Monthly Report September 2025

Markets on the rise, efficiency as a demand driver – a double-edged sword.

Despite the seasonally weaker summer months, equity markets managed to advance in August. The S&P 500 gained 1.9%, reaching its twentieth all-time high of the year on 28 August at 6,502 points. The tech-heavy Nasdaq Composite rose 1.6% over the month, while the Russell 2000 – a benchmark for smaller companies – surged 6.9%. The VIX volatility index briefly spiked above 20 in early August but subsequently held below 19.

In Europe, performance was more muted. The STOXX 600 edged up 0.7%, while Switzerland’s SLI gained 1.9%, supported by heavyweights Novartis, UBS and Nestlé.

Year-to-date, the S&P 500 was up 9.8%, the Nasdaq Composite 11.1% and the Russell 2000 6.0%. The pan-European STOXX 600 rose 8.4% since January, while the SLI gained 4.6%, with the European banking and insurance sector standing out as one of the strongest performers.

On currency markets, the euro-franc pair remained broadly stable, trading at 0.936 on 29 August compared with 0.939 at the end of 2024. The US dollar, by contrast, weakened sharply – down about 12% against both the euro and the Swiss franc since the start of the year.

Precious metals rallied strongly: gold was up 34%, silver 38% and platinum 50%. Gold mining equities, as tracked by the GDX ETF, surged 86% in dollar terms.

Bond markets saw further convergence in eurozone sovereign yields. At the end of August, 10-year German Bunds yielded 2.72%, Italian BTPs 3.61%, French OATs 3.51%, Spanish Bonos 3.33% and Greek paper 3.43%. In the US, 10-year Treasuries stood at 4.23% compared with 4.57% at the start of the year. In Switzerland, the 10-year government bond yielded 0.34%, with maturities of up to three years still in negative territory.

Geopolitical tensions, fresh US tariffs and political attacks on the Federal Reserve’s independence have so far unsettled markets only at the margin. The overarching narrative remains artificial intelligence – and with it a modern incarnation of the Jevons paradox.

In The Coal Question (1865), British economist William Stanley Jevons argued that more efficient steam engines did not reduce coal consumption but in fact drove it higher. A similar pattern is now visible in AI. Gains in efficiency lower the cost per calculation, per analysis or per text, accelerating deployment rather than curbing it. Companies are producing more content, processing larger datasets and building ever more powerful models. The result is rising energy use in data centres and sustained demand for semiconductors.

Historically, productivity gains have also shortened working hours – from seven days to six, and eventually to five. A four-day week may appear the next logical step. AI could in theory hasten this shift, compressing tasks that once took days into minutes. Yet whether that translates into more leisure or simply greater activity remains uncertain. Efficiency and productivity gains are not a guarantee of lower resource use; they may equally unleash fresh demand for energy, infrastructure, chips and labour. Investors should be wary of interpreting such developments too linearly – particularly where prevailing sentiment relies on simplistic notions of cost savings…

The US economy expanded by 3.3% in the second quarter, stronger than initially estimated. For the third quarter, the Atlanta Fed’s GDPNow model projects growth of 3.5%. The probability of recession this year has fallen sharply, with betting platform Kalshi.com putting the odds at just 6% at the end of August, down from nearly 70% in April and 15% at the start of the month.

Inflation has proved more stubborn. In July, headline CPI stood at 2.7% and the core rate at 3.1%. The Cleveland Fed’s Nowcasting model projects 2.84% and 3.05% respectively for August. Our expectation is for both measures to ease towards year-end.

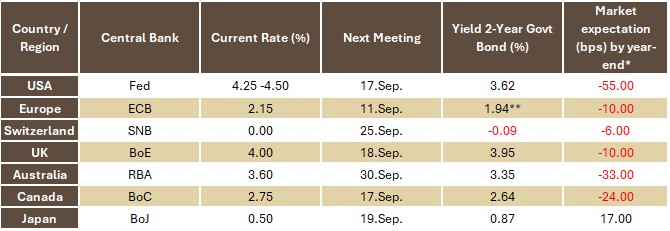

Central banks have moved cautiously. The Bank of England and the Reserve Bank of Australia both cut rates by 25 basis points in August, in line with expectations. Markets now assign an 89% probability to a quarter-point cut at the Federal Reserve’s September meeting. Among other major central banks, no immediate policy moves are in sight.

Source: own illustration, as of 29 August 2025. *as of 28 August 2025; **Germany

September has long been regarded as the most challenging month of the year for equities. Since 1990, the S&P 500 has delivered an average return of –0.84% during the month, with losses recorded in 51% of cases. Yet futures positioning is currently heavily bearish – a pattern that in the past has often served as a contrarian signal. Added to this is an abundance of negative headlines and commentary, which historically has served as a brake on excessive exuberance.

Against this backdrop, we remain cautiously optimistic on equities and would view potential setbacks as opportunities to selectively add exposure. Emerging market stocks appear particularly attractive, supported by relatively low valuations, the prospect of lower global interest rates and a weaker US dollar.

We expect inflation to ease into year-end. Combined with signs of a cooling labour market, this should give the Federal Reserve further scope to cut rates. In such an environment, sovereign bonds with medium-term maturities offer a sensible addition to portfolios. Emerging market debt could also benefit from softer US monetary policy and a weaker dollar.

As a strategic hedge against geopolitical risks and potential erosion of confidence in monetary and fiscal institutions, we continue to favour a meaningful allocation to precious metals.

In currency markets, we expect Swiss franc strength to persist. EUR/USD is likely to trend lower, while the Canadian and Australian dollars could deliver positive surprises in the weeks ahead.