Quarterly Outlook Q4 2025

Despite record highs in the stock markets, rising debt and geopolitical tensions call for caution – balance remains the key theme for the fourth quarter.

Review

Fixed Income

Yields on ten-year US Treasury bonds declined slightly in the third quarter to 4.15%, down from 4.23% at the end of June. Volatility narrowed considerably, with yields fluctuating within a range of 4.0% to 4.5%. This moderate decline led to a modest 1.3% price gain in the iShares 20+ Year Treasury Bond ETF (TLT). Two-year US Treasury yields fell even more sharply, ending the quarter at 3.60% (previous quarter: 3.73%). This resulted in a so-called “bull steepener”, as the yield curve between ten- and two-year maturities widened to 55 basis points. On 17 September, the Federal Reserve cut its policy rate as expected, from 4.50% to 4.25%. Market participants anticipate two additional gradual rate cuts at the upcoming meetings on 29 October and 10 December.

In the euro area, the trend was the opposite. Yields rose slightly over the quarter: in Germany to 2.71% (from 2.60%), in Italy to 3.56% (from 3.51%), in France to 3.54% (from 3.29%), in Spain to 3.26% (from 3.25%), and in Greece to 3.41% (from 3.30%). Remarkably, yield differentials between core and peripheral countries have largely disappeared. French yields are now almost at the same level as Italian ones, while Greece – once the eurozone’s problem child – now trades significantly below France. The ECB left its key interest rate unchanged at 2.15% during the quarter. Rate cuts at the upcoming meetings on 30 October and 18 December are currently seen as unlikely.

In the United Kingdom, ten-year gilt yields rose to 4.70% by the end of the quarter, up from 4.44% at the end of June. The Bank of England lowered its policy rate to 4.00% during the quarter but signaled a pause for now. Markets are not pricing in an additional cut at the next meeting on 6 November.

In Japan, ten-year government bond yields increased to 1.65% (end of June: 1.40%). Despite this, the Bank of Japan is expected to keep its policy rate unchanged at the 30 October meeting.

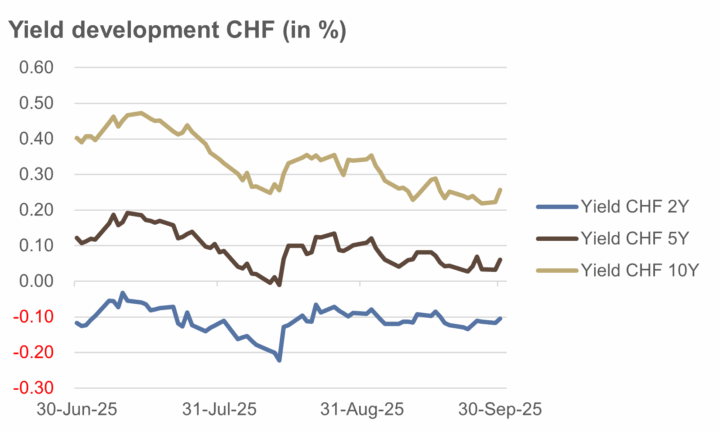

In Switzerland, long-term yields declined the most. Ten-year government bonds ended the quarter at 0.26% (end of June: 0.40%), while two-year yields remained flat at around -0.10%. However, ten-year CHF interest rate swaps traded significantly higher at 0.52%, suggesting a possible scarcity of Swiss government bonds. A rate cut by the SNB at its next policy assessment on 11 December – currently the policy rate stands at 0.00% – is considered unlikely.

Source: own illustration

Credit

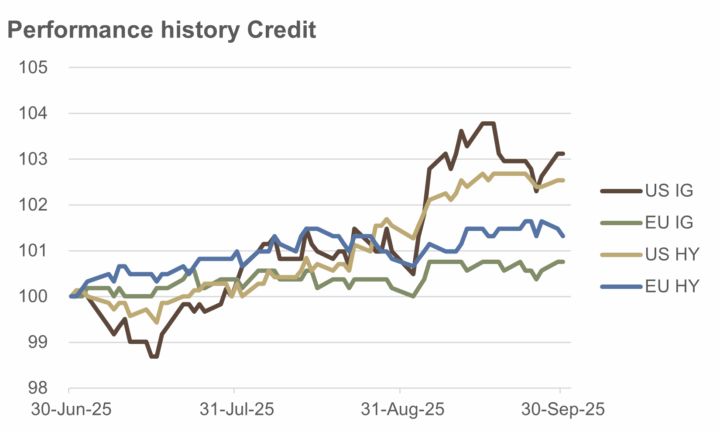

Credit spreads for high-yield bonds narrowed further on both sides of the Atlantic during the third quarter. In the United States, spreads declined from 2.96% to 2.80%, while in Europe the tightening was even more pronounced – from 3.10% to 2.72%. Whereas overall interest rates in Europe rose slightly, yields in the US moved lower.

US high-yield spreads showed little reaction to the bankruptcies of First Brands and Tricolor Holdings, both of which were viewed as idiosyncratic, isolated cases. Neither the auto parts supplier First Brands nor the subprime lender Tricolor Holdings were major issuers within the high-yield segment, leaving their bonds with only minor index weights.

Against this backdrop, US corporate bonds performed stronger over the quarter. US investment-grade bonds gained 3.1%, while US high-yield bonds advanced 2.5%. In Europe, high-yield bonds rose 1.3%, and investment-grade bonds added 0.8%.

In this risk-on environment, emerging-market bonds (in USD) were also performing strongly, gaining 4.3%. Global convertible bonds performed even better, surging 8.2%.

Source: own illustration

Equities

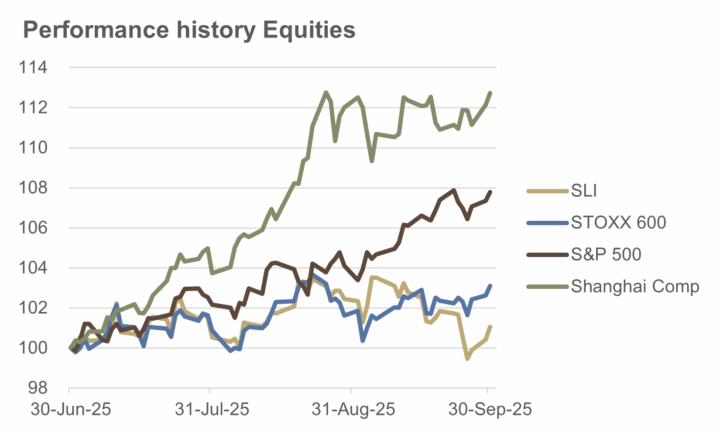

US equity markets extended their rally unabated in the third quarter. The S&P 500 advanced 7.8%, setting no fewer than 23 new record highs during the period. The Nasdaq Composite gained an even stronger 11.2%. By contrast, an equal-weighted S&P 500 ETF – where each constituent carries a 0.2% weight – rose only 4.4%, underscoring the market’s continued concentration in a handful of large-cap stocks.

In Europe, the STOXX 600 gained 3.1% in the third quarter, while Switzerland’s defensively oriented Swiss Leader Index (SLI) rose by just 1.1%. The main drag was Nestlé, whose shares fell more than 7% amid another leadership reshuffle – the company’s third CEO in just thirteen months.

Asian equity benchmarks performed significantly better: the Shanghai Composite climbed 12.7%, the Hang Seng Index gained 11.6%, and Japan’s Nikkei 225 advanced 11.0%.

Year-to-date (as of 3 October), the S&P 500 was up 14.2% and the Nasdaq Composite 17.3%. In Europe, the STOXX 600 gained 10.0% and the SLI 3.2%. In Asia, the Shanghai Composite rose 15.8%, the Hang Seng surged 33.9%, and the Nikkei 225 added 12.6%.

Globally, the strongest gains so far this year came from equity markets in South Korea (Kospi), Pakistan (Karachi 100), and Vietnam (VN 30), while the weakest performances were recorded in Russia (MOEX), Thailand (SET), and the Philippines (PSEi Composite).

Source: own illustration

Commodities and Alternative Investments

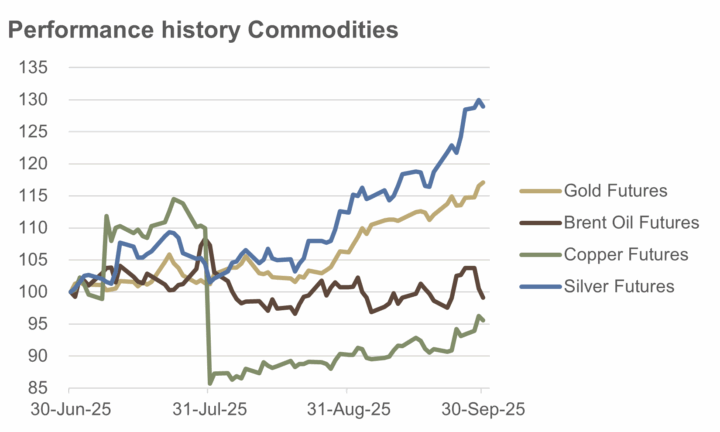

Precious metals posted strong gains in the third quarter. The gold price rose 17%, while silver surged 29%. Year-to-date, this translated into increases of 47% for gold and 60% for silver, both in USD terms. The rally was driven by continued central bank purchases, a general decline in US yields, a weaker dollar, and persistent geopolitical tensions. Several studies also attempted to show, using regression analysis, that rising prices triggered investor inflows into precious metals funds – rather than the other way around.

Industrial metal copper proved far more volatile. At the end of July, it suffered a historic drop of more than 20% after the US government unexpectedly scaled back its previously broad-based import tariffs. The exemption of refined copper led to massive position liquidations and an abrupt correction of previously overheated US prices. Over the quarter, copper ended down about 4%, though it remained more than 20% higher year-to-date.

Brent crude oil prices fluctuated between $65 and $73 per barrel during the quarter, closing 1% lower at $67. Since the beginning of the year, prices have fallen by roughly 10%.

The two leading cryptocurrencies performed positively in the third quarter: Bitcoin (BTC/USD) gained 6%, while Ethereum (ETH/USD) surged 67%. Year-to-date, Bitcoin was up 22% and Ethereum 24%.

Source: own illustration

Currencies

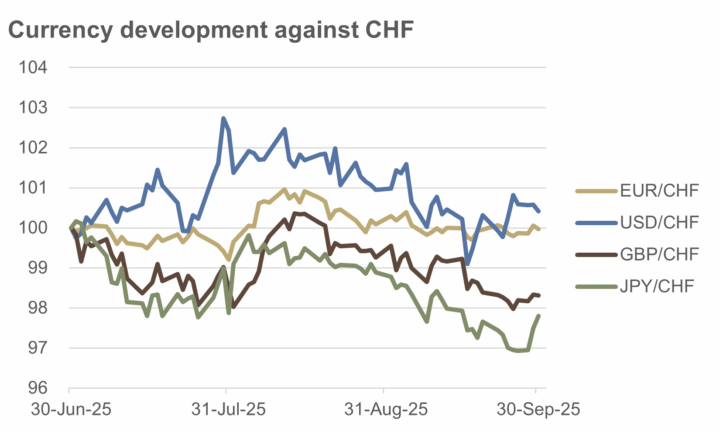

The US dollar’s decline came to a halt in the third quarter. The trade-weighted DXY index rose 0.9%, from 96.9 to 97.8, though it remained down nearly 10% year-to-date. The EUR/USD pair ended the quarter at 1.173 (end of June: 1.179), while USD/JPY closed at 148 (end of June: 144).

Against the Swiss franc, the euro remained largely stable. EUR/CHF fluctuated between 0.927 and 0.944 during the quarter, closing at 0.935 at the end of September – almost unchanged from the previous quarter. The US dollar moved more noticeably versus the franc, gaining 0.4% over the quarter, though it remained over 12% below its level at the start of the year. USD/CHF stood at 0.796 at the end of September (end of June: 0.793).

The British pound lost 1.7% against the franc in the third quarter (GBP/CHF 1.071 after 1.089), while the Japanese yen fell 2.2%. Among the major trading currencies, only the Swedish krona showed a modest gain against the franc on a year-to-date basis.

Source: own illustration

Outlook

Most equity markets are trading at or near all-time highs. Other asset classes, including precious metals and cryptocurrencies, are also hitting record levels, while high-yield credit spreads remain at multi-year lows.

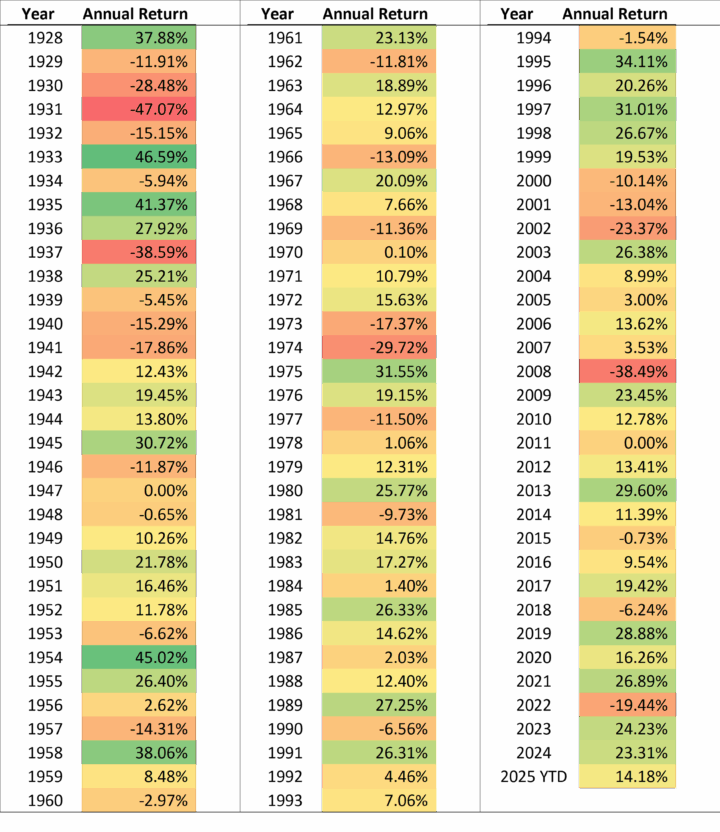

The table below shows the historical annual returns of the S&P 500 equity index.

Source: own illustration; as of 3 October 2025

A look at the historical performance of the S&P 500 vividly illustrates the long-term earning power of broadly diversified equity portfolios – even though the composition of the index has changed fundamentally over the decades. Few of the companies included back then remain today; bankruptcies, mergers, and structural transformations have continuously reshaped the index landscape. The S&P 500 is therefore not a static entity but is regularly reviewed and adjusted – a process driven less by passive investing and more by systematic stock selection.

Notably, only during the late-1990s internet boom did the index achieve annual returns above 20% for three or more consecutive years. With the current AI-driven euphoria, history seems to be repeating itself in a sense – albeit under different circumstances.

US economic growth has so far proved exceptionally robust. Final GDP growth for Q2 was revised upward to 3.8% from 3.3%, and the Atlanta Fed expects a 3.8% increase for Q3 (as of 1 October 2025). At the same time, recent labor market data show early signs of cooling. Surprisingly high economic output alongside declining labor input points to rising productivity – a classic “Goldilocks” scenario for financial markets.

Inflation remains above the 2% target, yet the Federal Reserve has resumed its rate-cutting cycle after a year. In the medium-term, price pressures are expected to ease, particularly due to the easing impact of migration policies on the housing market.

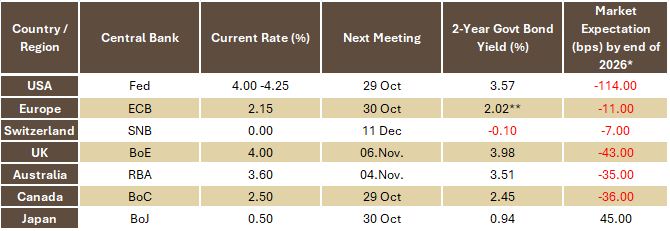

In an international comparison, markets outside the US are barely expecting further major interest rate moves by their respective central banks (see table below). A “surprise” scenario would therefore be one in which the Fed cuts less aggressively while other central banks are forced to ease more sharply – potentially giving the US dollar a significant boost.

Source: own illustration; *cumulative as of today, not 2026 alone; **Germany;

As of 3 October 2025

For the fourth quarter, we anticipate a reflation scenario in the US, with modestly accelerating growth and moderate inflation. By Q1 2026, this could evolve into an ideal balance of declining inflation and robust economic expansion. In contrast, prospects for Europe appear more muted – the combination of weak growth and persistent price pressures points to a mild stagflation environment.

Fixed Income

Government bonds primarily serve to hedge equity risk. We currently favor intermediate maturities, as we expect slightly rising yields in the near term. Over the course of the quarter, duration could be gradually extended, given our expectation of lower interest rates in 2026.

To hedge potential inflation risks, we maintain a small allocation to inflation-linked bonds.

Credit

We prefer investment-grade over high-yield bonds. Current tight spreads offer little compensation for the risks taken. A moderate diversification into selected emerging-market bonds also appears worth considering.

Equities

We remain cautiously optimistic on equities. The popular narrative comparing the current AI boom to the dot-com bubble seems overstated. We favor cyclical sectors and selected technology names. Utilities and energy stocks also remain attractive. Given stronger economic momentum, we maintain a slight preference for the US over Europe, while selected emerging markets offer additional diversification opportunities. Seasonally, the fourth quarter is traditionally the strongest.

Commodities

Precious metals – particularly gold – remain a stabilizing portfolio component. Silver also deserves attention. Oil could present a positive surprise, given the very defensive positioning in the futures market.

Currencies

A strong US dollar in Q4 would not be surprising. Market sentiment toward the greenback is deeply negative – any modest positive surprise could trigger a significant counter-move. The British pound and Australian dollar could also benefit, while we see less upside potential for the euro. The Swiss franc is likely to retain its safe-haven status, albeit without major appreciation potential.

Conclusion

Disciplined implementation of the investment process remains crucial. The goal is not to profit from every position at all times, but to structure the portfolio so that market dislocations can be weathered without significant damage.

As the old market adage goes, “No one rings a bell at the top.” Given current all-time highs, it is essential to stay calm. We remain cautiously constructive on equities, maintain positions in gold and intermediate-term government bonds, and complement the portfolio with trend-following strategies (CTAs), which have historically provided valuable stability during periods of heightened volatility.