by monetary policy, long-term bond yields reflect market expectations regarding growth and inflation.

The strongly inverted yield curves – long-term yields are lower than short-term yields – point to an upcoming economic downturn in the major economies. Headline inflation rates are pointing down, but core inflation – excluding food and energy – seems much more stuck at a higher level. In our view, this will lead central banks to tighten interest rates further and pursue a restrictive monetary policy for some time to come.

We are positive on first-class long-term government bonds and recommend longer durations, also with a view to portfolio diversification. Due to further increases in key interest rates and the gloomy outlook, short-term money market investments can also be recommended.

Credit

In an economic downturn or periods of market stress, credit spreads normally widen, as investors demand a higher return for the credit risk taken.

As we expect an economic downturn in Q2 and possibly further turmoil in the financial sector, we expect credit spreads to widen, especially for high yield bonds. Therefore, we prefer investment grade bonds.

We remain very selective on emerging market bonds. Currently, more than a quarter of these countries effectively no longer have access to the international bond market as a result of the turmoil in the banking sector.

We take care to invest only in liquid bonds and ETFs and avoid complex illiquid structures. Here, we expect that investors’ redemption requests can no longer be met, mainly due to the liquidity mismatch.

Equities

Stock markets have started the new year very euphorically. In the US, so-called “meme stocks”, the artificial intelligence theme, mega-cap tech, TMT growth, and non-profitable tech stocks have performed the best in Q1. All sectors that had lost some of the most in 2022.

Not even the March banking crisis could bring the rally to a sustained halt. The economic downturn expected for many quarters has not yet materialized. All this underlines once again that one should always take a pragmatic and flexible stance in financial markets.

Nevertheless, we see strong headwinds for further rising equity prices from the end of April at the latest: 1) the quarterly reporting season from mid-April onwards is likely to be sobering; 2) the economy is likely to deteriorate further, also due to increasingly restrictive lending; 3) due to stubbornly high core inflation, central banks are unlikely to pivot as quickly as currently expected by the market.

In addition, there are two exogenous factors that tend to work to the disadvantage of risk assets such as equities: rising geopolitical tensions and increasing financial market regulations.

Due to the expected disinflation scenario, we favor sectors such as utilities, consumer staples, healthcare, and large-cap technology and communications sectors. We are careful to invest mainly in low leveraged companies, as credit availability is likely to become more restrictive in the coming months. We prefer stocks that meet the factor criteria of quality and minimum volatility. In general, we give a slight preference to US stocks over European ones.

Commodities

Supply and demand dynamics, global economy, geopolitical events. These are some of the factors influencing price discovery on the commodity markets.

The oil market started the 2nd quarter with a bang. The decision by OPEC+ during the first weekend of April to cut daily production by around 1% from May led to an abrupt price increase of over 6% per barrel. We believe that these supply cuts were anticipated partly due to the expected global economic downturn and the resulting decline in demand. In the futures market, net long positions had already risen sharply in recent weeks. We expect a weakening price trend in the 2nd quarter after the strong short-term bounce.

No strong trend can be discerned in the copper price at present; at best, the price is likely to move slightly lower as signs of a global economic downturn materialize.

The gold price has been scratching the psychologically important mark of $2,000 per ounce for several weeks now. We expect prices to move higher in the medium term, but still see some potential for a setback in the short run, as net long positions in the futures market are already relatively high. Due to the expected economic downturn, we remain more cautious on silver at the moment.

Currencies

We expect a stronger USD/CHF in Q2. The interest rate differential is likely to widen in favor of the USD in the coming months, as the SNB’s hands are increasingly tied politically. Its involvement in the emergency rescue of Credit Suisse is likely to raise some more regulatory questions.

The EUR/CHF currency pair should move in an orderly fashion in Q2, with a slight advantage for the euro, which also finds support from purchasing power parity. We consider CHF 1.10 more likely than 0.89 by the end of the year.

Profiteer of the banking crisis could be the financial center of London and the GBP, respectively. The upward trend in GBP/CHF, which began with the fall of Credit Suisse, should continue in Q2. Purchasing power parity also argues for a stronger pound.

We see the most potential in the JPY. The new head of the Bank of Japan is likely to review and possibly even overthrow the yield curve control policy in coming months, as inflation rates in Japan also remain at stubbornly high levels. This could lead to a violent quake on the global financial markets, from which, however, the JPY is likely to emerge as a shining winner.

Conclusion

In the current environment with such conflicting signals, we recommend liquid and transparent investments in order to be able to react quickly and flexibly to opportunities and risks. Feelings and hopes are not an investment strategy. It is about protecting and growing hard-earned capital as well as possible. As the banking crisis has shown, many people believe that even bank deposits are no longer 100% safe. It is not even essential whether this is really true or not. Perception is often more important than reality.

Against this backdrop, a structured investment process and disciplined execution are the “nuts and bolts” of professional asset management.

We recommend an overweight in cash (including short-term money market investments), an increased allocation to longer duration government bonds and to gold. For equity investments, we look for quality and low leverage. We consider a certain currency diversification to be sensible.