Monthly Report August 2025

Tariffs, rate concerns and seasonal weakness: Financial markets are starting to wobble.

Equity markets lost momentum in the final days of July, following a string of record highs. After closing June at a new peak, the S&P 500 added ten more record closes in July, reaching an all-time high of 6,390 on 28 July. Over the subsequent four trading sessions, however, the index posted mild losses, accompanied by a sharp rise in the VIX volatility index, which climbed above 20 – a level broadly seen as a sign of mounting unease on Wall Street.

Since the start of the year, the S&P 500 has outpaced its European peers in local currency terms, gaining 6.1% compared with a 5.6% rise for the STOXX 600 and a 2.7% advance in Switzerland’s SLI. Currency movements played a significant role: the euro has strengthened roughly 12% against the dollar year-to-date, while the Swiss franc has appreciated by nearly 1% versus the euro.

One of the strongest performing segments this year has been gold miners, with shares in the sector up 55% in US dollar terms, outpacing the 28% rise in the gold price itself.

Yields on 10-year US Treasuries had reached a cycle high of 4.8% in January, just days before Donald Trump’s inauguration. Following “Liberation Day” in early April and the announcement of sweeping new tariffs, yields fell to just below 4%. They have since recovered modestly to around 4.2%.

The recent bout of market weakness has been partly attributed to growing disarray in US trade policy. Rising tensions between President Trump and Federal Reserve Chair Jay Powell have added to the uncertainty – not least because weaker-than-expected labour market data appeared to support Trump’s calls for rate cuts.

The US economy expanded by 3.0% in the second quarter, according to the initial estimate. The Atlanta Fed’s GDPNow model, as of 1 August, projects 2.1% growth in Q3. The probability of a US recession has ticked higher, but remains low: Kalshi.com puts the odds at just 15% as of 1 August, down sharply from nearly 70% in April. A recession is typically defined as two consecutive quarters of negative economic growth.

Headline inflation in the US currently stands at 2.7%, with core inflation at 2.9%. The Cleveland Fed’s Inflation Nowcasting model forecasts core inflation of around 3.0% for both July and August (as of 1 August).

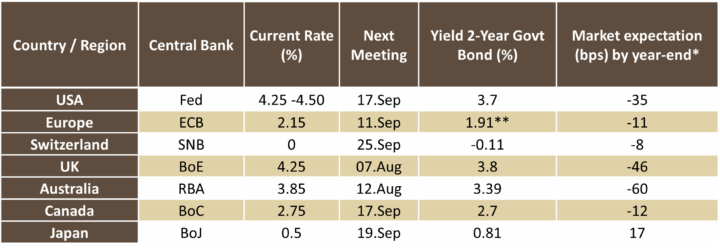

Two-year Treasury yields – widely seen as a gauge of interest rate expectations – suggest that markets are pricing in further rate cuts later this year.

Source: own illustration, as of 1 August 2025. *as of 31 July 2025; **Germany

In the United States, markets are currently pricing in an 80% probability of an interest rate cut in September. Similar expectations are taking hold in the United Kingdom and Australia, where investors anticipate an easing of monetary policy at the upcoming central bank meetings.

As good as it gets

Toward the end of the month, a wave of second-quarter earnings reports from major global corporates came in – many of them well above expectations. Tech giants such as Meta and Microsoft surprised positively, while results from Apple and Amazon also held up reasonably well.

Yet, despite these robust figures, equity markets faltered toward the end of July. In market parlance, this phenomenon is referred to as a “news failure” – when positive developments are no longer sufficient to propel share prices higher.

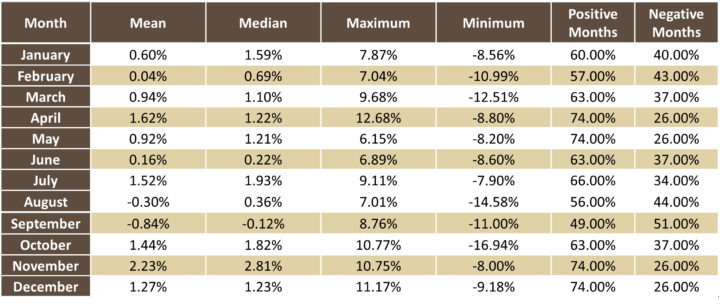

Such a pattern often serves as a warning signal, especially against the backdrop of August and September – months that have historically displayed weaker seasonal trends. The table below illustrates this seasonal pattern using average monthly returns for the S&P 500 index since the end of 1990.

Source: own illustration

Given the seasonally challenging environment, we favour a somewhat more defensive stance in equity markets over the coming weeks, while maintaining a cautiously optimistic outlook. Should markets experience a pullback, we would consider adding selectively to existing positions. Potential positive catalysts include further interest rate cuts and early impulses from the recently passed fiscal package, the “One Big Beautiful Bill Act”.

We believe a renewed surge in inflation due to newly announced tariffs is unlikely. At most, we expect a one-off price effect. Combined with signs of a softening labour market, this could give the Federal Reserve greater leeway for monetary easing. Against this backdrop, we consider exposure to medium-duration government bonds appropriate. To hedge against unexpected inflation risks, we continue to hold a modest allocation to inflation-linked bonds.

As a safeguard against political tensions and a potential loss of confidence in central bank policy, we are maintaining a strategically significant position in gold. This was recently complemented by a targeted allocation to silver.

In currencies, we retain a slight preference for the US dollar over the euro. From today’s perspective, a sustained move above the EUR/USD 1.20 level appears unlikely. While the Swiss franc may face some short-term pressure, we expect it to recover swiftly.