Monthly Report August 2023

The seasonal weakness during the summer months can be used as a buying opportunity in the stock markets.

Review

As of the end of July, the US S&P 500 index has posted a remarkable gain of more than 19% since the beginning of the year, securing five consecutive months of positive returns – the index’s longest winning streak in two years. The market rally was fuelled by optimism surrounding declining inflation and the resilience of the economy, contributing to increasingly broad-based market gains. During July, the S&P 500 rose by 3.1%.

Meanwhile, the technology-heavy Nasdaq Composite also exhibited strength, registering a 4% increase since the end of June and an impressive surge of over 37% year-to-date.

Initially, the rise in benchmark indices during the first five months of 2023 was largely driven by the so-called “Magnificent Seven” mega cap companies, namely Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. However, in the past two months, stock gains have become more widespread due to indications that the US Federal Reserve may soon conclude its rate hiking cycle, raising the prospect of reducing inflation without triggering a recession.

A version of the S&P 500 that equally weights its index components saw a rise of nearly 11% since early June, compared to a 1% decline in the previous five months. In the final week of July, the Fed raised its benchmark interest rate to 5.50%, the highest level in 22 years. While leaving the door open for further rate increases, many economists anticipate that this may have been the last rate hike in the current cycle.

The outlook for a “soft landing” of the economy was also reflected in the bond markets, where the premium that risky corporate debt issuers must pay for new bonds has rapidly decreased. The difference between yields on US high-yield bonds and corresponding government bonds has declined by almost 0.9% since early June – one of the most substantial drops over a two-month period since 2020. In July, long-term US government bond yields rose, while their short-term counterparts remained relatively unchanged.

European stocks also demonstrated solid performance, with the pan-European Stoxx 600 index recording its second consecutive monthly gain and rising by approximately 11% year-to-date. The Swiss Leader Index posted a 9% increase since the beginning of the year. The Eurozone economy grew by a higher-than-expected 0.3% in the second quarter of 2023 after stagnating in the first quarter. In July, the annual inflation rate in the 20-country currency block slowed to 5.3%. European Central Bank President Christine Lagarde hinted that interest rate increases within the Eurozone might also be nearing their end, following the bank’s decision to raise rates to 4.25% – the highest level since 2001.

In Asia, Chinese stocks experienced their strongest monthly surge since January, as weak economic data fuelled hopes for stimulus measures from authorities and policymakers to boost growth and counter deflation risks. The Shanghai Composite rose by 2.8% in July and achieved a 6.5% gain since the beginning of the year. In Japan, the broad Topix index climbed by 1.5% in July, marking the seventh consecutive month of gains and the longest winning streak in a decade. The index has surged by 22.8% since the start of the year. Furthermore, Japanese 10-year government bond yields reached their highest level since mid-2014, after the Bank of Japan took the surprising step of easing its yield curve control on the JGB market.

Outlook

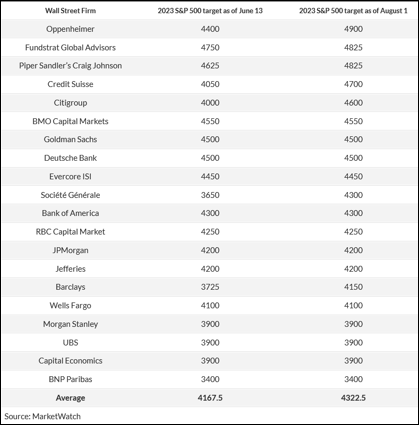

The positive performance of the stock markets in the year-to-date period caught most strategists off guard. As depicted in the figure, some have now thrown in the towel and revised their year-end forecasts upward. However, the average projection still lags approximately 4% below the current level of 4,513.

Source: MarketWatch, August 2nd, 2023

Following the substantial market gains in recent months, many surveys and sentiment indicators have become more optimistic. However, when analysing the actual market positioning, a different picture emerges.

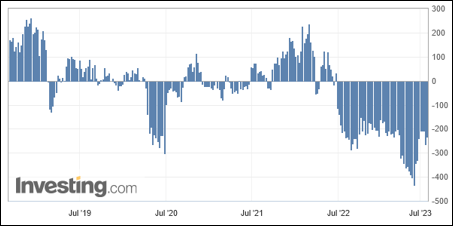

Source: investing.com, July 28th, 2023

The figure illustrates the net positioning of “non-commercial” (speculative) traders in the S&P 500 Futures market. It becomes evident that since the middle of last year, these traders have predominantly bet on falling stock prices.

This negative market positioning, along with an expected slowdown in inflation, robust economic growth, and the central banks’ conclusion of the rate hiking cycle, could indeed lead to further rising stock prices.

Indications are growing that inflation will decrease in the upcoming months. For instance, substantial declines in producer prices in China, a prominent global consumer goods producer, are suggestive of this trend.

GDP growth consists of consumption, investments, and government expenditures. While private consumption has cooled down somewhat, especially in the goods sector, it has been less affected in the services sector. On the other hand, companies have held back on investments for a long time due to the most-anticipated – and so far unrealized – recession in history. Now, there is increasing pent-up demand in this regard. Additionally, government expenditures are likely to remain at high levels due to infrastructure projects, while also positively impacting supply chains, thus preventing the economy from sliding into a recession. With decreasing inflation rates, further interest rate hikes are no longer necessary. The money supply has slightly increased in recent months after a declining trend in 2022.

Does the strongly inverted yield curve still serve as a harbinger of a future recession? An alternative explanation could be as follows:

As part of its announced quantitative tightening of monetary policy, the US Federal Reserve allowed long-term Treasury bonds to expire and raised short-term interest rates. At the same time, government infrastructure projects were funded with short-term Treasury notes. These short-term papers practically serve as 100% collateral, allowing holders to borrow money easily. As a result, the money supply can even expand. The reduced supply of long-term bonds, combined with constant demand, led to rising prices, resulting in lower interest rates.

In other words, in the US, the interaction between monetary and fiscal policies indirectly led to quantitative easing and yield curve control without publicly announcing it. The advantage was to lower inflation expectations without reducing the money supply and thus stifling the economy.

The seasonal weakness during the summer months can be used as a buying opportunity in the stock markets.