Quarterly Outlook Q3 2025

Stocks, gold, bitcoin, and credit markets are reaching new peaks – but uncertainty lingers.

Review

Fixed Income

Yields on 10-year US Treasuries held broadly steady in the second quarter, ending June at 4.23%, little changed from 4.21% in the previous quarter. Beneath the surface, however, markets were anything but calm. Following the announcement of US import tariffs on April 2 – dubbed “Liberation Day” by President Trump – and the subsequent bout of market turbulence, yields initially fell to 3.86%. They then rebounded sharply, reaching 4.63% after a 90-day suspension of the tariffs helped calm investor nerves. On May 16, Moody’s became the last of the three major rating agencies to downgrade the US sovereign credit rating, cutting it to Aa1.

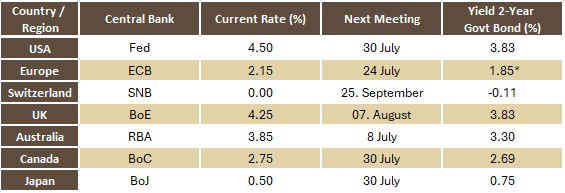

Two-year Treasury yields declined to 3.73% by the end of June, down from 3.89%, widening the spread over 10-year paper to 51 basis points. The Federal Reserve held its benchmark interest rate steady at 4.50% throughout the quarter. While some dissenting voices may emerge at the upcoming July 30 meeting, markets are pricing in a high likelihood of a rate cut at the September 17 decision.

In the eurozone, yields drifted slightly lower. German 10-year Bunds closed the quarter at 2.60%, compared with 2.73% at the end of March, while Italian equivalents yielded 3.50%. Notably, the quarter saw a rare convergence in borrowing costs across the currency bloc: 10-year yields stood at 3.25% for Spain, 3.28% for Greece, and 3.29% for France. The European Central Bank cut its key rate in two steps by a total of 50 basis points to 2.15%. Further easing at the upcoming July 24 and September 11 meetings is not anticipated at this stage.

In the UK, 10-year gilt yields declined to 4.48% at quarter-end, down from 4.68% in March. The Bank of England lowered its policy rate to 4.25% during the quarter, with another cut widely expected at its August 7 meeting.

Japanese yields also edged lower, with 10-year government bonds ending the quarter at 1.43% compared with 1.47% in March. Market expectations for a rate hike by the Bank of Japan at its July 30 meeting have since lost momentum.

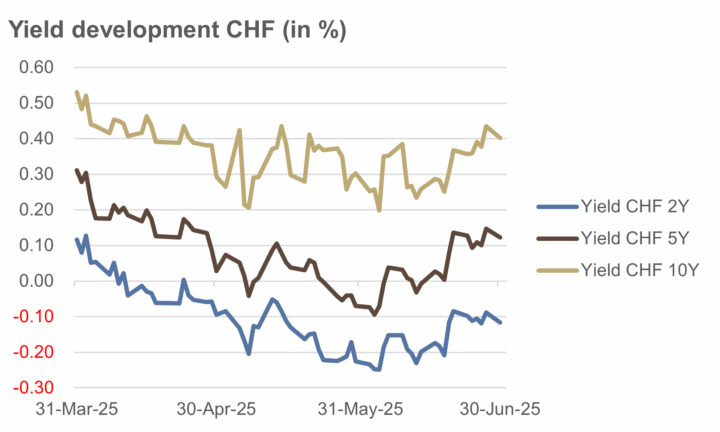

In Switzerland, yields fell across the curve in the second quarter. The decline was particularly pronounced at the short end, where two-year government bonds dropped from +0.12% to -0.12%. The 10-year yield ended June at 0.40%, down from 0.53% three months earlier. The Swiss National Bank cut its policy rate in June from 0.25% to 0.00%. A return to negative territory at the next policy assessment on September 25 is currently seen as unlikely.

Source: own illustration

Credit

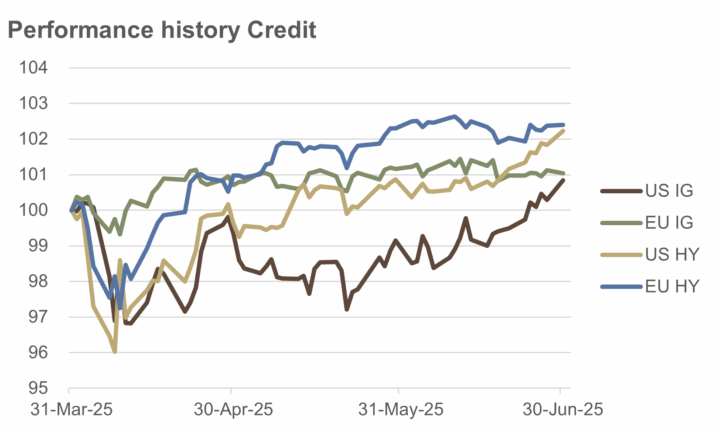

A sharp decline in credit spreads on both sides of the Atlantic provided a tailwind for high-yield bonds. In the US, spreads narrowed from 3.55% to 2.96% over the course of the quarter, having briefly spiked to 4.61% on April 7. In Europe, spreads declined from 3.28% to 3.10%, following a temporary peak of 4.29% on April 9.

Against this backdrop, European high-yield bonds posted a gain of 2.4% for the quarter, while their US counterparts rose by 2.2%. The comparatively flatter interest rate path in Europe also supported investment-grade debt: euro-denominated IG bonds returned 1.0%, while US investment-grade bonds advanced by 0.8%.

Emerging market debt benefited further from dollar weakness. On a quarterly basis, EM bonds posted a price gain of 3.7% in USD terms, bringing the year-to-date return to 5.1%.

Source: own illustration

Equities

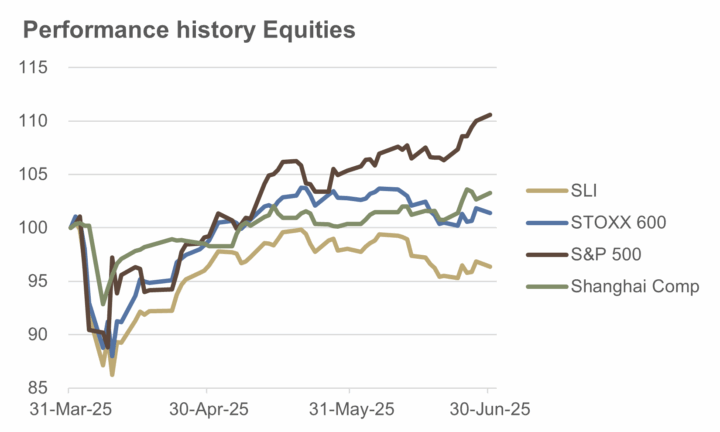

The sharp rebound in US equities in the second quarter put the sceptics of American exceptionalism to the test. The S&P 500 rose 10.6%, closing at a record high of 6,205 points. The Nasdaq Composite delivered an even stronger performance, surging 17.7%. By contrast, the equal-weighted S&P 500 ETF advanced just 4.9% – a reflection of the continued dominance of a small group of large-cap technology stocks.

European markets struggled to keep pace. The STOXX 600 gained a modest 1.5%, while the defensively tilted Swiss Leader Index (SLI) fell by 3.6%, weighed down in particular by Nestlé, whose shares dropped nearly 12% over the quarter.

Asian benchmarks also moved higher. The Shanghai Composite added 3.3%, the Hang Seng rose 4.1%, and Japan’s Nikkei 225 jumped 13.7%.

Over the first half of the year, a more nuanced picture emerged. Both the S&P 500 and the Nasdaq registered gains of 5.5%, while the STOXX 600 edged ahead with a 6.6% return. Several European markets stood out, with Poland, Hungary, Austria, Spain and Germany each posting year-to-date gains of more than 20%. The SLI, however, lagged behind with a muted 2.1% rise.

In Asia, performance was mixed. Hong Kong’s Hang Seng delivered an impressive 20% rally in the first six months, while the Shanghai Composite advanced 2.8% and the Nikkei 225 added 1.5%.

Source: own illustration

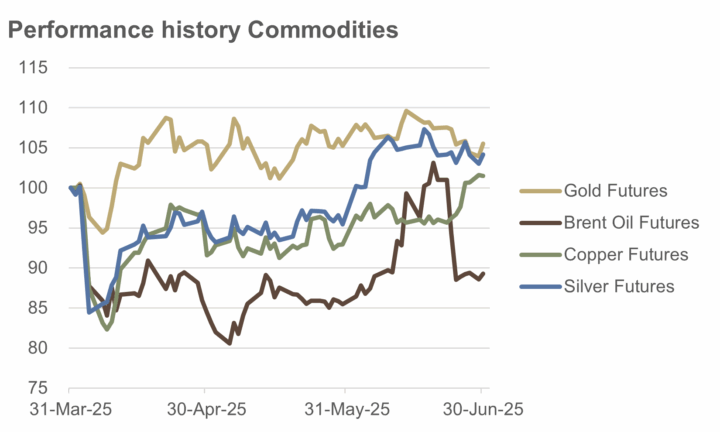

Gold extended its upward trajectory in the second quarter, gaining 5.5% and bringing its year-to-date increase to an impressive 25.9%. A new all-time high of $3,450 per ounce was reached in mid-June. Silver also advanced, narrowing the performance gap to gold with a quarterly gain of 4.2%, pushing its year-to-date return to 23.3%.

Copper, often seen as a bellwether for global growth, recovered losses from the tariff-driven sell-off in April, ending the quarter 1.5% higher. Since the start of the year, the metal has gained 26.9%.

Brent crude remained notably volatile, trading between $60 and $77 per barrel. After a setback in April, prices surged in June amid escalating tensions between Iran and Israel, peaking following US strikes on Iranian nuclear facilities. The rally proved short-lived, however, as a swift ceasefire announcement and signals of increased output from OPEC triggered a sharp reversal.

Cryptocurrencies continued their rollercoaster ride. Bitcoin (BTC/USD) rallied 30% over the quarter, lifting its year-to-date performance to 14%, having ended the first quarter down 12%. Ethereum (ETH/USD) surged 36% in Q2 but remained 26% lower for the year.

Source: own illustration

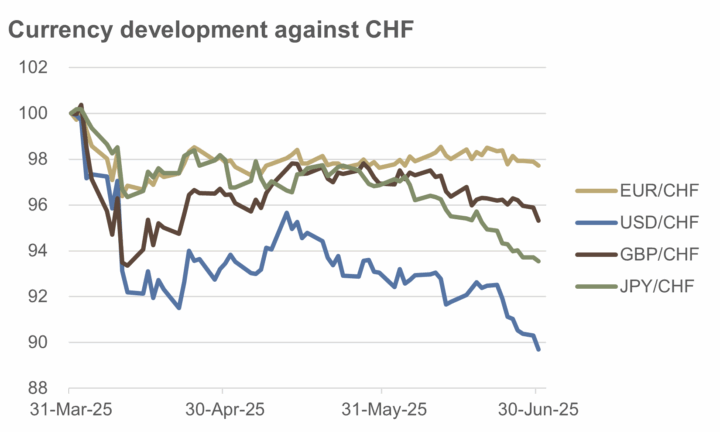

Currencies

The US dollar, as measured by the DXY index, recorded its weakest first-half performance since 1973 – and its sharpest six-month decline since the crisis year of 2009. The index dropped 7% in the second quarter alone, bringing the year-to-date loss to just under 11%.

The Swiss franc stood out as particularly strong. Against the dollar, it appreciated by 10.3% in the second quarter and by 12.6% since the beginning of the year. The USD/CHF exchange rate ended June at 0.793 – a level last seen in 2011, excluding the brief spike following the Swiss National Bank’s abandonment of the euro floor of 1.20 in January 2015.

The CHF also gained ground against the euro, with EUR/CHF falling from 0.956 to 0.935 in the second quarter, a 2.3% drop. On a year-to-date basis, the single currency declined 0.5% versus the Swiss franc.

Sterling weakened 4.7% against the Swiss franc over the quarter, closing at CHF 1.089, while the yen depreciated by 6.5% – leaving it 4.5% lower versus the CHF in the first half of the year.

One of the few currencies to outperform the Swiss franc during the quarter was the Swedish krona (SEK).

Source: own illustration

Outlook

Most equity markets are currently trading at or near record highs. At the same time, credit spreads on high-yield bonds have narrowed to levels seen in the summer of 2007. Prices for gold, Bitcoin and copper are likewise hovering close to historical peaks. This broad-based “asset inflation” points to ample liquidity across financial markets.

Market-based recession probabilities have shifted dramatically. According to the prediction platform Kalshi (https://kalshi.com/markets/kxrecssnber/recession, as of July 3, 2025), the likelihood of a US recession in 2025 has dropped to just 20% – down sharply from nearly 70% in early May. A recession is defined as two consecutive quarters of negative GDP growth.

The final reading of US GDP for the first quarter of 2025 was revised down from -0.2% to -0.5%. Growth for the second quarter is currently estimated at +2.6%, according to the Atlanta Fed’s GDPNow model (July 3, 2025).

Headline inflation in the United States remained stubbornly above target in the first half of the year. The headline rate has exceeded the Federal Reserve’s 2.0% objective continuously since March 2021 – now more than four years. The Cleveland Fed’s Inflation Nowcasting model points to a further uptick, with projected annual rates of 2.64% for June and 2.60% for July (as of July 3, 2025).

Against this backdrop, the Federal Reserve is unlikely to begin cutting interest rates at its July meeting. A first rate cut in September appears more probable, particularly as early signs point to a cooling economy and moderating inflation in the second half of the year.

In the eurozone, inflation stood at precisely 2.0% in June. A stronger Euro – especially against the US dollar – have helped mitigate imported price pressures.

Yields on two-year government bonds continue to serve as key indicators of market expectations for future monetary policy (see table).

Source: own illustration, as of 3 July 2025. *Germany

The gap between the policy rate and two-year government bond yields suggests that markets are currently pricing in at least two 25 basis point rate cuts by the Federal Reserve. In the eurozone, one additional easing move is expected before year-end, while in the UK, another rate cut is anticipated as early as the next policy meeting. In Switzerland, by contrast, market expectations remain more subdued, with no clear consensus emerging for now.

Looking ahead to the third quarter, we expect a stagflationary backdrop in the US, with growth showing signs of moderation while inflation ticks higher once more. Toward the end of the year, however, the outlook may begin to brighten. The recently passed fiscal stimulus package – the so-called “One Big Beautiful Bill” – and increased clarity on US trade tariffs could pave the way for a potential reacceleration in growth. A reflationary scenario cannot be ruled out.

In Europe and Switzerland, by contrast, conditions increasingly point to a classic “Goldilocks” scenario – an economic environment characterised by moderate growth and declining inflation. Enhanced economic integration within the eurozone may also generate productivity gains over time.

Overall, the environment remains broadly supportive for risk assets. July, in particular, tends to be one of the strongest months for equity markets from a seasonal perspective.

Fixed Income

Long-term interest rates are primarily shaped by expectations around growth and inflation. Given signs of moderate economic cooling in the US and only a modest uptick in price pressures, we maintain a constructive view on US Treasuries. We anticipate falling yields in the intermediate segment of the curve and favour securities with a duration of two to five years.

The global rise in stablecoins – most of which are pegged to the US dollar – has further supported demand for Treasuries.

In the eurozone, bond yields across member states are showing signs of increasing convergence. Against this backdrop, we favour issuers that continue to offer a relative yield premium over German Bunds.

To hedge against unexpected inflation shocks, we continue to hold a moderate allocation to inflation-linked bonds.

Credit

Credit spreads in the high-yield segment remain at historically low levels – in our view, they do not adequately reflect underlying credit risks. Against this backdrop, we favour corporate bonds with investment-grade ratings over high-yield counterparts.

Emerging market bonds represent a selective, opportunistic addition. They offer attractive yields and stand to benefit further from a structurally softer US dollar.

Equities

The backdrop for equities remains constructive for the time being – not least because July is historically one of the strongest months for stock markets. We continue to favour companies in the technology, energy and financial sectors. From a regional perspective, we hold a positive stance on the US, Europe and Switzerland, while maintaining a more cautious view on Japan.

All-time highs often beget further all-time highs. Current futures positioning still points to substantial short exposure – a classic contrarian signal. We would adopt a more defensive posture only in the presence of signs of excessive market exuberance. At present, we see no such cause for concern.

Commodities

Gold is trading near its all-time high of $3,450 per ounce. Yet positioning in the futures market remains subdued – a sign that the rally is not yet overheating. Against this backdrop, we maintain a strategic allocation to gold as a stabilising element within the portfolio. For added diversification, we have also initiated a complementary position in silver.

Copper prices are likewise hovering near historic highs. Further gains appear possible, provided global growth does not experience a material slowdown.

In contrast, the outlook for crude oil is more muted. With signs of cooling in the US economy, a relative easing of tensions in the Middle East, and increased supply from OPEC, prices are likely to move sideways or trend moderately lower. For the third quarter, we anticipate a slight decline in crude prices.

Among commodities, select agricultural markets look particularly appealing this quarter – notably coffee, sugar and cocoa.

Currencies

The Swiss franc is likely to remain firm in the third quarter. We do not expect the Swiss National Bank to cut rates back into negative territory, whereas the US Federal Reserve is widely expected to deliver a rate cut in September.

In the EUR/USD pair, we anticipate a temporary bout of US dollar strength. Extreme positioning in the futures market suggests scope for a counter-move. We expect the euro’s upward momentum to fade as it approaches the $1.20 level.

Investors betting on a yen rebound have once again been left disappointed. Bullish positioning remains elevated, yet the currency continues to weaken. At present, we see limited potential for a sustained yen recovery.

The Australian dollar could deliver a positive surprise. Futures sentiment is deeply negative – a classic contrarian signal. Moreover, the AUD tends to correlate with global risk appetite; stronger equity markets would typically lend support to the currency.

Conclusion

Despite mounting geopolitical tensions, rising protectionist undercurrents and deepening political polarisation in Washington, financial markets have so far demonstrated remarkable resilience. Against this backdrop, equity indices continue to climb the proverbial “wall of worry” advancing to fresh record highs, undeterred by a litany of risks. We maintain a constructive stance – both for the US and Europe – not least because the upcoming second-quarter earnings season is likely to deliver a series of positive surprises.

To hedge portfolio risk, we retain exposure to government bonds with intermediate duration, complemented by a modest allocation to inflation-linked securities. In the corporate bond segment, we continue to favour investment-grade issuers over high-yield names. Selective exposure to emerging market debt also appears worth considering.

We maintain our strategic allocation to gold, supplemented by a smaller position in silver for additional diversification.

In currency markets, we expect the Swiss franc to remain firm. The euro’s recent rally against the US dollar appears to have stalled for now. A positive surprise in the third quarter may come from the Australian dollar.

Charles Dickens, A Tale of Two Cities, Book the First, Chapter I» (Published in 1859)